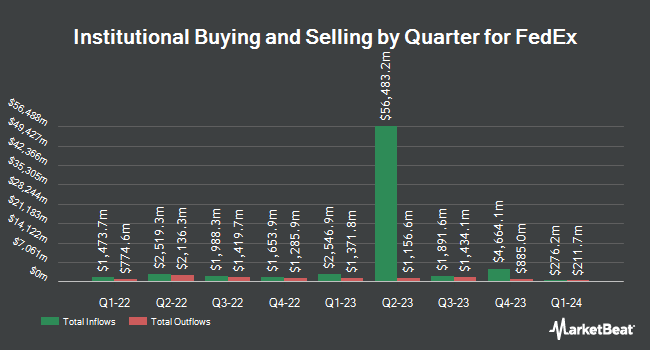

Universal Beteiligungs und Servicegesellschaft mbH purchased a new position in FedEx Co. (NYSE:FDX - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 151,380 shares of the shipping service provider's stock, valued at approximately $42,588,000. Universal Beteiligungs und Servicegesellschaft mbH owned about 0.06% of FedEx as of its most recent SEC filing.

Other institutional investors also recently bought and sold shares of the company. Transce3nd LLC bought a new stake in FedEx in the fourth quarter worth $26,000. Kentucky Trust Co bought a new stake in shares of FedEx during the fourth quarter worth $28,000. Pilgrim Partners Asia Pte Ltd bought a new stake in shares of FedEx during the fourth quarter worth $28,000. Activest Wealth Management bought a new stake in shares of FedEx during the fourth quarter worth $29,000. Finally, R Squared Ltd bought a new stake in shares of FedEx during the fourth quarter worth $31,000. 84.47% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

FDX has been the subject of several research analyst reports. Wall Street Zen downgraded FedEx from a "buy" rating to a "hold" rating in a research report on Friday. JPMorgan Chase & Co. cut their target price on FedEx from $323.00 to $280.00 and set an "overweight" rating on the stock in a research note on Friday, March 21st. Citigroup cut their target price on FedEx from $305.00 to $267.00 and set a "buy" rating on the stock in a research note on Tuesday, April 8th. Raymond James cut their target price on FedEx from $320.00 to $290.00 and set an "outperform" rating on the stock in a research note on Friday, March 21st. Finally, Loop Capital lowered FedEx from a "hold" rating to a "sell" rating and cut their target price for the company from $283.00 to $221.00 in a research note on Friday, March 21st. Two analysts have rated the stock with a sell rating, ten have issued a hold rating, eighteen have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $296.17.

View Our Latest Report on FDX

Insider Buying and Selling at FedEx

In other news, COO John Alan Smith sold 6,155 shares of the business's stock in a transaction that occurred on Thursday, March 27th. The stock was sold at an average price of $243.55, for a total value of $1,499,050.25. Following the completion of the sale, the chief operating officer now directly owns 23,347 shares in the company, valued at $5,686,161.85. The trade was a 20.86% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 8.87% of the stock is currently owned by corporate insiders.

FedEx Stock Performance

Shares of FedEx stock traded down $2.35 on Friday, reaching $217.91. 2,339,089 shares of the stock were exchanged, compared to its average volume of 1,826,101. FedEx Co. has a twelve month low of $194.30 and a twelve month high of $313.84. The firm has a market capitalization of $52.21 billion, a price-to-earnings ratio of 13.89, a PEG ratio of 1.11 and a beta of 1.36. The business has a 50 day moving average price of $218.75 and a two-hundred day moving average price of $252.97. The company has a quick ratio of 1.19, a current ratio of 1.23 and a debt-to-equity ratio of 0.73.

FedEx (NYSE:FDX - Get Free Report) last announced its quarterly earnings results on Thursday, March 20th. The shipping service provider reported $4.51 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $4.56 by ($0.05). FedEx had a net margin of 4.45% and a return on equity of 15.59%. The company had revenue of $22.16 billion during the quarter, compared to analyst estimates of $21.96 billion. During the same period in the previous year, the firm posted $3.86 earnings per share. The company's revenue was up 1.9% compared to the same quarter last year. Analysts anticipate that FedEx Co. will post 19.14 earnings per share for the current fiscal year.

About FedEx

(

Free Report)

FedEx Corporation provides transportation, e-commerce, and business services in the United States and internationally. It operates through FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services segments. The FedEx Express segment offers express transportation, small-package ground delivery, and freight transportation services; and time-critical transportation services.

Featured Articles

Before you consider FedEx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FedEx wasn't on the list.

While FedEx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.