Trexquant Investment LP lifted its position in TruBridge, Inc. (NASDAQ:TBRG - Free Report) by 221.9% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 53,944 shares of the company's stock after buying an additional 37,184 shares during the period. Trexquant Investment LP owned approximately 0.36% of TruBridge worth $1,485,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

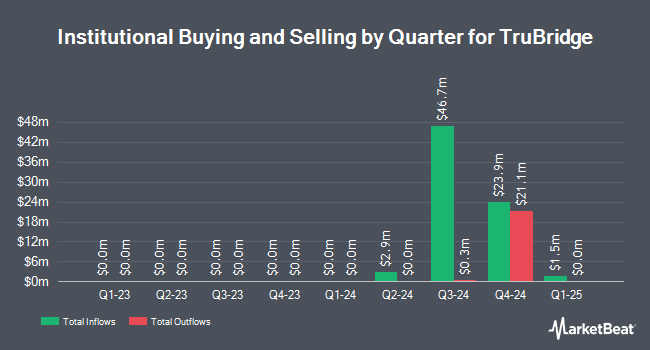

A number of other institutional investors and hedge funds have also recently modified their holdings of TBRG. Dimensional Fund Advisors LP boosted its stake in shares of TruBridge by 12.5% in the 4th quarter. Dimensional Fund Advisors LP now owns 348,941 shares of the company's stock worth $6,881,000 after buying an additional 38,902 shares during the last quarter. Tower Research Capital LLC TRC boosted its stake in shares of TruBridge by 47.5% in the 4th quarter. Tower Research Capital LLC TRC now owns 2,170 shares of the company's stock worth $43,000 after buying an additional 699 shares during the last quarter. Schonfeld Strategic Advisors LLC purchased a new position in shares of TruBridge in the 4th quarter worth $556,000. Jane Street Group LLC boosted its stake in shares of TruBridge by 211.6% in the 4th quarter. Jane Street Group LLC now owns 104,331 shares of the company's stock worth $2,057,000 after buying an additional 70,850 shares during the last quarter. Finally, Bank of America Corp DE lifted its position in TruBridge by 260.3% during the fourth quarter. Bank of America Corp DE now owns 36,591 shares of the company's stock valued at $722,000 after purchasing an additional 26,436 shares in the last quarter. 88.64% of the stock is currently owned by hedge funds and other institutional investors.

TruBridge Stock Performance

NASDAQ TBRG traded up $0.74 on Thursday, hitting $20.64. 137,094 shares of the company traded hands, compared to its average volume of 81,173. The company has a market capitalization of $309.81 million, a price-to-earnings ratio of -24.57 and a beta of 0.55. The company has a current ratio of 1.80, a quick ratio of 1.79 and a debt-to-equity ratio of 0.94. The business's 50 day moving average price is $20.94 and its 200-day moving average price is $23.91. TruBridge, Inc. has a 52-week low of $11.39 and a 52-week high of $32.00.

TruBridge Profile

(

Free Report)

TruBridge, Inc provides healthcare solutions and services for community hospitals, clinics, and other healthcare systems in the United States and internationally. The company operates in three segments: Revenue Cycle Management (RCM), Electronic Health Record (HER), and Patient Engagement. It focuses on providing RCM solutions for care settings, regardless of primary healthcare information solutions provider along with business management, consulting, managed IT services, and analytics and business intelligence.

Featured Articles

Before you consider TruBridge, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TruBridge wasn't on the list.

While TruBridge currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.