Belpointe Asset Management LLC lowered its position in shares of Ulta Beauty Inc. (NASDAQ:ULTA - Free Report) by 48.0% in the second quarter, according to the company in its most recent filing with the SEC. The firm owned 738 shares of the specialty retailer's stock after selling 680 shares during the quarter. Belpointe Asset Management LLC's holdings in Ulta Beauty were worth $345,000 at the end of the most recent reporting period.

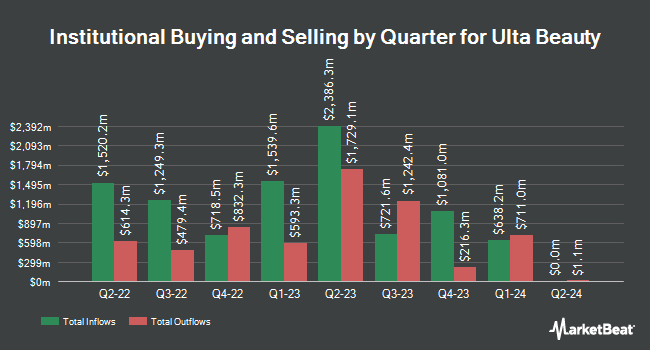

A number of other institutional investors have also modified their holdings of ULTA. Price T Rowe Associates Inc. MD raised its stake in shares of Ulta Beauty by 128.2% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,225,023 shares of the specialty retailer's stock valued at $449,021,000 after buying an additional 688,267 shares during the last quarter. JPMorgan Chase & Co. raised its stake in shares of Ulta Beauty by 81.7% during the 1st quarter. JPMorgan Chase & Co. now owns 913,600 shares of the specialty retailer's stock valued at $334,871,000 after buying an additional 410,900 shares during the last quarter. T. Rowe Price Investment Management Inc. raised its stake in shares of Ulta Beauty by 64.8% during the 1st quarter. T. Rowe Price Investment Management Inc. now owns 931,557 shares of the specialty retailer's stock valued at $341,453,000 after buying an additional 366,147 shares during the last quarter. Pacer Advisors Inc. raised its stake in shares of Ulta Beauty by 5,117.0% during the 1st quarter. Pacer Advisors Inc. now owns 220,312 shares of the specialty retailer's stock valued at $80,753,000 after buying an additional 216,089 shares during the last quarter. Finally, AQR Capital Management LLC raised its stake in shares of Ulta Beauty by 237.7% during the 1st quarter. AQR Capital Management LLC now owns 270,420 shares of the specialty retailer's stock valued at $96,674,000 after buying an additional 190,353 shares during the last quarter. Hedge funds and other institutional investors own 90.39% of the company's stock.

Ulta Beauty Trading Down 2.1%

NASDAQ:ULTA opened at $549.28 on Friday. Ulta Beauty Inc. has a 12 month low of $309.01 and a 12 month high of $572.23. The stock has a 50 day moving average of $528.22 and a two-hundred day moving average of $463.92. The firm has a market cap of $24.63 billion, a P/E ratio of 21.06, a price-to-earnings-growth ratio of 3.09 and a beta of 1.08.

Ulta Beauty (NASDAQ:ULTA - Get Free Report) last posted its quarterly earnings data on Thursday, August 28th. The specialty retailer reported $5.78 EPS for the quarter, topping the consensus estimate of $5.03 by $0.75. Ulta Beauty had a return on equity of 48.78% and a net margin of 10.31%.The company had revenue of $2.79 billion during the quarter, compared to analyst estimates of $2.66 billion. During the same period in the previous year, the business earned $5.30 EPS. Ulta Beauty's quarterly revenue was up 9.3% on a year-over-year basis. On average, research analysts forecast that Ulta Beauty Inc. will post 23.96 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of research firms have weighed in on ULTA. Piper Sandler began coverage on Ulta Beauty in a research note on Thursday, September 4th. They set an "overweight" rating and a $590.00 price objective for the company. Weiss Ratings restated a "hold (c)" rating on shares of Ulta Beauty in a research note on Wednesday. Raymond James Financial restated an "outperform" rating and issued a $605.00 price target (up previously from $580.00) on shares of Ulta Beauty in a research note on Friday, August 29th. Telsey Advisory Group restated an "outperform" rating and issued a $610.00 price target on shares of Ulta Beauty in a research note on Monday, September 8th. Finally, Canaccord Genuity Group lifted their price target on Ulta Beauty from $650.00 to $653.00 and gave the company a "buy" rating in a research note on Friday. One investment analyst has rated the stock with a Strong Buy rating, thirteen have issued a Buy rating, twelve have given a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $549.33.

View Our Latest Analysis on Ulta Beauty

Insider Activity

In other news, Director Mike C. Smith sold 500 shares of the company's stock in a transaction that occurred on Thursday, September 4th. The stock was sold at an average price of $528.43, for a total value of $264,215.00. Following the completion of the sale, the director directly owned 2,263 shares in the company, valued at $1,195,837.09. This represents a 18.10% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 0.17% of the stock is owned by company insiders.

Ulta Beauty Company Profile

(

Free Report)

Ulta Beauty, Inc operates as a specialty beauty retailer in the United States. The company offers branded and private label beauty products, including cosmetics, fragrance, haircare, skincare, bath and body products, professional hair products, and salon styling tools through its Ulta Beauty stores, shop-in-shops, Ulta.com website, and its mobile applications.

Read More

Want to see what other hedge funds are holding ULTA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Ulta Beauty Inc. (NASDAQ:ULTA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ulta Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ulta Beauty wasn't on the list.

While Ulta Beauty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.