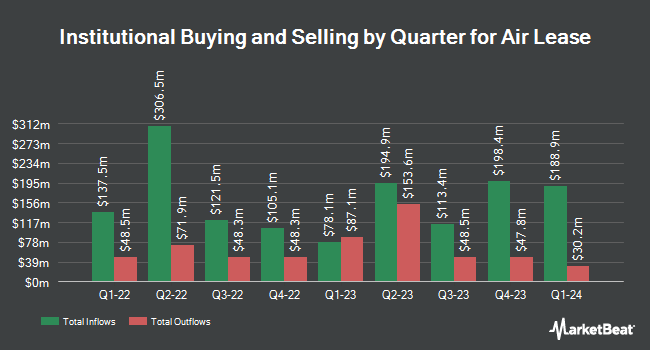

United Services Automobile Association bought a new stake in Air Lease Corporation (NYSE:AL - Free Report) in the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The firm bought 6,837 shares of the transportation company's stock, valued at approximately $330,000.

Several other hedge funds have also recently bought and sold shares of the stock. Illinois Municipal Retirement Fund lifted its position in Air Lease by 0.5% during the first quarter. Illinois Municipal Retirement Fund now owns 56,306 shares of the transportation company's stock worth $2,720,000 after acquiring an additional 272 shares during the last quarter. Squarepoint Ops LLC lifted its position in Air Lease by 3.0% during the fourth quarter. Squarepoint Ops LLC now owns 9,564 shares of the transportation company's stock worth $461,000 after acquiring an additional 281 shares during the last quarter. MBM Wealth Consultants LLC lifted its position in Air Lease by 2.1% during the first quarter. MBM Wealth Consultants LLC now owns 14,131 shares of the transportation company's stock worth $686,000 after acquiring an additional 284 shares during the last quarter. Versant Capital Management Inc lifted its position in Air Lease by 88.1% during the first quarter. Versant Capital Management Inc now owns 743 shares of the transportation company's stock worth $36,000 after acquiring an additional 348 shares during the last quarter. Finally, Brooklyn Investment Group lifted its position in Air Lease by 152.4% during the first quarter. Brooklyn Investment Group now owns 588 shares of the transportation company's stock worth $28,000 after acquiring an additional 355 shares during the last quarter. 94.59% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several brokerages recently issued reports on AL. TD Cowen cut Air Lease from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, September 3rd. Cowen cut shares of Air Lease from a "buy" rating to a "hold" rating in a research note on Wednesday, September 3rd. Deutsche Bank Aktiengesellschaft cut shares of Air Lease from a "buy" rating to a "hold" rating and set a $65.00 price objective on the stock. in a research note on Wednesday, September 3rd. Finally, Barclays reissued an "overweight" rating and issued a $67.00 price objective (up previously from $56.00) on shares of Air Lease in a research note on Thursday, July 10th. Four investment analysts have rated the stock with a Buy rating, three have issued a Hold rating and one has given a Sell rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $60.29.

View Our Latest Report on Air Lease

Air Lease Stock Up 0.0%

NYSE:AL traded up $0.01 on Thursday, hitting $63.56. The stock had a trading volume of 1,147,419 shares, compared to its average volume of 1,092,166. The company has a debt-to-equity ratio of 2.47, a quick ratio of 0.42 and a current ratio of 0.42. The stock has a market cap of $7.10 billion, a P/E ratio of 7.71, a price-to-earnings-growth ratio of 0.66 and a beta of 1.37. Air Lease Corporation has a 1 year low of $38.25 and a 1 year high of $64.30. The firm's fifty day simple moving average is $59.17 and its two-hundred day simple moving average is $53.92.

Air Lease (NYSE:AL - Get Free Report) last posted its quarterly earnings data on Monday, August 4th. The transportation company reported $1.40 EPS for the quarter, beating the consensus estimate of $1.33 by $0.07. The firm had revenue of $731.70 million during the quarter, compared to analyst estimates of $723.35 million. Air Lease had a net margin of 34.04% and a return on equity of 7.99%. The company's revenue for the quarter was up 9.7% on a year-over-year basis. During the same quarter last year, the business posted $1.23 EPS. Analysts predict that Air Lease Corporation will post 5.16 earnings per share for the current year.

Air Lease Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 8th. Investors of record on Wednesday, September 3rd will be paid a $0.22 dividend. This represents a $0.88 dividend on an annualized basis and a yield of 1.4%. The ex-dividend date is Wednesday, September 3rd. Air Lease's payout ratio is currently 10.68%.

Insider Buying and Selling

In other news, EVP David Beker sold 5,000 shares of the business's stock in a transaction on Monday, September 15th. The shares were sold at an average price of $63.53, for a total transaction of $317,650.00. Following the completion of the transaction, the executive vice president directly owned 13,970 shares in the company, valued at $887,514.10. The trade was a 26.36% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP Grant A. Levy sold 5,000 shares of Air Lease stock in a transaction on Friday, September 12th. The stock was sold at an average price of $63.57, for a total transaction of $317,850.00. Following the sale, the executive vice president directly owned 141,316 shares of the company's stock, valued at $8,983,458.12. This represents a 3.42% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 12,000 shares of company stock valued at $746,380 over the last quarter. 6.64% of the stock is owned by company insiders.

Air Lease Profile

(

Free Report)

Air Lease Corporation, an aircraft leasing company, engages in the purchase and leasing of commercial jet aircraft to airlines worldwide. It sells aircraft from its fleet to third parties, including other leasing companies, financial services companies, airlines, and other investors. The company provides fleet management services to investors and owners of aircraft portfolios.

Further Reading

Before you consider Air Lease, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air Lease wasn't on the list.

While Air Lease currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.