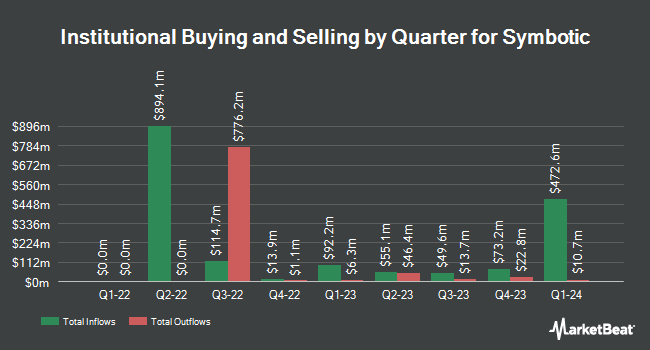

Tyche Wealth Partners LLC purchased a new stake in Symbotic Inc. (NASDAQ:SYM - Free Report) in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 10,365 shares of the company's stock, valued at approximately $403,000.

Other large investors have also recently modified their holdings of the company. Amanah Holdings Trust purchased a new stake in shares of Symbotic in the second quarter valued at approximately $19,824,000. Mirae Asset Global Investments Co. Ltd. boosted its holdings in shares of Symbotic by 21.3% in the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 17,248 shares of the company's stock valued at $348,000 after purchasing an additional 3,024 shares during the period. Amundi boosted its holdings in shares of Symbotic by 53.0% in the first quarter. Amundi now owns 72,192 shares of the company's stock valued at $1,459,000 after purchasing an additional 24,993 shares during the period. Bank of New York Mellon Corp boosted its holdings in shares of Symbotic by 35.7% in the first quarter. Bank of New York Mellon Corp now owns 60,554 shares of the company's stock valued at $1,224,000 after purchasing an additional 15,947 shares during the period. Finally, Freemont Management S.A. purchased a new stake in shares of Symbotic in the first quarter valued at approximately $1,479,000.

Insider Transactions at Symbotic

In related news, Director Rollin L. Ford sold 90,000 shares of the company's stock in a transaction on Tuesday, August 12th. The stock was sold at an average price of $51.57, for a total value of $4,641,300.00. Following the transaction, the director directly owned 14,507 shares of the company's stock, valued at $748,125.99. This represents a 86.12% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider William M. Boyd III sold 25,000 shares of the company's stock in a transaction on Thursday, July 10th. The shares were sold at an average price of $49.00, for a total transaction of $1,225,000.00. Following the completion of the sale, the insider directly owned 34,544 shares in the company, valued at approximately $1,692,656. The trade was a 41.99% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 479,032 shares of company stock worth $23,711,528 over the last 90 days. Insiders own 0.60% of the company's stock.

Symbotic Price Performance

NASDAQ SYM opened at $68.42 on Wednesday. The stock's fifty day moving average price is $52.34 and its 200 day moving average price is $38.40. Symbotic Inc. has a 1 year low of $16.32 and a 1 year high of $71.29. The company has a market cap of $40.40 billion, a price-to-earnings ratio of -977.29, a PEG ratio of 13.15 and a beta of 2.06.

Symbotic (NASDAQ:SYM - Get Free Report) last released its earnings results on Wednesday, August 6th. The company reported ($0.05) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.03 by ($0.08). Symbotic had a negative net margin of 0.38% and a negative return on equity of 2.02%. The firm had revenue of $592.12 million during the quarter, compared to analyst estimates of $533.55 million. During the same period in the previous year, the company earned ($0.02) earnings per share. Symbotic's revenue was up 25.9% on a year-over-year basis. Research analysts expect that Symbotic Inc. will post 0.13 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on the company. Northland Securities upped their target price on Symbotic from $35.00 to $56.00 and gave the stock an "outperform" rating in a report on Tuesday, July 8th. Northcoast Research set a $65.00 price target on Symbotic and gave the stock a "buy" rating in a research report on Thursday, October 2nd. Arete downgraded Symbotic from a "buy" rating to a "neutral" rating and set a $50.00 price target on the stock. in a research report on Friday, July 25th. Needham & Company LLC upped their price target on Symbotic from $32.00 to $57.00 and gave the stock a "buy" rating in a research report on Thursday, August 7th. Finally, Barclays started coverage on Symbotic in a research report on Tuesday. They set an "underweight" rating and a $38.00 price target on the stock. Seven investment analysts have rated the stock with a Buy rating, thirteen have given a Hold rating and three have assigned a Sell rating to the company. According to MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $44.61.

Check Out Our Latest Stock Analysis on SYM

Symbotic Company Profile

(

Free Report)

Symbotic Inc, an automation technology company, engages in developing technologies to improve operating efficiencies in modern warehouses. The company automates the processing of pallets and cases in large warehouses or distribution centers for retail companies. Its systems enhance operations at the front end of the supply chain.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Symbotic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Symbotic wasn't on the list.

While Symbotic currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.