Edmond DE Rothschild Holding S.A. increased its position in shares of Unity Software Inc. (NYSE:U - Free Report) by 57.7% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 2,088,003 shares of the company's stock after purchasing an additional 763,570 shares during the period. Edmond DE Rothschild Holding S.A. owned approximately 0.50% of Unity Software worth $40,904,000 as of its most recent SEC filing.

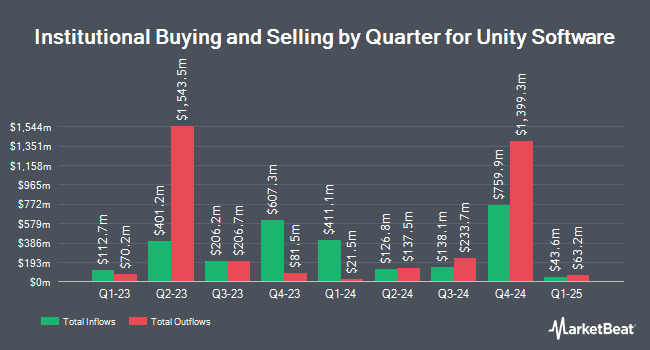

Other large investors have also recently added to or reduced their stakes in the company. Cornerstone Planning Group LLC raised its holdings in Unity Software by 30,300.0% during the first quarter. Cornerstone Planning Group LLC now owns 1,216 shares of the company's stock worth $25,000 after purchasing an additional 1,212 shares in the last quarter. Banque Transatlantique SA purchased a new position in Unity Software during the first quarter worth about $28,000. Point72 Asia Singapore Pte. Ltd. purchased a new position in Unity Software during the fourth quarter worth about $36,000. GAMMA Investing LLC raised its holdings in Unity Software by 72.5% during the first quarter. GAMMA Investing LLC now owns 2,822 shares of the company's stock worth $55,000 after purchasing an additional 1,186 shares in the last quarter. Finally, Signaturefd LLC raised its holdings in Unity Software by 26.3% during the first quarter. Signaturefd LLC now owns 3,658 shares of the company's stock worth $72,000 after purchasing an additional 762 shares in the last quarter. 73.46% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In related news, Director Tomer Bar-Zeev sold 150,000 shares of the firm's stock in a transaction that occurred on Tuesday, September 2nd. The shares were sold at an average price of $37.75, for a total transaction of $5,662,500.00. Following the sale, the director owned 1,948,146 shares in the company, valued at approximately $73,542,511.50. This trade represents a 7.15% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, SVP Anirma Gupta sold 10,819 shares of the firm's stock in a transaction that occurred on Monday, August 25th. The stock was sold at an average price of $39.32, for a total transaction of $425,403.08. Following the sale, the senior vice president owned 630,749 shares in the company, valued at approximately $24,801,050.68. This trade represents a 1.69% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 641,036 shares of company stock valued at $22,710,923 in the last 90 days. Insiders own 3.61% of the company's stock.

Wall Street Analyst Weigh In

U has been the subject of a number of research analyst reports. JMP Securities increased their target price on shares of Unity Software from $30.00 to $35.00 and gave the company a "market outperform" rating in a report on Thursday, August 7th. Wedbush increased their target price on shares of Unity Software from $39.00 to $41.00 and gave the company an "outperform" rating in a report on Thursday, August 7th. Jefferies Financial Group increased their target price on shares of Unity Software from $29.00 to $35.00 and gave the company a "buy" rating in a report on Wednesday, July 16th. Bank of America initiated coverage on shares of Unity Software in a report on Thursday, June 26th. They issued an "underperform" rating and a $15.00 target price for the company. Finally, Morgan Stanley increased their target price on shares of Unity Software from $25.00 to $40.00 and gave the company an "overweight" rating in a report on Thursday, August 7th. Two research analysts have rated the stock with a Strong Buy rating, eight have given a Buy rating, seven have issued a Hold rating and two have assigned a Sell rating to the stock. According to data from MarketBeat, Unity Software currently has a consensus rating of "Moderate Buy" and a consensus price target of $31.20.

Get Our Latest Stock Analysis on U

Unity Software Price Performance

Shares of U traded up $3.65 during mid-day trading on Friday, reaching $43.83. 20,028,371 shares of the company's stock were exchanged, compared to its average volume of 10,964,210. The company has a quick ratio of 2.73, a current ratio of 2.73 and a debt-to-equity ratio of 0.70. The company has a 50-day simple moving average of $34.19 and a two-hundred day simple moving average of $26.39. Unity Software Inc. has a 52-week low of $15.33 and a 52-week high of $44.22. The company has a market cap of $18.52 billion, a price-to-earnings ratio of -41.35 and a beta of 2.33.

Unity Software (NYSE:U - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The company reported ($0.26) earnings per share for the quarter, missing analysts' consensus estimates of ($0.25) by ($0.01). Unity Software had a negative return on equity of 13.59% and a negative net margin of 24.38%.The business had revenue of $440.94 million for the quarter, compared to analysts' expectations of $425.18 million. During the same period last year, the business earned ($0.32) earnings per share. The company's revenue for the quarter was down 1.9% on a year-over-year basis. On average, sell-side analysts predict that Unity Software Inc. will post -1.25 EPS for the current fiscal year.

Unity Software Profile

(

Free Report)

Unity Software Inc operates a real-time 3D development platform. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company offers its solutions directly through its online store and field sales operations in North America, Denmark, Finland, the United Kingdom, Germany, Japan, China, Singapore, and South Korea, as well as indirectly through independent distributors and resellers worldwide.

See Also

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report