Triasima Portfolio Management inc. purchased a new position in shares of Kyndryl Holdings, Inc. (NYSE:KD - Free Report) in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor purchased 80,900 shares of the company's stock, valued at approximately $2,540,000.

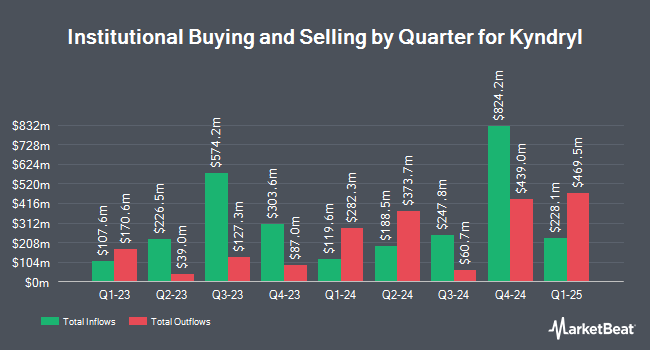

Other institutional investors and hedge funds also recently made changes to their positions in the company. Opal Wealth Advisors LLC bought a new position in Kyndryl in the 1st quarter valued at approximately $27,000. True Wealth Design LLC lifted its stake in Kyndryl by 150.6% in the 4th quarter. True Wealth Design LLC now owns 872 shares of the company's stock valued at $30,000 after purchasing an additional 524 shares during the last quarter. Marshall & Sterling Wealth Advisors Inc. bought a new position in Kyndryl in the 4th quarter valued at approximately $30,000. Millstone Evans Group LLC bought a new position in Kyndryl in the 4th quarter valued at approximately $35,000. Finally, Private Trust Co. NA lifted its stake in Kyndryl by 107.9% in the 1st quarter. Private Trust Co. NA now owns 1,021 shares of the company's stock valued at $32,000 after purchasing an additional 530 shares during the last quarter. Institutional investors own 71.53% of the company's stock.

Insider Activity

In other news, SVP Vineet Khurana sold 26,451 shares of the stock in a transaction on Monday, June 2nd. The shares were sold at an average price of $39.14, for a total transaction of $1,035,292.14. Following the completion of the sale, the senior vice president directly owned 73,278 shares in the company, valued at $2,868,100.92. This represents a 26.52% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Insiders own 1.90% of the company's stock.

Kyndryl Trading Up 0.8%

Shares of KD stock traded up $0.31 during trading hours on Friday, hitting $39.47. 1,280,584 shares of the company's stock traded hands, compared to its average volume of 2,023,704. The stock's 50 day simple moving average is $40.39 and its 200 day simple moving average is $37.17. The stock has a market cap of $9.13 billion, a PE ratio of 50.60, a price-to-earnings-growth ratio of 0.89 and a beta of 1.93. Kyndryl Holdings, Inc. has a 12 month low of $21.34 and a 12 month high of $44.20. The company has a quick ratio of 1.07, a current ratio of 1.07 and a debt-to-equity ratio of 2.29.

Kyndryl (NYSE:KD - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The company reported $0.52 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.52. The firm had revenue of $3.80 billion during the quarter, compared to the consensus estimate of $3.77 billion. Kyndryl had a net margin of 1.67% and a return on equity of 15.97%. The company's revenue for the quarter was down 1.3% on a year-over-year basis. During the same quarter last year, the firm earned ($0.01) earnings per share. On average, sell-side analysts anticipate that Kyndryl Holdings, Inc. will post 0.73 EPS for the current year.

Analyst Ratings Changes

Several equities analysts recently commented on the stock. Susquehanna dropped their price objective on shares of Kyndryl from $46.00 to $43.00 and set a "positive" rating for the company in a research note on Wednesday, April 23rd. Oppenheimer increased their price objective on shares of Kyndryl from $47.00 to $55.00 and gave the company an "outperform" rating in a research note on Tuesday, July 8th. Finally, Wall Street Zen downgraded shares of Kyndryl from a "strong-buy" rating to a "buy" rating in a research note on Saturday, July 12th.

Check Out Our Latest Analysis on KD

Kyndryl Company Profile

(

Free Report)

Kyndryl Holdings, Inc operates as a technology services company and IT infrastructure services provider worldwide. The company offers cloud services; core enterprise and zCloud services; application, data, and artificial intelligence services; digital workplace services; security and resiliency services; and network services and edge services.

Further Reading

Before you consider Kyndryl, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kyndryl wasn't on the list.

While Kyndryl currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.