Truist Financial Corp lessened its stake in CompoSecure, Inc. (NASDAQ:CMPO - Free Report) by 23.8% in the second quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 45,350 shares of the company's stock after selling 14,143 shares during the quarter. Truist Financial Corp's holdings in CompoSecure were worth $639,000 at the end of the most recent reporting period.

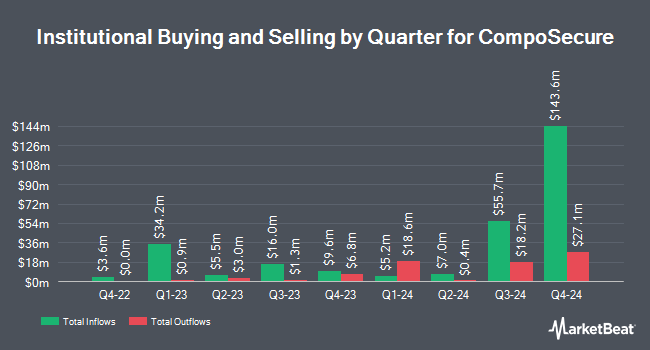

Other hedge funds also recently made changes to their positions in the company. GAMMA Investing LLC raised its stake in shares of CompoSecure by 1,524.4% during the first quarter. GAMMA Investing LLC now owns 2,794 shares of the company's stock valued at $30,000 after purchasing an additional 2,622 shares during the period. MorganRosel Wealth Management LLC purchased a new stake in shares of CompoSecure during the first quarter valued at approximately $43,000. AlphaQuest LLC purchased a new stake in shares of CompoSecure during the first quarter valued at approximately $72,000. Summit Securities Group LLC purchased a new stake in shares of CompoSecure during the first quarter valued at approximately $107,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank raised its stake in shares of CompoSecure by 71.1% during the first quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 10,547 shares of the company's stock valued at $115,000 after purchasing an additional 4,384 shares during the period. Hedge funds and other institutional investors own 37.56% of the company's stock.

Insider Transactions at CompoSecure

In other news, Director Rebecca Corbin Loree purchased 5,240 shares of the stock in a transaction dated Friday, August 29th. The stock was acquired at an average cost of $19.09 per share, for a total transaction of $100,031.60. Following the acquisition, the director owned 5,240 shares of the company's stock, valued at $100,031.60. The trade was a ∞ increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is accessible through this link. Also, COO Gregoire Maes sold 97,226 shares of the business's stock in a transaction that occurred on Thursday, August 14th. The shares were sold at an average price of $19.36, for a total value of $1,882,295.36. Following the completion of the sale, the chief operating officer owned 779,062 shares of the company's stock, valued at $15,082,640.32. This trade represents a 11.10% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 217,125 shares of company stock valued at $4,139,550 over the last 90 days. Insiders own 52.10% of the company's stock.

Wall Street Analyst Weigh In

CMPO has been the topic of several analyst reports. B. Riley restated a "buy" rating and set a $23.00 price objective (up from $17.00) on shares of CompoSecure in a report on Monday, August 18th. Benchmark lifted their price objective on CompoSecure from $14.00 to $17.00 and gave the stock a "buy" rating in a report on Friday, August 8th. Finally, JPMorgan Chase & Co. restated an "underweight" rating and set a $16.00 price objective on shares of CompoSecure in a report on Wednesday, August 20th. Five equities research analysts have rated the stock with a Buy rating and one has issued a Sell rating to the company's stock. Based on data from MarketBeat.com, CompoSecure currently has a consensus rating of "Moderate Buy" and a consensus target price of $17.67.

View Our Latest Stock Report on CMPO

CompoSecure Trading Up 2.9%

Shares of NASDAQ CMPO opened at $20.46 on Wednesday. CompoSecure, Inc. has a twelve month low of $9.24 and a twelve month high of $21.00. The company has a market capitalization of $2.09 billion, a price-to-earnings ratio of -12.18 and a beta of 0.97. The business has a 50 day simple moving average of $19.34 and a 200-day simple moving average of $15.08.

CompoSecure Company Profile

(

Free Report)

CompoSecure, Inc manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally. Its primary metal form factors include embedded, metal veneer lite, metal veneer, and full metal products. The company also offers Arculus Cold Storage Wallet, a three-factor authentication solution, which supports specific digital assets, including Bitcoin, Ethereum, non-fungible tokens and others.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CompoSecure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CompoSecure wasn't on the list.

While CompoSecure currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.