TT International Asset Management LTD acquired a new stake in shares of KANZHUN LIMITED Sponsored ADR (NASDAQ:BZ - Free Report) during the 2nd quarter, according to its most recent 13F filing with the SEC. The firm acquired 28,207 shares of the company's stock, valued at approximately $503,000.

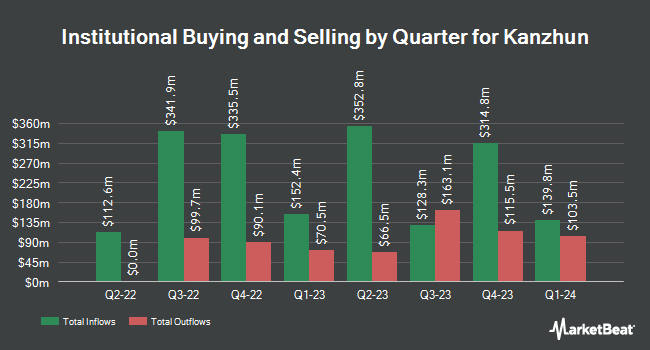

Other large investors have also bought and sold shares of the company. China Universal Asset Management Co. Ltd. lifted its stake in KANZHUN by 1,304.3% during the 1st quarter. China Universal Asset Management Co. Ltd. now owns 64,600 shares of the company's stock valued at $1,238,000 after acquiring an additional 60,000 shares in the last quarter. Charles Schwab Investment Management Inc. raised its stake in shares of KANZHUN by 3.2% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 437,579 shares of the company's stock worth $8,388,000 after purchasing an additional 13,763 shares during the period. Nuveen Asset Management LLC raised its stake in shares of KANZHUN by 3.2% during the 4th quarter. Nuveen Asset Management LLC now owns 649,330 shares of the company's stock worth $8,961,000 after purchasing an additional 20,100 shares during the period. Citigroup Inc. raised its stake in shares of KANZHUN by 2.9% during the 1st quarter. Citigroup Inc. now owns 4,084,520 shares of the company's stock worth $78,300,000 after purchasing an additional 116,280 shares during the period. Finally, Mackenzie Financial Corp bought a new stake in shares of KANZHUN during the 1st quarter worth $1,607,000. 60.67% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

A number of research firms have recently commented on BZ. Barclays lifted their target price on KANZHUN from $22.00 to $25.00 and gave the stock an "overweight" rating in a research note on Friday, August 22nd. Daiwa America upgraded KANZHUN from a "hold" rating to a "strong-buy" rating in a research note on Monday, June 2nd. UBS Group upgraded KANZHUN from a "neutral" rating to a "buy" rating and set a $26.00 price objective on the stock in a research note on Thursday, August 21st. Zacks Research upgraded KANZHUN from a "hold" rating to a "strong-buy" rating in a research note on Friday, September 12th. Finally, Jefferies Financial Group boosted their price objective on KANZHUN from $20.00 to $24.00 and gave the company a "buy" rating in a research note on Wednesday, August 20th. Two investment analysts have rated the stock with a Strong Buy rating, five have assigned a Buy rating and one has assigned a Hold rating to the company. Based on data from MarketBeat.com, KANZHUN currently has a consensus rating of "Buy" and a consensus price target of $21.17.

View Our Latest Research Report on BZ

KANZHUN Price Performance

Shares of BZ traded down $0.52 during midday trading on Monday, hitting $23.76. 3,551,867 shares of the company traded hands, compared to its average volume of 4,218,791. The stock has a 50-day moving average of $21.85 and a 200-day moving average of $18.94. KANZHUN LIMITED Sponsored ADR has a one year low of $12.16 and a one year high of $25.26. The firm has a market cap of $9.79 billion, a P/E ratio of 35.46 and a beta of 0.43.

KANZHUN Dividend Announcement

The business also recently declared a full year 25 dividend, which will be paid on Thursday, October 23rd. Stockholders of record on Wednesday, October 8th will be given a dividend of $0.084 per share. The ex-dividend date is Wednesday, October 8th. This represents a dividend yield of 60.0%.

KANZHUN Profile

(

Free Report)

Kanzhun Limited, together with its subsidiaries, provides online recruitment services in the People's Republic of China. The company offers its recruitment services through a mobile app under the BOSS Zhipin brand name. Its services allow enterprise customers to access and interact with job seekers and manage their recruitment process.

Featured Articles

Before you consider KANZHUN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KANZHUN wasn't on the list.

While KANZHUN currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.