Triasima Portfolio Management inc. lifted its position in shares of MakeMyTrip Limited (NASDAQ:MMYT - Free Report) by 21.4% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 24,423 shares of the technology company's stock after purchasing an additional 4,301 shares during the period. Triasima Portfolio Management inc.'s holdings in MakeMyTrip were worth $2,393,000 at the end of the most recent quarter.

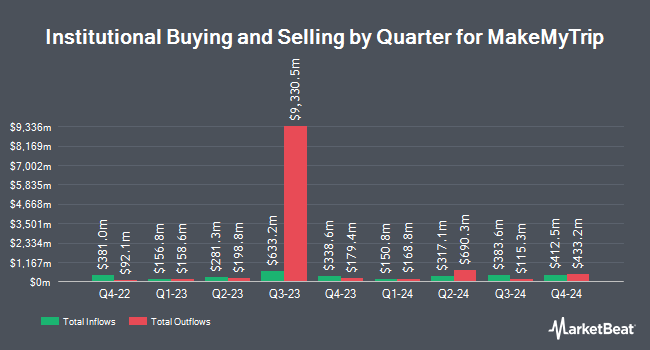

Other large investors also recently made changes to their positions in the company. Allspring Global Investments Holdings LLC raised its position in MakeMyTrip by 325.8% in the first quarter. Allspring Global Investments Holdings LLC now owns 22,218 shares of the technology company's stock worth $2,202,000 after acquiring an additional 17,000 shares during the period. Public Employees Retirement System of Ohio bought a new stake in MakeMyTrip in the fourth quarter worth about $2,183,000. Squarepoint Ops LLC raised its position in MakeMyTrip by 103.1% in the fourth quarter. Squarepoint Ops LLC now owns 6,105 shares of the technology company's stock worth $685,000 after acquiring an additional 3,099 shares during the period. Diversify Wealth Management LLC bought a new stake in MakeMyTrip in the first quarter worth about $1,063,000. Finally, Norges Bank purchased a new position in shares of MakeMyTrip in the fourth quarter worth about $97,833,000. 51.89% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several research firms have recently weighed in on MMYT. Citigroup lifted their target price on shares of MakeMyTrip from $120.00 to $125.00 and gave the stock a "buy" rating in a research note on Thursday, May 15th. Wall Street Zen upgraded shares of MakeMyTrip from a "sell" rating to a "hold" rating in a research note on Thursday, May 15th. Finally, Macquarie upgraded shares of MakeMyTrip from a "neutral" rating to an "outperform" rating and set a $110.00 target price for the company in a research note on Tuesday, June 24th.

Check Out Our Latest Stock Analysis on MakeMyTrip

MakeMyTrip Price Performance

NASDAQ:MMYT traded up $0.62 during mid-day trading on Friday, hitting $96.09. 1,216,876 shares of the stock traded hands, compared to its average volume of 836,286. The business's 50-day moving average price is $98.41 and its 200 day moving average price is $101.26. The company has a market cap of $10.69 billion, a PE ratio of 76.26 and a beta of 0.85. MakeMyTrip Limited has a 12-month low of $76.95 and a 12-month high of $123.00. The company has a quick ratio of 1.85, a current ratio of 1.85 and a debt-to-equity ratio of 0.01.

MakeMyTrip Profile

(

Free Report)

MakeMyTrip Limited, an online travel company, sells travel products and solutions in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, and Indonesia. The company operates through three segments: Air Ticketing, Hotels and Packages, and Bus Ticketing.

Further Reading

Before you consider MakeMyTrip, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MakeMyTrip wasn't on the list.

While MakeMyTrip currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.