Universal Beteiligungs und Servicegesellschaft mbH purchased a new stake in CompoSecure, Inc. (NASDAQ:CMPO - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 116,000 shares of the company's stock, valued at approximately $1,261,000. Universal Beteiligungs und Servicegesellschaft mbH owned about 0.11% of CompoSecure as of its most recent filing with the Securities and Exchange Commission (SEC).

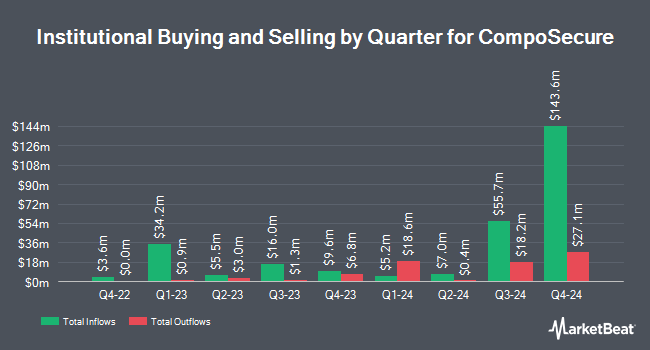

Other institutional investors and hedge funds have also recently bought and sold shares of the company. GAMMA Investing LLC boosted its holdings in CompoSecure by 1,524.4% in the first quarter. GAMMA Investing LLC now owns 2,794 shares of the company's stock valued at $30,000 after purchasing an additional 2,622 shares during the last quarter. MorganRosel Wealth Management LLC purchased a new position in CompoSecure in the first quarter valued at about $43,000. KLP Kapitalforvaltning AS purchased a new position in CompoSecure in the fourth quarter valued at about $75,000. Summit Trail Advisors LLC purchased a new position in CompoSecure in the first quarter valued at about $129,000. Finally, Price T Rowe Associates Inc. MD purchased a new position in CompoSecure in the fourth quarter valued at about $156,000. Hedge funds and other institutional investors own 37.56% of the company's stock.

CompoSecure Price Performance

NASDAQ CMPO remained flat at $14.15 on Tuesday. The company's stock had a trading volume of 293,298 shares, compared to its average volume of 909,247. The company has a fifty day moving average price of $14.18 and a 200-day moving average price of $13.18. The stock has a market capitalization of $1.45 billion, a P/E ratio of -12.87 and a beta of 0.94. CompoSecure, Inc. has a 12-month low of $7.44 and a 12-month high of $17.71.

CompoSecure (NASDAQ:CMPO - Get Free Report) last announced its quarterly earnings results on Monday, May 12th. The company reported $0.25 earnings per share for the quarter, topping analysts' consensus estimates of $0.19 by $0.06. The business had revenue of $103.90 million for the quarter, compared to analysts' expectations of $103.22 million. CompoSecure had a negative return on equity of 33.46% and a negative net margin of 15.36%. Research analysts expect that CompoSecure, Inc. will post 1.02 earnings per share for the current year.

Analyst Ratings Changes

A number of brokerages recently commented on CMPO. Wall Street Zen downgraded CompoSecure from a "buy" rating to a "hold" rating in a report on Thursday, May 22nd. Needham & Company LLC restated a "buy" rating and set a $15.00 price objective on shares of CompoSecure in a research note on Tuesday, May 13th. Two investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $16.19.

Read Our Latest Report on CompoSecure

About CompoSecure

(

Free Report)

CompoSecure, Inc manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally. Its primary metal form factors include embedded, metal veneer lite, metal veneer, and full metal products. The company also offers Arculus Cold Storage Wallet, a three-factor authentication solution, which supports specific digital assets, including Bitcoin, Ethereum, non-fungible tokens and others.

Featured Articles

Before you consider CompoSecure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CompoSecure wasn't on the list.

While CompoSecure currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.