Truist Financial Corp purchased a new position in shares of Koninklijke Philips N.V. (NYSE:PHG - Free Report) in the second quarter, according to its most recent filing with the Securities & Exchange Commission. The fund purchased 12,044 shares of the technology company's stock, valued at approximately $289,000.

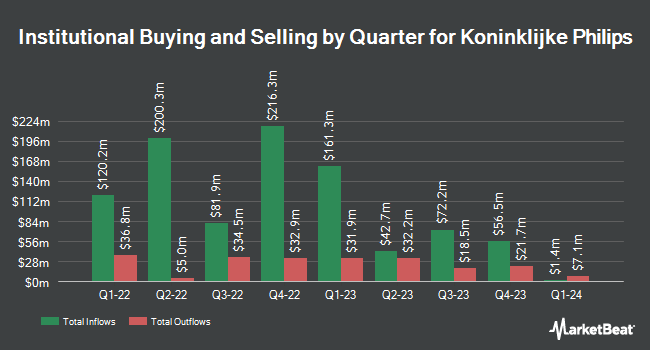

Other hedge funds and other institutional investors have also modified their holdings of the company. Bessemer Group Inc. grew its stake in Koninklijke Philips by 2,935.4% in the 1st quarter. Bessemer Group Inc. now owns 1,973 shares of the technology company's stock worth $51,000 after acquiring an additional 1,908 shares during the period. Caitong International Asset Management Co. Ltd grew its position in shares of Koninklijke Philips by 1,170.3% in the first quarter. Caitong International Asset Management Co. Ltd now owns 2,439 shares of the technology company's stock valued at $62,000 after purchasing an additional 2,247 shares during the period. Allworth Financial LP grew its position in shares of Koninklijke Philips by 16.2% in the first quarter. Allworth Financial LP now owns 4,638 shares of the technology company's stock valued at $115,000 after purchasing an additional 645 shares during the period. Wealthquest Corp purchased a new stake in shares of Koninklijke Philips in the first quarter valued at $116,000. Finally, Geneos Wealth Management Inc. grew its position in shares of Koninklijke Philips by 45.5% in the first quarter. Geneos Wealth Management Inc. now owns 4,755 shares of the technology company's stock valued at $121,000 after purchasing an additional 1,488 shares during the period. 13.67% of the stock is currently owned by hedge funds and other institutional investors.

Koninklijke Philips Stock Performance

NYSE:PHG opened at $28.54 on Friday. The stock has a market cap of $27.48 billion, a P/E ratio of 150.18, a PEG ratio of 0.76 and a beta of 0.82. Koninklijke Philips N.V. has a 1-year low of $21.48 and a 1-year high of $32.25. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.26 and a quick ratio of 0.81. The firm has a 50-day moving average of $27.69 and a two-hundred day moving average of $25.35.

Koninklijke Philips (NYSE:PHG - Get Free Report) last issued its quarterly earnings results on Tuesday, July 29th. The technology company reported $0.41 EPS for the quarter, beating analysts' consensus estimates of $0.29 by $0.12. The firm had revenue of $5.05 billion during the quarter, compared to the consensus estimate of $4.35 billion. Koninklijke Philips had a return on equity of 11.95% and a net margin of 1.00%. On average, research analysts expect that Koninklijke Philips N.V. will post 1.63 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several analysts have commented on the company. Weiss Ratings restated a "sell (d+)" rating on shares of Koninklijke Philips in a report on Wednesday, October 8th. Wall Street Zen downgraded shares of Koninklijke Philips from a "buy" rating to a "hold" rating in a report on Saturday, August 2nd. One research analyst has rated the stock with a Strong Buy rating, two have issued a Buy rating, one has issued a Hold rating and one has assigned a Sell rating to the company. According to data from MarketBeat.com, Koninklijke Philips has a consensus rating of "Moderate Buy".

Check Out Our Latest Report on Koninklijke Philips

Koninklijke Philips Profile

(

Free Report)

Koninklijke Philips N.V. operates as a health technology company in North America, the Greater China, and internationally. The company operates through Diagnosis & Treatment Businesses, Connected Care Businesses, and Personal Health Businesses segments. It also provides diagnostic imaging solutions, includes magnetic resonance imaging, X-ray systems, and computed tomography (CT) systems and software comprising detector-based spectral CT solutions, as well as molecular and hybrid imaging solutions for nuclear medicine; echography solutions focused on diagnosis, treatment planning and guidance for cardiology, general imaging, obstetrics/gynecology, and point-of-care applications; integrated interventional systems, and interventional diagnostic and therapeutic devices to treat coronary artery and peripheral vascular disease.

Further Reading

Want to see what other hedge funds are holding PHG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Koninklijke Philips N.V. (NYSE:PHG - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Koninklijke Philips, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Koninklijke Philips wasn't on the list.

While Koninklijke Philips currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.