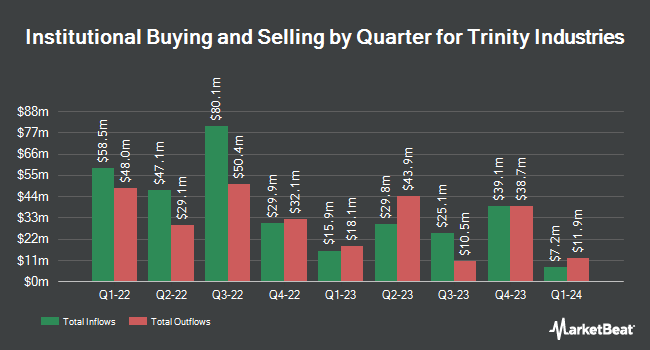

Great Lakes Advisors LLC lowered its holdings in shares of Trinity Industries, Inc. (NYSE:TRN - Free Report) by 4.3% during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 244,007 shares of the transportation company's stock after selling 10,940 shares during the period. Great Lakes Advisors LLC owned about 0.30% of Trinity Industries worth $6,847,000 as of its most recent SEC filing.

Other institutional investors have also recently bought and sold shares of the company. Headlands Technologies LLC boosted its stake in Trinity Industries by 3,418.2% during the first quarter. Headlands Technologies LLC now owns 1,548 shares of the transportation company's stock worth $43,000 after buying an additional 1,504 shares in the last quarter. Russell Investments Group Ltd. boosted its stake in Trinity Industries by 97.4% during the first quarter. Russell Investments Group Ltd. now owns 3,604 shares of the transportation company's stock worth $101,000 after buying an additional 1,778 shares in the last quarter. Stephens Inc. AR boosted its stake in Trinity Industries by 6.5% during the first quarter. Stephens Inc. AR now owns 7,317 shares of the transportation company's stock worth $205,000 after buying an additional 444 shares in the last quarter. Matrix Trust Co boosted its stake in Trinity Industries by 60.2% during the first quarter. Matrix Trust Co now owns 7,888 shares of the transportation company's stock worth $221,000 after buying an additional 2,965 shares in the last quarter. Finally, Mercer Global Advisors Inc. ADV acquired a new stake in Trinity Industries during the fourth quarter worth $225,000. Institutional investors and hedge funds own 86.57% of the company's stock.

Wall Street Analysts Forecast Growth

TRN has been the topic of several recent analyst reports. Susquehanna reduced their target price on shares of Trinity Industries from $26.00 to $24.00 and set a "neutral" rating on the stock in a research note on Tuesday, July 29th. Wall Street Zen upgraded shares of Trinity Industries from a "sell" rating to a "hold" rating in a research note on Saturday, August 30th. Two equities research analysts have rated the stock with a Hold rating, According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $27.50.

Get Our Latest Analysis on Trinity Industries

Trinity Industries Trading Up 1.2%

Trinity Industries stock traded up $0.33 during trading hours on Monday, reaching $28.48. 73,229 shares of the company's stock traded hands, compared to its average volume of 611,794. The company has a debt-to-equity ratio of 4.66, a quick ratio of 1.01 and a current ratio of 1.96. Trinity Industries, Inc. has a fifty-two week low of $22.38 and a fifty-two week high of $39.83. The firm has a market capitalization of $2.30 billion, a price-to-earnings ratio of 24.97 and a beta of 1.52. The firm's 50 day moving average is $27.43 and its 200-day moving average is $27.00.

Trinity Industries (NYSE:TRN - Get Free Report) last released its earnings results on Thursday, July 31st. The transportation company reported $0.19 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.31 by ($0.12). Trinity Industries had a net margin of 3.83% and a return on equity of 8.49%. The business had revenue of $506.20 million for the quarter, compared to analyst estimates of $589.96 million. During the same quarter in the previous year, the company posted $0.66 earnings per share. The business's revenue for the quarter was down 39.8% on a year-over-year basis. Trinity Industries has set its FY 2025 guidance at 1.400-1.60 EPS. On average, analysts predict that Trinity Industries, Inc. will post 1.65 earnings per share for the current year.

Trinity Industries Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, October 31st. Investors of record on Wednesday, October 15th will be given a $0.30 dividend. This represents a $1.20 dividend on an annualized basis and a dividend yield of 4.2%. The ex-dividend date is Wednesday, October 15th. Trinity Industries's dividend payout ratio (DPR) is currently 105.26%.

Trinity Industries Company Profile

(

Free Report)

Trinity Industries, Inc provides rail transportation products and services under the TrinityRail name in North America. It operates in two segments, Railcar Leasing and Management Services Group, and Rail Products Group. The Railcar Leasing and Management Services Group segment leases freight and tank railcars; originates and manages railcar leases for third-party investors; and provides fleet maintenance and management services.

Featured Articles

Before you consider Trinity Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trinity Industries wasn't on the list.

While Trinity Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.