Truvestments Capital LLC decreased its position in shares of Spok Holdings, Inc. (NASDAQ:SPOK - Free Report) by 84.2% during the 1st quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 20,471 shares of the Wireless communications provider's stock after selling 109,061 shares during the quarter. Truvestments Capital LLC owned approximately 0.10% of Spok worth $337,000 as of its most recent SEC filing.

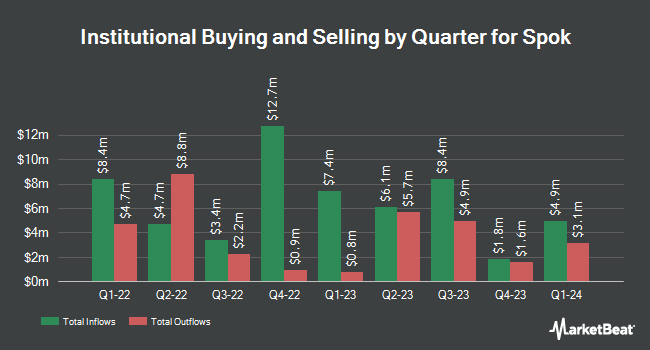

Other large investors have also recently bought and sold shares of the company. Ameriprise Financial Inc. acquired a new position in Spok during the 4th quarter worth $494,000. Bank of America Corp DE lifted its holdings in Spok by 37.3% during the 4th quarter. Bank of America Corp DE now owns 26,978 shares of the Wireless communications provider's stock worth $433,000 after buying an additional 7,332 shares in the last quarter. GAMMA Investing LLC lifted its holdings in Spok by 2,378.4% during the 1st quarter. GAMMA Investing LLC now owns 9,864 shares of the Wireless communications provider's stock worth $162,000 after buying an additional 9,466 shares in the last quarter. Public Employees Retirement System of Ohio acquired a new position in Spok during the 4th quarter worth $196,000. Finally, Millennium Management LLC lifted its holdings in Spok by 37.9% during the 4th quarter. Millennium Management LLC now owns 52,929 shares of the Wireless communications provider's stock worth $850,000 after buying an additional 14,552 shares in the last quarter. Institutional investors and hedge funds own 50.81% of the company's stock.

Spok Price Performance

Shares of Spok stock traded up $0.24 on Friday, hitting $18.16. 115,199 shares of the company's stock traded hands, compared to its average volume of 173,420. The firm's 50-day moving average price is $17.85 and its two-hundred day moving average price is $16.73. The stock has a market capitalization of $373.93 million, a PE ratio of 21.88 and a beta of 0.57. Spok Holdings, Inc. has a one year low of $13.55 and a one year high of $19.31.

Spok (NASDAQ:SPOK - Get Free Report) last issued its earnings results on Wednesday, July 30th. The Wireless communications provider reported $0.22 EPS for the quarter, beating the consensus estimate of $0.18 by $0.04. The company had revenue of $35.69 million during the quarter, compared to analysts' expectations of $35.00 million. Spok had a net margin of 12.12% and a return on equity of 11.11%. Spok has set its FY 2025 guidance at EPS. On average, analysts forecast that Spok Holdings, Inc. will post 0.76 earnings per share for the current fiscal year.

Spok Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, September 9th. Shareholders of record on Tuesday, August 19th will be given a dividend of $0.3125 per share. The ex-dividend date is Tuesday, August 19th. This represents a $1.25 annualized dividend and a dividend yield of 6.9%. Spok's payout ratio is presently 150.60%.

Insider Buying and Selling at Spok

In related news, CEO Vincent D. Kelly sold 25,000 shares of the company's stock in a transaction on Thursday, August 21st. The shares were sold at an average price of $17.69, for a total value of $442,250.00. Following the completion of the sale, the chief executive officer owned 102,817 shares in the company, valued at $1,818,832.73. This represents a 19.56% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, COO Michael W. Wallace sold 10,806 shares of the company's stock in a transaction on Monday, August 25th. The shares were sold at an average price of $17.87, for a total transaction of $193,103.22. Following the completion of the sale, the chief operating officer owned 40,369 shares of the company's stock, valued at approximately $721,394.03. This represents a 21.12% decrease in their position. The disclosure for this sale can be found here. Insiders own 7.37% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen raised Spok from a "buy" rating to a "strong-buy" rating in a report on Saturday, May 10th. One investment analyst has rated the stock with a Strong Buy rating, According to MarketBeat, the company currently has a consensus rating of "Strong Buy" and a consensus price target of $20.00.

Read Our Latest Report on SPOK

About Spok

(

Free Report)

Spok Holdings, Inc, through its subsidiary, Spok, Inc, provides healthcare communication solutions in the United States, Europe, Canada, Australia, Asia, and the Middle East. The company's products and services enhance workflows for clinicians and support administrative compliance. It delivers clinical information to care teams when and where it matters to enhance patient outcomes; and provides GenA Pager, a one-way alphanumeric pager.

Featured Articles

Before you consider Spok, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spok wasn't on the list.

While Spok currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.