Trinity Street Asset Management LLP acquired a new position in shares of Axalta Coating Systems Ltd. (NYSE:AXTA - Free Report) during the first quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 492,845 shares of the specialty chemicals company's stock, valued at approximately $16,348,000. Axalta Coating Systems makes up approximately 1.7% of Trinity Street Asset Management LLP's holdings, making the stock its 15th largest position. Trinity Street Asset Management LLP owned approximately 0.23% of Axalta Coating Systems at the end of the most recent quarter.

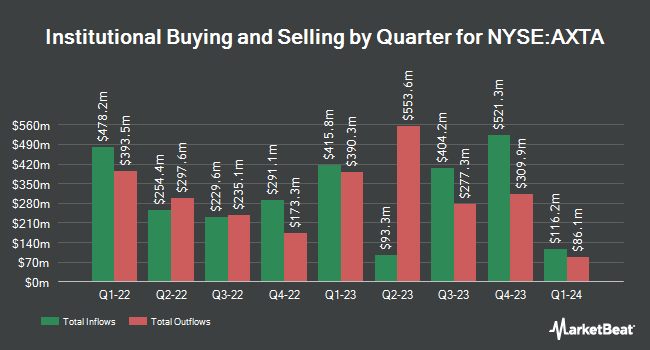

A number of other large investors have also recently bought and sold shares of AXTA. Victory Capital Management Inc. lifted its holdings in shares of Axalta Coating Systems by 9.6% in the fourth quarter. Victory Capital Management Inc. now owns 11,321,994 shares of the specialty chemicals company's stock worth $387,439,000 after acquiring an additional 988,397 shares during the last quarter. JPMorgan Chase & Co. lifted its holdings in shares of Axalta Coating Systems by 0.4% in the fourth quarter. JPMorgan Chase & Co. now owns 11,280,882 shares of the specialty chemicals company's stock worth $386,032,000 after acquiring an additional 50,520 shares during the last quarter. Wellington Management Group LLP lifted its holdings in shares of Axalta Coating Systems by 1.3% in the fourth quarter. Wellington Management Group LLP now owns 6,598,172 shares of the specialty chemicals company's stock worth $225,789,000 after acquiring an additional 82,200 shares during the last quarter. Fuller & Thaler Asset Management Inc. raised its holdings in Axalta Coating Systems by 54.9% in the 4th quarter. Fuller & Thaler Asset Management Inc. now owns 5,587,090 shares of the specialty chemicals company's stock valued at $191,190,000 after buying an additional 1,980,296 shares during the last quarter. Finally, Dimensional Fund Advisors LP raised its holdings in Axalta Coating Systems by 2.5% in the 4th quarter. Dimensional Fund Advisors LP now owns 3,874,038 shares of the specialty chemicals company's stock valued at $132,568,000 after buying an additional 93,298 shares during the last quarter. 98.28% of the stock is currently owned by institutional investors and hedge funds.

Axalta Coating Systems Trading Up 1.4%

Shares of AXTA stock traded up $0.43 during trading hours on Friday, hitting $30.74. 1,564,258 shares of the company were exchanged, compared to its average volume of 2,039,173. The firm has a market cap of $6.72 billion, a P/E ratio of 17.27, a P/E/G ratio of 0.92 and a beta of 1.35. Axalta Coating Systems Ltd. has a fifty-two week low of $27.70 and a fifty-two week high of $41.66. The company has a debt-to-equity ratio of 1.74, a quick ratio of 1.47 and a current ratio of 2.01. The company has a 50 day simple moving average of $31.46 and a two-hundred day simple moving average of $34.61.

Axalta Coating Systems (NYSE:AXTA - Get Free Report) last posted its quarterly earnings results on Wednesday, May 7th. The specialty chemicals company reported $0.59 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.54 by $0.05. Axalta Coating Systems had a net margin of 7.41% and a return on equity of 26.29%. The business had revenue of $1.29 billion during the quarter, compared to the consensus estimate of $1.29 billion. During the same quarter last year, the firm posted $0.48 EPS. Axalta Coating Systems's revenue was down 2.5% compared to the same quarter last year. Equities analysts anticipate that Axalta Coating Systems Ltd. will post 2.55 EPS for the current year.

Wall Street Analyst Weigh In

AXTA has been the subject of a number of research reports. Wall Street Zen lowered shares of Axalta Coating Systems from a "buy" rating to a "hold" rating in a report on Thursday, May 8th. JPMorgan Chase & Co. lowered shares of Axalta Coating Systems from an "overweight" rating to a "neutral" rating and dropped their price objective for the company from $42.00 to $32.00 in a report on Thursday, May 8th. Barclays dropped their price objective on shares of Axalta Coating Systems from $45.00 to $42.00 and set an "overweight" rating for the company in a report on Thursday, May 15th. Citigroup dropped their price objective on shares of Axalta Coating Systems from $42.00 to $32.00 and set a "neutral" rating for the company in a report on Tuesday, April 8th. Finally, Morgan Stanley dropped their price objective on shares of Axalta Coating Systems from $40.00 to $36.00 and set an "equal weight" rating for the company in a report on Thursday, May 8th. Six analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $40.38.

Read Our Latest Analysis on AXTA

Axalta Coating Systems Company Profile

(

Free Report)

Axalta Coating Systems Ltd., through its subsidiaries, manufactures, markets, and distributes high-performance coatings systems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates through two segments, Performance Coatings and Mobility Coatings.

See Also

Before you consider Axalta Coating Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axalta Coating Systems wasn't on the list.

While Axalta Coating Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.