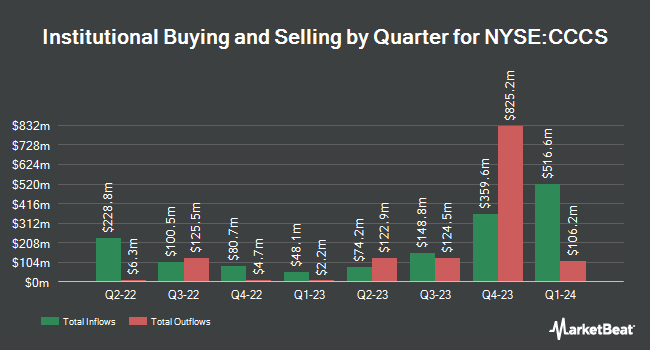

Triple Frond Partners LLC bought a new position in CCC Intelligent Solutions Holdings Inc. (NYSE:CCCS - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm bought 2,415,000 shares of the company's stock, valued at approximately $21,807,000. CCC Intelligent Solutions accounts for 2.9% of Triple Frond Partners LLC's portfolio, making the stock its 10th largest position. Triple Frond Partners LLC owned approximately 0.37% of CCC Intelligent Solutions at the end of the most recent reporting period.

Several other hedge funds also recently made changes to their positions in CCCS. Legal & General Group Plc lifted its stake in shares of CCC Intelligent Solutions by 13.5% in the fourth quarter. Legal & General Group Plc now owns 424,741 shares of the company's stock valued at $4,982,000 after purchasing an additional 50,359 shares during the period. Rockefeller Capital Management L.P. acquired a new stake in shares of CCC Intelligent Solutions in the fourth quarter valued at about $231,000. Townsquare Capital LLC lifted its stake in shares of CCC Intelligent Solutions by 6.5% in the fourth quarter. Townsquare Capital LLC now owns 24,338 shares of the company's stock valued at $285,000 after purchasing an additional 1,475 shares during the period. Barclays PLC lifted its stake in shares of CCC Intelligent Solutions by 357.3% in the fourth quarter. Barclays PLC now owns 498,560 shares of the company's stock valued at $5,849,000 after purchasing an additional 389,540 shares during the period. Finally, Mariner LLC lifted its stake in shares of CCC Intelligent Solutions by 2.7% in the fourth quarter. Mariner LLC now owns 71,244 shares of the company's stock valued at $836,000 after purchasing an additional 1,878 shares during the period. Institutional investors and hedge funds own 95.79% of the company's stock.

Wall Street Analysts Forecast Growth

CCCS has been the subject of several recent analyst reports. The Goldman Sachs Group reduced their price objective on shares of CCC Intelligent Solutions from $13.00 to $11.50 and set a "buy" rating for the company in a research note on Wednesday, May 7th. Piper Sandler reiterated a "hold" rating and issued a $10.00 price objective on shares of CCC Intelligent Solutions in a research note on Thursday, August 14th. JPMorgan Chase & Co. cut shares of CCC Intelligent Solutions from a "neutral" rating to an "underweight" rating and set a $10.00 price objective for the company. in a research note on Monday, June 23rd. Barrington Research reiterated an "outperform" rating and issued a $14.00 price objective on shares of CCC Intelligent Solutions in a research note on Monday, August 4th. Finally, Barclays raised their price objective on shares of CCC Intelligent Solutions from $11.00 to $12.00 and gave the company an "equal weight" rating in a research note on Friday, August 1st. Three investment analysts have rated the stock with a Buy rating, two have assigned a Hold rating and one has assigned a Sell rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $11.75.

Check Out Our Latest Stock Analysis on CCC Intelligent Solutions

Insider Transactions at CCC Intelligent Solutions

In other news, Director Lauren Young sold 30,000,000 shares of CCC Intelligent Solutions stock in a transaction dated Thursday, August 7th. The shares were sold at an average price of $9.87, for a total transaction of $296,100,000.00. Following the completion of the sale, the director directly owned 866,345 shares in the company, valued at $8,550,825.15. The trade was a 97.19% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, Director Eric Wei sold 30,000,000 shares of CCC Intelligent Solutions stock in a transaction dated Thursday, August 7th. The stock was sold at an average price of $9.87, for a total transaction of $296,100,000.00. Following the sale, the director owned 866,345 shares of the company's stock, valued at approximately $8,550,825.15. This trade represents a 97.19% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 60,005,302 shares of company stock worth $592,251,748 over the last ninety days. 6.03% of the stock is currently owned by corporate insiders.

CCC Intelligent Solutions Price Performance

NYSE:CCCS traded up $0.07 during mid-day trading on Friday, hitting $9.90. 4,304,450 shares of the company's stock traded hands, compared to its average volume of 7,538,338. The company has a debt-to-equity ratio of 0.39, a quick ratio of 3.19 and a current ratio of 3.19. The firm's 50 day simple moving average is $9.62 and its 200 day simple moving average is $9.38. CCC Intelligent Solutions Holdings Inc. has a 1 year low of $8.14 and a 1 year high of $12.88. The company has a market cap of $6.45 billion, a PE ratio of 495.25 and a beta of 0.74.

CCC Intelligent Solutions (NYSE:CCCS - Get Free Report) last posted its earnings results on Thursday, July 31st. The company reported $0.09 earnings per share for the quarter, beating the consensus estimate of $0.08 by $0.01. CCC Intelligent Solutions had a net margin of 5.02% and a return on equity of 5.35%. The firm had revenue of $260.45 million during the quarter, compared to the consensus estimate of $256.21 million. During the same period last year, the firm posted $0.09 EPS. The firm's revenue for the quarter was up 12.0% on a year-over-year basis. CCC Intelligent Solutions has set its Q3 2025 guidance at EPS. FY 2025 guidance at EPS. Sell-side analysts expect that CCC Intelligent Solutions Holdings Inc. will post 0.17 EPS for the current year.

CCC Intelligent Solutions Company Profile

(

Free Report)

CCC Intelligent Solutions Holdings Inc, operates as a software as a service company for the property and casualty insurance economy in the United States and China. The company's cloud-based software as a service platform connects trading partners, facilitates commerce, and supports mission-critical, artificial intelligence enabled digital workflow across the insurance economy, including insurers, repairers, automakers, parts suppliers, lenders and more.

Featured Stories

Before you consider CCC Intelligent Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CCC Intelligent Solutions wasn't on the list.

While CCC Intelligent Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.