Trexquant Investment LP bought a new stake in shares of JD.com, Inc. (NASDAQ:JD - Free Report) during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund bought 216,888 shares of the information services provider's stock, valued at approximately $8,918,000.

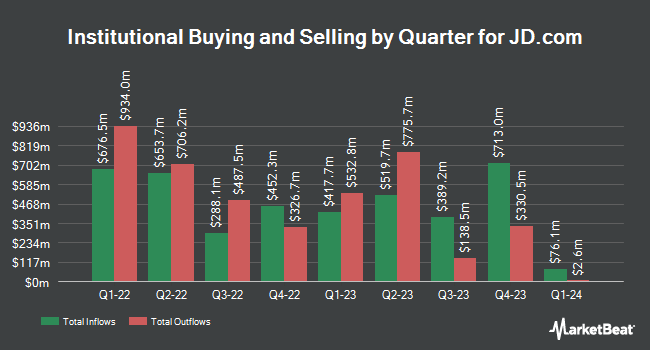

Other institutional investors also recently modified their holdings of the company. Cerity Partners LLC lifted its position in shares of JD.com by 33.1% during the 1st quarter. Cerity Partners LLC now owns 26,565 shares of the information services provider's stock valued at $1,092,000 after acquiring an additional 6,611 shares during the period. BI Asset Management Fondsmaeglerselskab A S acquired a new position in shares of JD.com during the 1st quarter valued at $1,900,000. Temasek Holdings Private Ltd raised its position in shares of JD.com by 18.4% during the fourth quarter. Temasek Holdings Private Ltd now owns 4,625,490 shares of the information services provider's stock worth $160,366,000 after purchasing an additional 718,760 shares during the period. Banco Bilbao Vizcaya Argentaria S.A. raised its position in shares of JD.com by 45.0% during the first quarter. Banco Bilbao Vizcaya Argentaria S.A. now owns 38,878 shares of the information services provider's stock worth $1,608,000 after purchasing an additional 12,071 shares during the period. Finally, Principal Financial Group Inc. raised its position in shares of JD.com by 1,724.9% during the first quarter. Principal Financial Group Inc. now owns 694,199 shares of the information services provider's stock worth $28,545,000 after purchasing an additional 656,158 shares during the period. Institutional investors and hedge funds own 15.98% of the company's stock.

JD.com Stock Performance

Shares of JD stock traded up $0.51 on Tuesday, hitting $31.58. 16,038,085 shares of the stock were exchanged, compared to its average volume of 12,423,867. The company has a current ratio of 1.22, a quick ratio of 0.90 and a debt-to-equity ratio of 0.19. The firm has a market capitalization of $44.11 billion, a PE ratio of 8.87, a P/E/G ratio of 3.53 and a beta of 0.36. JD.com, Inc. has a one year low of $25.61 and a one year high of $47.82. The firm's 50 day moving average is $32.04 and its two-hundred day moving average is $35.10.

Analyst Ratings Changes

A number of equities analysts have recently weighed in on the company. Benchmark lowered their target price on JD.com from $53.00 to $47.00 and set a "buy" rating on the stock in a research report on Monday, July 21st. Wall Street Zen lowered JD.com from a "buy" rating to a "hold" rating in a research report on Friday, May 30th. JPMorgan Chase & Co. lowered their target price on JD.com from $48.00 to $42.00 and set an "overweight" rating on the stock in a research report on Tuesday, May 27th. Mizuho lowered their target price on JD.com from $50.00 to $48.00 and set an "outperform" rating on the stock in a research report on Wednesday, May 14th. Finally, Arete Research lowered JD.com from a "hold" rating to a "strong sell" rating in a research report on Friday, August 1st. One analyst has rated the stock with a Strong Buy rating, nine have issued a Buy rating, four have given a Hold rating and one has given a Sell rating to the company. According to MarketBeat, JD.com presently has a consensus rating of "Moderate Buy" and a consensus target price of $43.31.

Get Our Latest Report on JD

About JD.com

(

Free Report)

JD.com, Inc operates as a supply chain-based technology and service provider in the People's Republic of China. The company offers computers, communication, and consumer electronics products, as well as home appliances; and general merchandise products comprising food, beverage and fresh produce, baby and maternity products, furniture and household goods, cosmetics and other personal care items, pharmaceutical and healthcare products, industrial products, books, automobile accessories, apparel and footwear, bags, and jewelry.

Featured Stories

Before you consider JD.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JD.com wasn't on the list.

While JD.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.