Triton Financial Group Inc bought a new stake in Corning Incorporated (NYSE:GLW - Free Report) during the second quarter, according to the company in its most recent Form 13F filing with the SEC. The firm bought 19,692 shares of the electronics maker's stock, valued at approximately $1,036,000.

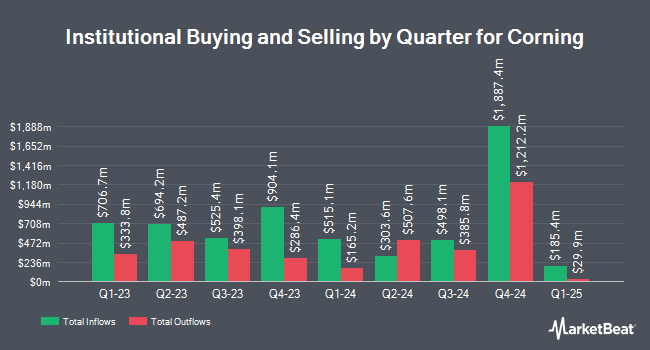

A number of other large investors have also recently bought and sold shares of the company. REAP Financial Group LLC lifted its position in shares of Corning by 191.5% in the second quarter. REAP Financial Group LLC now owns 516 shares of the electronics maker's stock worth $27,000 after purchasing an additional 339 shares in the last quarter. Investment Management Corp VA ADV increased its stake in Corning by 165.9% in the 1st quarter. Investment Management Corp VA ADV now owns 742 shares of the electronics maker's stock valued at $34,000 after buying an additional 463 shares during the last quarter. Annis Gardner Whiting Capital Advisors LLC lifted its position in Corning by 90.1% during the 1st quarter. Annis Gardner Whiting Capital Advisors LLC now owns 745 shares of the electronics maker's stock worth $34,000 after buying an additional 353 shares in the last quarter. Banque Transatlantique SA acquired a new position in shares of Corning during the 1st quarter worth about $34,000. Finally, Resources Management Corp CT ADV boosted its stake in shares of Corning by 66.7% during the 1st quarter. Resources Management Corp CT ADV now owns 750 shares of the electronics maker's stock worth $34,000 after buying an additional 300 shares during the last quarter. Institutional investors and hedge funds own 69.80% of the company's stock.

Wall Street Analyst Weigh In

Several analysts recently issued reports on the company. Mizuho upped their target price on Corning from $74.00 to $90.00 and gave the stock an "outperform" rating in a report on Friday, October 3rd. Oppenheimer reaffirmed an "outperform" rating and set a $72.00 price target (up previously from $55.00) on shares of Corning in a research report on Wednesday, July 30th. JPMorgan Chase & Co. increased their price objective on Corning from $62.00 to $65.00 and gave the company an "overweight" rating in a report on Friday, July 25th. Barclays boosted their target price on shares of Corning from $52.00 to $65.00 and gave the stock an "equal weight" rating in a report on Wednesday, July 30th. Finally, Weiss Ratings reaffirmed a "hold (c+)" rating on shares of Corning in a research report on Wednesday, October 8th. One analyst has rated the stock with a Strong Buy rating, eleven have assigned a Buy rating and three have assigned a Hold rating to the company. Based on data from MarketBeat, Corning currently has an average rating of "Moderate Buy" and a consensus price target of $73.00.

Get Our Latest Stock Report on GLW

Insider Transactions at Corning

In related news, SVP Michael Paul O'day sold 14,879 shares of Corning stock in a transaction that occurred on Wednesday, July 30th. The stock was sold at an average price of $62.36, for a total transaction of $927,854.44. Following the completion of the sale, the senior vice president directly owned 35,743 shares of the company's stock, valued at approximately $2,228,933.48. This trade represents a 29.39% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, EVP Lewis A. Steverson sold 16,646 shares of the business's stock in a transaction on Wednesday, July 30th. The shares were sold at an average price of $62.22, for a total value of $1,035,714.12. Following the completion of the sale, the executive vice president owned 39,759 shares of the company's stock, valued at $2,473,804.98. This trade represents a 29.51% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 181,671 shares of company stock worth $11,816,899. 0.32% of the stock is currently owned by insiders.

Corning Stock Up 1.0%

GLW stock opened at $85.31 on Tuesday. The business's 50 day simple moving average is $75.74 and its 200 day simple moving average is $59.06. Corning Incorporated has a 1-year low of $37.31 and a 1-year high of $87.78. The firm has a market capitalization of $73.08 billion, a PE ratio of 90.75, a PEG ratio of 1.89 and a beta of 1.14. The company has a current ratio of 1.50, a quick ratio of 0.93 and a debt-to-equity ratio of 0.58.

Corning (NYSE:GLW - Get Free Report) last released its quarterly earnings data on Tuesday, July 29th. The electronics maker reported $0.60 EPS for the quarter, topping analysts' consensus estimates of $0.57 by $0.03. The firm had revenue of $3.86 billion during the quarter, compared to analysts' expectations of $3.84 billion. Corning had a net margin of 5.77% and a return on equity of 17.27%. During the same period in the previous year, the business posted $0.47 earnings per share. Corning has set its Q3 2025 guidance at 0.630-0.670 EPS. As a group, research analysts anticipate that Corning Incorporated will post 2.33 EPS for the current year.

Corning Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, December 12th. Shareholders of record on Friday, November 14th will be issued a $0.28 dividend. This represents a $1.12 annualized dividend and a yield of 1.3%. The ex-dividend date of this dividend is Friday, November 14th. Corning's dividend payout ratio is currently 119.15%.

Corning Profile

(

Free Report)

Corning Incorporated engages in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally. The company's Display Technologies segment offers glass substrates for flat panel displays, including liquid crystal displays and organic light-emitting diodes that are used in televisions, notebook computers, desktop monitors, tablets, and handheld devices.

See Also

Want to see what other hedge funds are holding GLW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Corning Incorporated (NYSE:GLW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corning wasn't on the list.

While Corning currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.