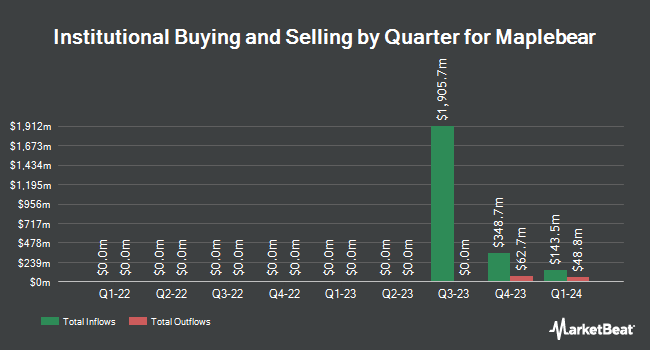

Twin Focus Capital Partners LLC acquired a new stake in shares of Maplebear Inc. (NASDAQ:CART - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 15,700 shares of the company's stock, valued at approximately $626,000.

Other institutional investors have also recently made changes to their positions in the company. Principal Financial Group Inc. boosted its stake in shares of Maplebear by 4,154.7% during the first quarter. Principal Financial Group Inc. now owns 372,581 shares of the company's stock valued at $14,862,000 after purchasing an additional 363,824 shares during the period. Mirae Asset Global Investments Co. Ltd. boosted its stake in shares of Maplebear by 18.6% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,056 shares of the company's stock valued at $82,000 after purchasing an additional 322 shares during the period. Cambridge Investment Research Advisors Inc. boosted its stake in shares of Maplebear by 7.6% during the first quarter. Cambridge Investment Research Advisors Inc. now owns 6,166 shares of the company's stock valued at $246,000 after purchasing an additional 433 shares during the period. Golden State Wealth Management LLC boosted its stake in shares of Maplebear by 100.0% during the first quarter. Golden State Wealth Management LLC now owns 1,066 shares of the company's stock valued at $43,000 after purchasing an additional 533 shares during the period. Finally, New York State Teachers Retirement System boosted its stake in shares of Maplebear by 542.8% during the first quarter. New York State Teachers Retirement System now owns 101,720 shares of the company's stock valued at $4,058,000 after purchasing an additional 85,896 shares during the period. Hedge funds and other institutional investors own 63.09% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts recently commented on the company. JMP Securities raised their price target on Maplebear from $55.00 to $60.00 and gave the stock a "market outperform" rating in a research note on Friday, August 8th. Wells Fargo & Company raised their price objective on Maplebear from $47.00 to $55.00 and gave the company an "equal weight" rating in a research report on Friday, August 8th. Robert W. Baird raised their price target on Maplebear from $47.00 to $52.00 and gave the company an "outperform" rating in a report on Thursday, July 17th. Stifel Nicolaus lifted their price objective on Maplebear from $55.00 to $64.00 and gave the stock a "buy" rating in a report on Friday, August 8th. Finally, Barclays lifted their price objective on Maplebear from $61.00 to $65.00 and gave the stock an "overweight" rating in a report on Friday, August 8th. One investment analyst has rated the stock with a Strong Buy rating, sixteen have given a Buy rating and nine have issued a Hold rating to the stock. According to data from MarketBeat, Maplebear currently has an average rating of "Moderate Buy" and a consensus target price of $55.46.

Get Our Latest Analysis on Maplebear

Maplebear Stock Down 2.1%

NASDAQ CART traded down $0.9590 during trading hours on Wednesday, reaching $45.5410. The company's stock had a trading volume of 2,524,675 shares, compared to its average volume of 4,361,827. The firm's 50-day moving average price is $46.85 and its 200-day moving average price is $44.68. Maplebear Inc. has a 1 year low of $33.06 and a 1 year high of $53.50. The company has a market capitalization of $12.00 billion, a price-to-earnings ratio of 26.24, a PEG ratio of 1.54 and a beta of 1.21.

Maplebear (NASDAQ:CART - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The company reported $0.41 EPS for the quarter, topping analysts' consensus estimates of $0.39 by $0.02. Maplebear had a return on equity of 15.69% and a net margin of 13.76%.The company had revenue of $914.00 million for the quarter, compared to analysts' expectations of $896.55 million. During the same period in the previous year, the firm earned $0.20 EPS. The firm's revenue was up 11.1% compared to the same quarter last year. Equities research analysts anticipate that Maplebear Inc. will post 1.43 EPS for the current fiscal year.

Insiders Place Their Bets

In other Maplebear news, insider Grosvenor L.P. Gcm sold 4,864,272 shares of Maplebear stock in a transaction that occurred on Friday, July 25th. The stock was sold at an average price of $47.75, for a total value of $232,268,988.00. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, CEO Fidji Simo sold 6,640 shares of the business's stock in a transaction that occurred on Wednesday, July 23rd. The shares were sold at an average price of $50.00, for a total value of $332,000.00. Following the transaction, the chief executive officer directly owned 1,958,805 shares in the company, valued at approximately $97,940,250. This represents a 0.34% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 4,975,327 shares of company stock worth $237,736,848. Insiders own 26.00% of the company's stock.

About Maplebear

(

Free Report)

Maplebear Inc, doing business as Instacart, engages in the provision of online grocery shopping services to households in North America. It sells and delivers grocery products, as well as pickup services through a mobile application and website. It also operates virtual convenience stores; and provides software-as-a-service solutions to retailers.

Further Reading

Before you consider Maplebear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maplebear wasn't on the list.

While Maplebear currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.