Trust Co of Kansas purchased a new stake in shares of Meta Platforms, Inc. (NASDAQ:META - Free Report) in the second quarter, according to its most recent 13F filing with the SEC. The fund purchased 5,476 shares of the social networking company's stock, valued at approximately $4,042,000. Meta Platforms makes up 1.9% of Trust Co of Kansas' investment portfolio, making the stock its 22nd largest position.

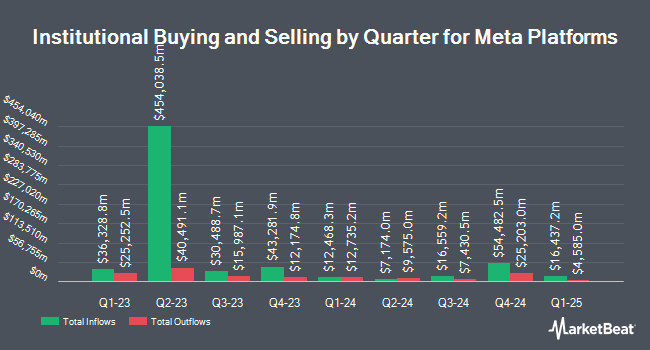

A number of other hedge funds have also recently made changes to their positions in META. Kingstone Capital Partners Texas LLC grew its position in shares of Meta Platforms by 608,429.2% during the 2nd quarter. Kingstone Capital Partners Texas LLC now owns 59,775,823 shares of the social networking company's stock valued at $44,119,937,000 after purchasing an additional 59,766,000 shares in the last quarter. Nuveen LLC purchased a new position in shares of Meta Platforms during the 1st quarter valued at $2,990,544,000. Assenagon Asset Management S.A. grew its position in shares of Meta Platforms by 712.2% during the 1st quarter. Assenagon Asset Management S.A. now owns 2,537,631 shares of the social networking company's stock valued at $1,462,589,000 after purchasing an additional 2,225,186 shares in the last quarter. Amundi grew its position in shares of Meta Platforms by 23.5% during the 1st quarter. Amundi now owns 7,733,061 shares of the social networking company's stock valued at $4,111,050,000 after purchasing an additional 1,470,070 shares in the last quarter. Finally, Goldman Sachs Group Inc. grew its position in shares of Meta Platforms by 8.8% during the 1st quarter. Goldman Sachs Group Inc. now owns 15,575,962 shares of the social networking company's stock valued at $8,977,361,000 after purchasing an additional 1,255,546 shares in the last quarter. 79.91% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Meta Platforms

In other news, insider Jennifer Newstead sold 519 shares of the stock in a transaction dated Tuesday, September 30th. The shares were sold at an average price of $741.50, for a total transaction of $384,838.50. Following the completion of the sale, the insider directly owned 29,832 shares in the company, valued at approximately $22,120,428. This represents a 1.71% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Robert M. Kimmitt sold 465 shares of the stock in a transaction dated Monday, September 15th. The stock was sold at an average price of $757.47, for a total transaction of $352,223.55. Following the completion of the transaction, the director directly owned 8,412 shares of the company's stock, valued at approximately $6,371,837.64. The trade was a 5.24% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 213,663 shares of company stock worth $164,574,107. Company insiders own 13.61% of the company's stock.

Wall Street Analysts Forecast Growth

A number of analysts have recently issued reports on the stock. BMO Capital Markets lifted their price objective on shares of Meta Platforms from $610.00 to $710.00 and gave the stock a "market perform" rating in a report on Thursday, July 31st. Hsbc Global Res raised shares of Meta Platforms from a "hold" rating to a "strong-buy" rating in a report on Thursday, July 31st. Pivotal Research lifted their price objective on shares of Meta Platforms from $830.00 to $930.00 and gave the stock a "buy" rating in a report on Thursday, July 31st. Weiss Ratings reaffirmed a "buy (b)" rating on shares of Meta Platforms in a report on Wednesday. Finally, Zacks Research downgraded shares of Meta Platforms from a "strong-buy" rating to a "hold" rating in a report on Tuesday, August 19th. Four research analysts have rated the stock with a Strong Buy rating, thirty-nine have given a Buy rating and five have given a Hold rating to the company. According to MarketBeat.com, Meta Platforms presently has a consensus rating of "Moderate Buy" and a consensus price target of $830.61.

Read Our Latest Stock Report on META

Meta Platforms Stock Performance

Meta Platforms stock opened at $717.84 on Thursday. The company has a current ratio of 1.97, a quick ratio of 1.97 and a debt-to-equity ratio of 0.15. The firm has a 50-day moving average of $753.89 and a 200-day moving average of $677.44. The firm has a market cap of $1.80 trillion, a P/E ratio of 25.99, a P/E/G ratio of 1.49 and a beta of 1.20. Meta Platforms, Inc. has a 1-year low of $479.80 and a 1-year high of $796.25.

Meta Platforms (NASDAQ:META - Get Free Report) last posted its earnings results on Wednesday, July 30th. The social networking company reported $7.14 earnings per share for the quarter, topping analysts' consensus estimates of $5.75 by $1.39. The company had revenue of $47.52 billion during the quarter, compared to analyst estimates of $44.55 billion. Meta Platforms had a net margin of 39.99% and a return on equity of 39.33%. Meta Platforms's revenue for the quarter was up 21.6% on a year-over-year basis. During the same period in the prior year, the business posted $5.16 earnings per share. Meta Platforms has set its Q3 2025 guidance at EPS. Sell-side analysts expect that Meta Platforms, Inc. will post 26.7 EPS for the current year.

Meta Platforms Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Monday, September 29th. Stockholders of record on Monday, September 22nd were issued a dividend of $0.525 per share. This represents a $2.10 dividend on an annualized basis and a dividend yield of 0.3%. The ex-dividend date was Monday, September 22nd. Meta Platforms's dividend payout ratio is currently 7.60%.

Meta Platforms Company Profile

(

Free Report)

Meta Platforms, Inc engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment offers Facebook, which enables people to share, discuss, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio, and video calls; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report