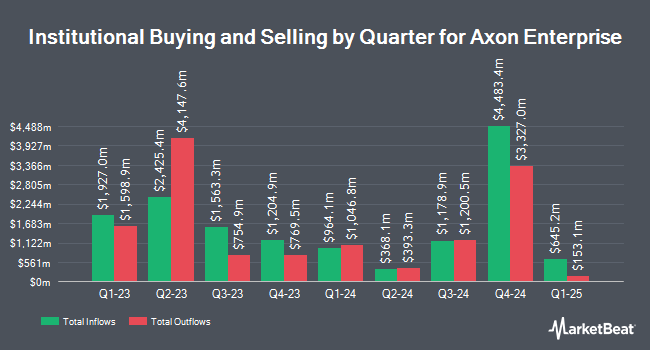

TriaGen Wealth Management LLC lifted its stake in Axon Enterprise, Inc (NASDAQ:AXON - Free Report) by 852.8% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 3,754 shares of the biotechnology company's stock after acquiring an additional 3,360 shares during the period. TriaGen Wealth Management LLC's holdings in Axon Enterprise were worth $1,974,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors also recently made changes to their positions in the stock. Versor Investments LP lifted its stake in shares of Axon Enterprise by 597.8% in the 1st quarter. Versor Investments LP now owns 2,798 shares of the biotechnology company's stock worth $1,472,000 after acquiring an additional 2,397 shares during the period. Berkshire Capital Holdings Inc. lifted its stake in Axon Enterprise by 157,600.0% during the first quarter. Berkshire Capital Holdings Inc. now owns 15,770 shares of the biotechnology company's stock valued at $8,294,000 after purchasing an additional 15,760 shares during the last quarter. Freestone Capital Holdings LLC lifted its stake in Axon Enterprise by 26.1% during the first quarter. Freestone Capital Holdings LLC now owns 2,916 shares of the biotechnology company's stock valued at $1,534,000 after purchasing an additional 603 shares during the last quarter. 17 Capital Partners LLC lifted its stake in Axon Enterprise by 1.9% during the first quarter. 17 Capital Partners LLC now owns 1,618 shares of the biotechnology company's stock valued at $851,000 after purchasing an additional 30 shares during the last quarter. Finally, Corient IA LLC acquired a new stake in Axon Enterprise during the first quarter valued at approximately $789,000. 79.08% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

AXON has been the subject of several recent research reports. Barclays increased their target price on shares of Axon Enterprise from $726.00 to $735.00 and gave the company an "overweight" rating in a research note on Friday, May 9th. Northland Securities set a $800.00 target price on shares of Axon Enterprise in a research note on Tuesday, August 5th. JMP Securities increased their target price on shares of Axon Enterprise from $725.00 to $825.00 and gave the company a "market outperform" rating in a research note on Tuesday, July 22nd. Needham & Company LLC set a $870.00 target price on shares of Axon Enterprise and gave the stock a "buy" rating in a research report on Tuesday, August 5th. Finally, Raymond James Financial reissued an "outperform" rating and issued a $855.00 target price (up from $645.00) on shares of Axon Enterprise in a research report on Tuesday, August 5th. Thirteen equities research analysts have rated the stock with a Buy rating and two have given a Hold rating to the company. Based on data from MarketBeat.com, Axon Enterprise has a consensus rating of "Moderate Buy" and an average price target of $837.69.

Read Our Latest Stock Report on AXON

Axon Enterprise Stock Down 4.2%

Shares of AXON stock traded down $33.33 during trading on Tuesday, hitting $758.29. 652,727 shares of the company were exchanged, compared to its average volume of 816,362. The company has a debt-to-equity ratio of 0.63, a quick ratio of 2.71 and a current ratio of 2.95. The firm has a market capitalization of $59.53 billion, a price-to-earnings ratio of 187.23, a P/E/G ratio of 29.05 and a beta of 1.36. The business's 50-day simple moving average is $773.92 and its 200 day simple moving average is $671.99. Axon Enterprise, Inc has a twelve month low of $346.71 and a twelve month high of $885.91.

Axon Enterprise (NASDAQ:AXON - Get Free Report) last posted its quarterly earnings results on Monday, August 4th. The biotechnology company reported $2.12 EPS for the quarter, topping the consensus estimate of $1.54 by $0.58. The business had revenue of $668.54 million during the quarter, compared to analysts' expectations of $641.77 million. Axon Enterprise had a net margin of 13.64% and a return on equity of 6.80%. The firm's quarterly revenue was up 32.6% compared to the same quarter last year. During the same period last year, the company posted $1.20 earnings per share. Axon Enterprise has set its FY 2025 guidance at EPS. As a group, analysts forecast that Axon Enterprise, Inc will post 5.8 EPS for the current fiscal year.

Insider Buying and Selling at Axon Enterprise

In related news, insider Jeffrey C. Kunins sold 7,891 shares of the firm's stock in a transaction that occurred on Thursday, August 14th. The shares were sold at an average price of $750.10, for a total transaction of $5,919,039.10. Following the completion of the sale, the insider directly owned 144,538 shares in the company, valued at approximately $108,417,953.80. This trade represents a 5.18% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CEO Patrick W. Smith sold 10,000 shares of the firm's stock in a transaction that occurred on Monday, August 11th. The shares were sold at an average price of $831.29, for a total transaction of $8,312,900.00. Following the transaction, the chief executive officer directly owned 3,053,982 shares in the company, valued at approximately $2,538,744,696.78. The trade was a 0.33% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 53,695 shares of company stock valued at $40,964,638 in the last 90 days. Corporate insiders own 5.70% of the company's stock.

Axon Enterprise Company Profile

(

Free Report)

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

See Also

Before you consider Axon Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axon Enterprise wasn't on the list.

While Axon Enterprise currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.