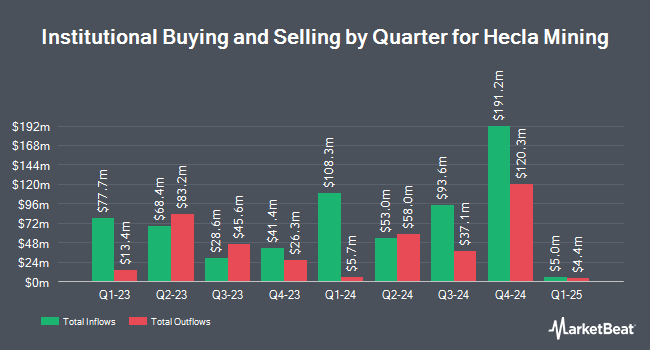

U S Global Investors Inc. boosted its position in Hecla Mining Company (NYSE:HL - Free Report) by 10.0% in the 2nd quarter, according to its most recent filing with the SEC. The firm owned 550,000 shares of the basic materials company's stock after acquiring an additional 50,000 shares during the period. U S Global Investors Inc. owned about 0.09% of Hecla Mining worth $3,294,000 at the end of the most recent reporting period.

A number of other hedge funds also recently made changes to their positions in HL. Migdal Insurance & Financial Holdings Ltd. acquired a new position in shares of Hecla Mining in the 1st quarter valued at $31,000. DRW Securities LLC acquired a new position in shares of Hecla Mining in the 1st quarter valued at $54,000. PFG Investments LLC acquired a new position in shares of Hecla Mining in the 1st quarter valued at $56,000. Hohimer Wealth Management LLC acquired a new position in shares of Hecla Mining in the 1st quarter valued at $58,000. Finally, Tradition Wealth Management LLC acquired a new position in shares of Hecla Mining in the 1st quarter valued at $62,000. Institutional investors and hedge funds own 63.01% of the company's stock.

Insider Buying and Selling

In other Hecla Mining news, VP Stuart Maurice Absolom sold 14,472 shares of the business's stock in a transaction on Friday, September 12th. The shares were sold at an average price of $11.29, for a total value of $163,388.88. Following the transaction, the vice president owned 73,200 shares in the company, valued at $826,428. The trade was a 16.51% decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. 0.62% of the stock is owned by corporate insiders.

Hecla Mining Stock Performance

NYSE:HL opened at $12.57 on Friday. The company has a current ratio of 2.67, a quick ratio of 1.99 and a debt-to-equity ratio of 0.23. The firm has a market capitalization of $8.42 billion, a price-to-earnings ratio of 78.54 and a beta of 1.31. The firm's fifty day simple moving average is $9.68 and its 200 day simple moving average is $7.03. Hecla Mining Company has a twelve month low of $4.46 and a twelve month high of $13.84.

Hecla Mining (NYSE:HL - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The basic materials company reported $0.08 EPS for the quarter, topping analysts' consensus estimates of $0.05 by $0.03. Hecla Mining had a net margin of 9.55% and a return on equity of 5.51%. The firm had revenue of $304.03 million for the quarter, compared to analyst estimates of $248.93 million. During the same quarter in the previous year, the business posted $0.02 EPS. The firm's revenue was up 23.8% compared to the same quarter last year. As a group, equities research analysts expect that Hecla Mining Company will post 0.21 earnings per share for the current fiscal year.

Hecla Mining Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, September 4th. Shareholders of record on Friday, August 22nd were issued a $0.0038 dividend. The ex-dividend date was Friday, August 22nd. This represents a $0.02 dividend on an annualized basis and a yield of 0.1%. Hecla Mining's payout ratio is currently 6.25%.

Analysts Set New Price Targets

HL has been the topic of a number of research analyst reports. Wall Street Zen upgraded shares of Hecla Mining from a "hold" rating to a "buy" rating in a report on Saturday, August 9th. Roth Capital set a $8.75 price target on shares of Hecla Mining and gave the company a "sell" rating in a report on Friday, October 3rd. CIBC lifted their target price on shares of Hecla Mining from $12.50 to $15.00 and gave the company a "neutral" rating in a report on Friday. BMO Capital Markets lifted their target price on shares of Hecla Mining from $6.00 to $6.50 and gave the company a "market perform" rating in a report on Thursday, August 7th. Finally, Weiss Ratings restated a "hold (c)" rating on shares of Hecla Mining in a report on Wednesday. Two research analysts have rated the stock with a Buy rating, five have given a Hold rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat.com, Hecla Mining presently has an average rating of "Hold" and a consensus price target of $8.75.

Check Out Our Latest Research Report on HL

Hecla Mining Company Profile

(

Free Report)

Hecla Mining Company, together with its subsidiaries, provides precious and base metal properties in the United States, Canada, Japan, Korea, and China. The company mines for silver, gold, lead, and zinc concentrates, as well as carbon material containing silver and gold for custom smelters, metal traders, and third-party processors; and doré containing silver and gold.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Hecla Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hecla Mining wasn't on the list.

While Hecla Mining currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.