Tributary Capital Management LLC grew its holdings in shares of Vital Energy, Inc. (NYSE:VTLE - Free Report) by 31.0% during the second quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 389,264 shares of the company's stock after purchasing an additional 92,185 shares during the quarter. Tributary Capital Management LLC owned about 1.00% of Vital Energy worth $6,263,000 as of its most recent filing with the Securities and Exchange Commission.

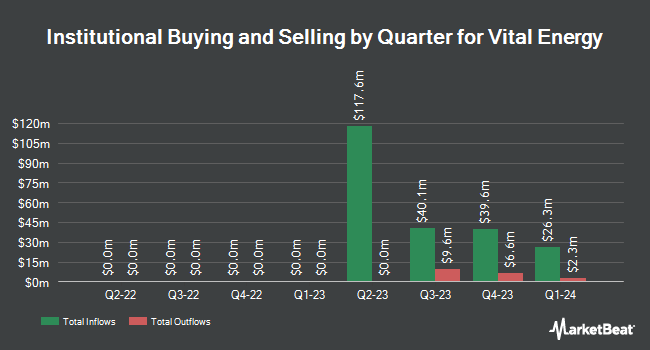

A number of other hedge funds and other institutional investors have also modified their holdings of the business. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in shares of Vital Energy by 4.3% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 16,980 shares of the company's stock valued at $360,000 after purchasing an additional 702 shares in the last quarter. Parallel Advisors LLC raised its holdings in shares of Vital Energy by 58.7% during the 2nd quarter. Parallel Advisors LLC now owns 2,000 shares of the company's stock valued at $32,000 after purchasing an additional 740 shares in the last quarter. State of Alaska Department of Revenue raised its holdings in shares of Vital Energy by 8.4% during the 2nd quarter. State of Alaska Department of Revenue now owns 16,190 shares of the company's stock valued at $260,000 after purchasing an additional 1,249 shares in the last quarter. NFJ Investment Group LLC raised its holdings in shares of Vital Energy by 1.9% during the 1st quarter. NFJ Investment Group LLC now owns 72,503 shares of the company's stock valued at $1,539,000 after purchasing an additional 1,346 shares in the last quarter. Finally, Pinnacle Holdings LLC raised its holdings in shares of Vital Energy by 6.8% during the 1st quarter. Pinnacle Holdings LLC now owns 22,576 shares of the company's stock valued at $479,000 after purchasing an additional 1,438 shares in the last quarter. Institutional investors own 86.54% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages recently commented on VTLE. Wells Fargo & Company dropped their target price on shares of Vital Energy from $22.00 to $16.00 and set an "equal weight" rating on the stock in a report on Friday, October 17th. Piper Sandler lifted their target price on shares of Vital Energy from $16.00 to $30.00 and gave the stock a "neutral" rating in a report on Tuesday. Weiss Ratings reaffirmed a "sell (d)" rating on shares of Vital Energy in a research report on Wednesday, October 8th. Zacks Research lowered shares of Vital Energy from a "strong-buy" rating to a "hold" rating in a research report on Monday, October 13th. Finally, Wall Street Zen lowered shares of Vital Energy from a "hold" rating to a "sell" rating in a research report on Saturday, August 9th. One research analyst has rated the stock with a Buy rating, six have assigned a Hold rating and five have given a Sell rating to the stock. According to data from MarketBeat, Vital Energy currently has an average rating of "Reduce" and a consensus target price of $27.33.

Get Our Latest Analysis on VTLE

Vital Energy Stock Up 0.4%

Shares of VTLE opened at $15.09 on Thursday. The firm has a market capitalization of $583.79 million, a P/E ratio of -0.76 and a beta of 1.45. The company has a 50-day simple moving average of $16.47 and a 200-day simple moving average of $16.53. Vital Energy, Inc. has a 52 week low of $12.30 and a 52 week high of $36.72. The company has a debt-to-equity ratio of 1.10, a quick ratio of 0.79 and a current ratio of 0.79.

Vital Energy (NYSE:VTLE - Get Free Report) last posted its earnings results on Wednesday, August 6th. The company reported $2.02 earnings per share for the quarter, beating analysts' consensus estimates of $1.98 by $0.04. The business had revenue of $429.63 million for the quarter, compared to analysts' expectations of $481.25 million. Vital Energy had a negative net margin of 38.52% and a positive return on equity of 11.86%. The firm's revenue for the quarter was down 9.8% on a year-over-year basis. During the same quarter in the previous year, the firm posted $1.46 earnings per share. On average, equities research analysts expect that Vital Energy, Inc. will post 8.49 earnings per share for the current year.

Vital Energy Profile

(

Free Report)

Vital Energy, Inc, an independent energy company, engages in the acquisition, exploration, and development of oil and natural gas properties in the Permian Basin of West Texas, the United States. The company was formerly known as Laredo Petroleum, Inc and changed its name to Vital Energy, Inc in January 2023.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vital Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vital Energy wasn't on the list.

While Vital Energy currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.