Public Employees Retirement System of Ohio reduced its position in shares of Twilio Inc. (NYSE:TWLO - Free Report) by 15.0% in the fourth quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 53,357 shares of the technology company's stock after selling 9,443 shares during the quarter. Public Employees Retirement System of Ohio's holdings in Twilio were worth $5,767,000 as of its most recent SEC filing.

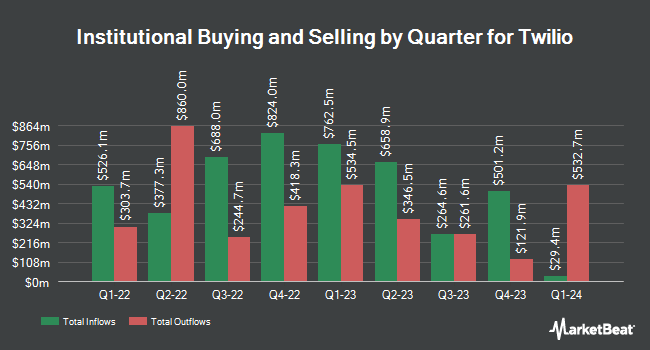

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Arrowstreet Capital Limited Partnership raised its holdings in shares of Twilio by 718.7% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 3,262,765 shares of the technology company's stock worth $352,640,000 after purchasing an additional 2,864,235 shares in the last quarter. Jericho Capital Asset Management L.P. acquired a new position in Twilio in the fourth quarter worth approximately $301,258,000. Norges Bank bought a new position in shares of Twilio in the fourth quarter valued at $222,146,000. Two Sigma Investments LP increased its holdings in shares of Twilio by 1,292.9% in the fourth quarter. Two Sigma Investments LP now owns 1,129,725 shares of the technology company's stock valued at $122,101,000 after buying an additional 1,048,619 shares in the last quarter. Finally, Whale Rock Capital Management LLC acquired a new stake in shares of Twilio during the 4th quarter valued at $111,312,000. 84.27% of the stock is owned by institutional investors.

Insider Activity at Twilio

In other news, CEO Khozema Shipchandler sold 12,056 shares of the firm's stock in a transaction on Monday, March 31st. The shares were sold at an average price of $95.88, for a total transaction of $1,155,929.28. Following the transaction, the chief executive officer now owns 295,134 shares in the company, valued at approximately $28,297,447.92. This trade represents a 3.92% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Aidan Viggiano sold 7,524 shares of Twilio stock in a transaction on Monday, March 31st. The shares were sold at an average price of $95.88, for a total transaction of $721,401.12. Following the completion of the sale, the chief financial officer now directly owns 176,640 shares of the company's stock, valued at approximately $16,936,243.20. The trade was a 4.09% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 44,784 shares of company stock valued at $4,226,942. 0.21% of the stock is owned by corporate insiders.

Twilio Stock Up 1.6%

Shares of NYSE:TWLO traded up $1.92 during midday trading on Monday, hitting $119.62. 3,017,886 shares of the stock were exchanged, compared to its average volume of 2,679,484. The company has a market capitalization of $18.26 billion, a PE ratio of -186.91, a P/E/G ratio of 4.30 and a beta of 1.44. Twilio Inc. has a 52-week low of $52.51 and a 52-week high of $151.95. The company has a debt-to-equity ratio of 0.12, a quick ratio of 5.06 and a current ratio of 5.06. The business's fifty day simple moving average is $99.99 and its two-hundred day simple moving average is $109.78.

Twilio (NYSE:TWLO - Get Free Report) last issued its earnings results on Thursday, May 1st. The technology company reported $1.14 earnings per share for the quarter, topping the consensus estimate of $0.92 by $0.22. Twilio had a positive return on equity of 1.38% and a negative net margin of 2.45%. The company had revenue of $1.17 billion for the quarter, compared to analyst estimates of $1.14 billion. During the same period in the prior year, the firm posted $0.80 EPS. The business's revenue was up 12.0% compared to the same quarter last year. As a group, research analysts predict that Twilio Inc. will post 1.44 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

TWLO has been the topic of a number of recent research reports. Tigress Financial restated a "buy" rating and issued a $170.00 target price on shares of Twilio in a report on Thursday, May 8th. Barclays increased their price target on Twilio from $120.00 to $140.00 and gave the company an "equal weight" rating in a research report on Friday, February 14th. Morgan Stanley cut their price objective on Twilio from $160.00 to $111.00 and set an "overweight" rating on the stock in a report on Wednesday, April 16th. Wall Street Zen lowered shares of Twilio from a "strong-buy" rating to a "buy" rating in a research note on Friday. Finally, Piper Sandler raised their target price on shares of Twilio from $106.00 to $121.00 and gave the stock an "overweight" rating in a report on Friday, May 2nd. One analyst has rated the stock with a sell rating, seven have given a hold rating, sixteen have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $124.41.

Read Our Latest Research Report on TWLO

About Twilio

(

Free Report)

Twilio Inc, together with its subsidiaries, provides customer engagement platform solutions in the United States and internationally. It operates through two segments, Twilio Communications and Twilio Segment. The company provides various application programming interfaces and software solutions for communications between customers and end users, including messaging, voice, email, flex, marketing campaigns, and user identity and authentication.

Featured Articles

Before you consider Twilio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twilio wasn't on the list.

While Twilio currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.