Universal Beteiligungs und Servicegesellschaft mbH bought a new position in shares of Chewy (NYSE:CHWY - Free Report) in the 1st quarter, according to its most recent 13F filing with the SEC. The fund bought 17,366 shares of the company's stock, valued at approximately $565,000.

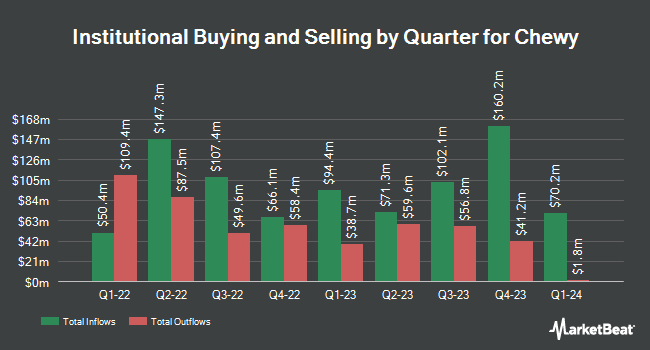

Other large investors have also recently bought and sold shares of the company. D.A. Davidson & CO. boosted its position in shares of Chewy by 38.7% during the first quarter. D.A. Davidson & CO. now owns 43,725 shares of the company's stock worth $1,422,000 after buying an additional 12,206 shares during the period. Polar Asset Management Partners Inc. raised its holdings in shares of Chewy by 26.5% in the fourth quarter. Polar Asset Management Partners Inc. now owns 288,733 shares of the company's stock valued at $9,670,000 after purchasing an additional 60,533 shares during the last quarter. Victory Capital Management Inc. lifted its position in shares of Chewy by 74.5% in the first quarter. Victory Capital Management Inc. now owns 139,889 shares of the company's stock worth $4,548,000 after purchasing an additional 59,711 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. bought a new stake in shares of Chewy in the first quarter worth $11,326,000. Finally, Interval Partners LP acquired a new stake in Chewy in the 4th quarter valued at $1,536,000. Institutional investors own 93.09% of the company's stock.

Chewy Stock Down 0.3%

NYSE CHWY traded down $0.10 on Monday, hitting $35.81. 7,253,895 shares of the stock were exchanged, compared to its average volume of 6,306,387. Chewy has a fifty-two week low of $19.75 and a fifty-two week high of $48.62. The company has a 50-day moving average price of $41.27 and a 200-day moving average price of $38.04. The company has a market cap of $14.87 billion, a PE ratio of 40.24, a PEG ratio of 7.50 and a beta of 1.67.

Chewy (NYSE:CHWY - Get Free Report) last released its quarterly earnings data on Wednesday, June 11th. The company reported $0.35 earnings per share for the quarter, topping analysts' consensus estimates of $0.34 by $0.01. The company had revenue of $3.12 billion for the quarter, compared to analysts' expectations of $3.08 billion. Chewy had a net margin of 3.21% and a return on equity of 35.04%. The firm's revenue for the quarter was up 6.3% on a year-over-year basis. During the same quarter last year, the company earned $0.31 earnings per share. As a group, equities research analysts predict that Chewy will post 0.24 EPS for the current fiscal year.

Insider Transactions at Chewy

In other news, major shareholder Argos Holdings Gp Llc sold 29,940,120 shares of Chewy stock in a transaction dated Wednesday, June 25th. The shares were sold at an average price of $41.75, for a total value of $1,250,000,010.00. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. Also, CEO Sumit Singh sold 148,063 shares of the business's stock in a transaction on Wednesday, May 14th. The stock was sold at an average price of $40.67, for a total transaction of $6,021,722.21. Following the sale, the chief executive officer owned 705,252 shares in the company, valued at $28,682,598.84. The trade was a 17.35% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 30,138,926 shares of company stock worth $1,258,056,019. Corporate insiders own 0.43% of the company's stock.

Analyst Ratings Changes

CHWY has been the topic of several analyst reports. Morgan Stanley reiterated an "overweight" rating and set a $50.00 target price (up previously from $39.00) on shares of Chewy in a report on Thursday, June 12th. Needham & Company LLC restated a "hold" rating on shares of Chewy in a research note on Thursday, June 12th. Barclays raised their target price on shares of Chewy from $44.00 to $50.00 and gave the company an "overweight" rating in a research note on Wednesday, May 28th. Deutsche Bank Aktiengesellschaft set a $27.00 price target on Chewy and gave the stock a "hold" rating in a research report on Monday, April 14th. Finally, Cowen restated a "buy" rating on shares of Chewy in a research note on Friday, June 6th. Nine analysts have rated the stock with a hold rating, seventeen have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, Chewy presently has an average rating of "Moderate Buy" and a consensus price target of $43.89.

Get Our Latest Report on Chewy

About Chewy

(

Free Report)

Chewy, Inc, together with its subsidiaries, engages in the pure play e-commerce business in the United States. It provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its retail websites and mobile applications.

Recommended Stories

Before you consider Chewy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chewy wasn't on the list.

While Chewy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.