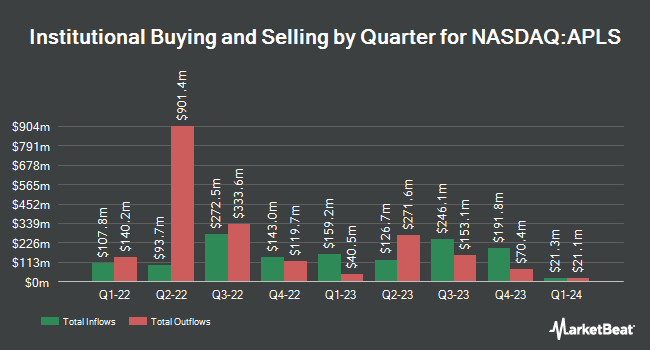

Universal Beteiligungs und Servicegesellschaft mbH bought a new position in shares of Apellis Pharmaceuticals, Inc. (NASDAQ:APLS - Free Report) during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund bought 16,159 shares of the company's stock, valued at approximately $353,000.

Other institutional investors and hedge funds have also made changes to their positions in the company. Boxer Capital Management LLC purchased a new stake in shares of Apellis Pharmaceuticals during the 4th quarter valued at approximately $45,504,000. Royal Bank of Canada raised its position in Apellis Pharmaceuticals by 969.6% in the fourth quarter. Royal Bank of Canada now owns 1,518,827 shares of the company's stock valued at $48,465,000 after purchasing an additional 1,376,832 shares during the period. Point72 Asset Management L.P. purchased a new stake in Apellis Pharmaceuticals in the fourth quarter valued at approximately $40,461,000. Avoro Capital Advisors LLC raised its position in Apellis Pharmaceuticals by 10.0% in the fourth quarter. Avoro Capital Advisors LLC now owns 12,222,222 shares of the company's stock valued at $390,011,000 after purchasing an additional 1,111,111 shares during the period. Finally, Norges Bank purchased a new stake in Apellis Pharmaceuticals in the fourth quarter valued at approximately $34,662,000. 96.29% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of analysts have issued reports on APLS shares. JPMorgan Chase & Co. boosted their target price on Apellis Pharmaceuticals from $35.00 to $37.00 and gave the company an "overweight" rating in a research report on Monday. Wells Fargo & Company upped their price objective on Apellis Pharmaceuticals from $26.00 to $29.00 and gave the stock an "equal weight" rating in a research report on Monday, June 2nd. Bank of America boosted their target price on shares of Apellis Pharmaceuticals from $23.00 to $24.00 and gave the stock a "neutral" rating in a research note on Wednesday, July 16th. Scotiabank lowered their target price on shares of Apellis Pharmaceuticals from $28.00 to $20.00 and set a "sector perform" rating for the company in a research note on Thursday, May 8th. Finally, Wall Street Zen upgraded shares of Apellis Pharmaceuticals from a "sell" rating to a "hold" rating in a research note on Saturday, August 2nd. Ten equities research analysts have rated the stock with a hold rating, ten have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $36.83.

Get Our Latest Stock Analysis on Apellis Pharmaceuticals

Insiders Place Their Bets

In other Apellis Pharmaceuticals news, CEO Cedric Francois sold 137,465 shares of the stock in a transaction on Monday, July 14th. The stock was sold at an average price of $20.19, for a total transaction of $2,775,418.35. Following the transaction, the chief executive officer owned 343,433 shares of the company's stock, valued at $6,933,912.27. This represents a 28.59% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this link. Also, General Counsel David O. Watson sold 5,000 shares of the stock in a transaction on Wednesday, July 16th. The stock was sold at an average price of $19.55, for a total value of $97,750.00. Following the transaction, the general counsel directly owned 128,730 shares in the company, valued at approximately $2,516,671.50. This represents a 3.74% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 169,090 shares of company stock worth $3,403,832. Corporate insiders own 6.50% of the company's stock.

Apellis Pharmaceuticals Price Performance

Apellis Pharmaceuticals stock traded down $0.19 during mid-day trading on Friday, reaching $24.15. The company had a trading volume of 674,048 shares, compared to its average volume of 2,291,635. The stock's 50-day simple moving average is $19.32 and its 200-day simple moving average is $21.68. The company has a market capitalization of $3.05 billion, a P/E ratio of -13.33 and a beta of 0.78. Apellis Pharmaceuticals, Inc. has a 1 year low of $16.10 and a 1 year high of $41.94. The company has a debt-to-equity ratio of 2.90, a current ratio of 3.77 and a quick ratio of 3.16.

Apellis Pharmaceuticals (NASDAQ:APLS - Get Free Report) last released its earnings results on Thursday, July 31st. The company reported ($0.33) EPS for the quarter, topping the consensus estimate of ($0.44) by $0.11. Apellis Pharmaceuticals had a negative net margin of 30.24% and a negative return on equity of 116.09%. The firm had revenue of $171.39 million during the quarter, compared to analysts' expectations of $187.91 million. During the same period in the previous year, the company earned ($0.30) EPS. Apellis Pharmaceuticals's revenue for the quarter was down 10.6% on a year-over-year basis. On average, equities analysts predict that Apellis Pharmaceuticals, Inc. will post -1.7 EPS for the current year.

About Apellis Pharmaceuticals

(

Free Report)

Apellis Pharmaceuticals, Inc, a commercial-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of therapeutic compounds through the inhibition of the complement system for autoimmune and inflammatory diseases. It offers EMPAVELI for the treatment of paroxysmal nocturnal hemoglobinuria, C3 glomerulopathy and immune complex membranoproliferative glomerulonephritis, and hematopoietic stem cell transplantation-associated thrombotic microangiopathy; and SYFOVRE for treating geographic atrophy secondary to age-related macular degeneration and geographic atrophy (GA).

Read More

Before you consider Apellis Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apellis Pharmaceuticals wasn't on the list.

While Apellis Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.