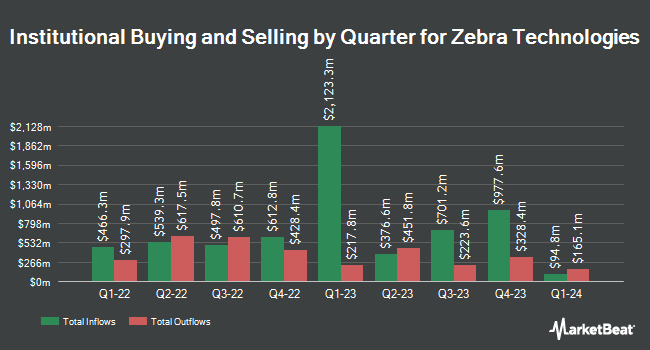

UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lessened its stake in Zebra Technologies Corporation (NASDAQ:ZBRA - Free Report) by 9.7% during the 1st quarter, according to its most recent disclosure with the SEC. The institutional investor owned 329,622 shares of the industrial products company's stock after selling 35,382 shares during the quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC owned approximately 0.65% of Zebra Technologies worth $93,138,000 at the end of the most recent reporting period.

A number of other hedge funds also recently bought and sold shares of ZBRA. Cetera Investment Advisers increased its position in Zebra Technologies by 2.5% during the fourth quarter. Cetera Investment Advisers now owns 7,752 shares of the industrial products company's stock valued at $2,994,000 after acquiring an additional 189 shares during the last quarter. Janus Henderson Group PLC increased its position in Zebra Technologies by 5.9% during the fourth quarter. Janus Henderson Group PLC now owns 6,376 shares of the industrial products company's stock valued at $2,463,000 after acquiring an additional 357 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its position in Zebra Technologies by 32.5% during the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 32,384 shares of the industrial products company's stock valued at $12,494,000 after acquiring an additional 7,936 shares during the last quarter. Millennium Management LLC increased its position in Zebra Technologies by 53.2% during the fourth quarter. Millennium Management LLC now owns 147,244 shares of the industrial products company's stock valued at $56,869,000 after acquiring an additional 51,158 shares during the last quarter. Finally, OMERS ADMINISTRATION Corp increased its position in Zebra Technologies by 20.2% during the fourth quarter. OMERS ADMINISTRATION Corp now owns 2,148 shares of the industrial products company's stock valued at $830,000 after acquiring an additional 361 shares during the last quarter. Hedge funds and other institutional investors own 91.03% of the company's stock.

Analyst Ratings Changes

A number of research analysts have recently commented on ZBRA shares. Morgan Stanley upped their price target on shares of Zebra Technologies from $280.00 to $300.00 and gave the stock an "equal weight" rating in a report on Wednesday, August 6th. Barclays set a $301.00 price target on shares of Zebra Technologies and gave the stock an "equal weight" rating in a report on Tuesday, August 5th. Citigroup restated a "neutral" rating and issued a $342.00 price target (up from $280.00) on shares of Zebra Technologies in a report on Monday, July 14th. Truist Financial upped their price target on shares of Zebra Technologies from $269.00 to $319.00 and gave the stock a "hold" rating in a report on Wednesday, August 6th. Finally, Needham & Company LLC upped their price target on shares of Zebra Technologies from $325.00 to $345.00 and gave the stock a "buy" rating in a report on Wednesday, August 6th. One research analyst has rated the stock with a Strong Buy rating, five have given a Buy rating and four have assigned a Hold rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $357.44.

Read Our Latest Report on Zebra Technologies

Zebra Technologies Stock Performance

Shares of NASDAQ ZBRA opened at $312.65 on Friday. The company has a current ratio of 1.46, a quick ratio of 1.03 and a debt-to-equity ratio of 0.59. Zebra Technologies Corporation has a 12 month low of $205.73 and a 12 month high of $427.76. The company has a 50 day simple moving average of $321.40 and a two-hundred day simple moving average of $292.46. The stock has a market cap of $15.90 billion, a price-to-earnings ratio of 29.52 and a beta of 1.78.

Zebra Technologies (NASDAQ:ZBRA - Get Free Report) last announced its quarterly earnings data on Tuesday, August 5th. The industrial products company reported $3.61 EPS for the quarter, beating the consensus estimate of $3.31 by $0.30. Zebra Technologies had a net margin of 10.56% and a return on equity of 18.95%. The business had revenue of $1.29 billion during the quarter, compared to analysts' expectations of $1.29 billion. During the same period in the previous year, the business posted $3.18 EPS. The business's quarterly revenue was up 6.2% compared to the same quarter last year. Zebra Technologies has set its FY 2025 guidance at 15.250-15.750 EPS. Q3 2025 guidance at 3.600-3.800 EPS. As a group, analysts predict that Zebra Technologies Corporation will post 13.71 earnings per share for the current year.

Zebra Technologies announced that its board has initiated a share buyback program on Tuesday, August 5th that allows the company to buyback $250.00 million in shares. This buyback authorization allows the industrial products company to reacquire up to 1.4% of its shares through open market purchases. Shares buyback programs are usually a sign that the company's leadership believes its shares are undervalued.

About Zebra Technologies

(

Free Report)

Zebra Technologies Corporation, together with its subsidiaries, provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide. It operates in two segments, Asset Intelligence & Tracking, and Enterprise Visibility & Mobility. The company designs, manufactures, and sells printers that produce labels, wristbands, tickets, receipts, and plastic cards; dye-sublimination thermal card printers that produce images, which are used for personal identification, access control, and financial transactions; radio frequency identification device (RFID) printers that encode data into passive RFID transponders; accessories and options for printers, including carrying cases, vehicle mounts, and battery chargers; stock and customized thermal labels, receipts, ribbons, plastic cards, and RFID tags for printers; and temperature-monitoring labels primarily used in vaccine distribution.

Further Reading

Want to see what other hedge funds are holding ZBRA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Zebra Technologies Corporation (NASDAQ:ZBRA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zebra Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zebra Technologies wasn't on the list.

While Zebra Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.