Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in Progyny, Inc. (NASDAQ:PGNY - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm acquired 87,088 shares of the company's stock, valued at approximately $1,946,000. Universal Beteiligungs und Servicegesellschaft mbH owned approximately 0.10% of Progyny at the end of the most recent reporting period.

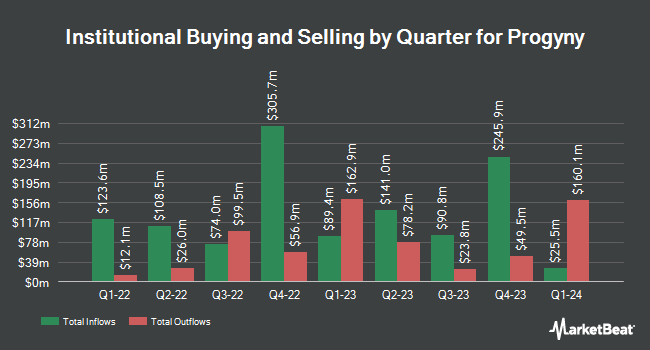

Other hedge funds also recently modified their holdings of the company. Barclays PLC lifted its position in Progyny by 95.7% during the fourth quarter. Barclays PLC now owns 1,382,205 shares of the company's stock worth $23,843,000 after acquiring an additional 676,048 shares during the last quarter. D. E. Shaw & Co. Inc. acquired a new stake in Progyny during the fourth quarter worth approximately $11,265,000. BNP Paribas Financial Markets acquired a new stake in Progyny during the fourth quarter worth approximately $10,557,000. First Sabrepoint Capital Management LP acquired a new stake in shares of Progyny in the fourth quarter valued at approximately $9,660,000. Finally, Voloridge Investment Management LLC raised its position in shares of Progyny by 85.5% in the fourth quarter. Voloridge Investment Management LLC now owns 1,197,993 shares of the company's stock valued at $20,665,000 after buying an additional 552,066 shares in the last quarter. Institutional investors own 94.93% of the company's stock.

Progyny Price Performance

Shares of Progyny stock traded down $1.02 during trading on Friday, hitting $22.49. The company's stock had a trading volume of 1,210,981 shares, compared to its average volume of 1,006,189. The stock has a market cap of $1.93 billion, a price-to-earnings ratio of 39.46, a price-to-earnings-growth ratio of 2.26 and a beta of 1.32. The stock has a 50-day moving average price of $22.11 and a two-hundred day moving average price of $22.11. Progyny, Inc. has a 52 week low of $13.39 and a 52 week high of $27.15.

Progyny (NASDAQ:PGNY - Get Free Report) last issued its quarterly earnings results on Thursday, May 8th. The company reported $0.17 EPS for the quarter, missing analysts' consensus estimates of $0.45 by ($0.28). Progyny had a net margin of 4.33% and a return on equity of 10.90%. The firm had revenue of $324.04 million for the quarter, compared to the consensus estimate of $307.86 million. During the same period last year, the company posted $0.17 EPS. The business's revenue was up 16.5% compared to the same quarter last year. On average, equities analysts predict that Progyny, Inc. will post 0.6 EPS for the current fiscal year.

Insider Buying and Selling at Progyny

In related news, Director Cheryl Scott sold 2,675 shares of the company's stock in a transaction dated Wednesday, June 11th. The shares were sold at an average price of $22.07, for a total value of $59,037.25. Following the sale, the director owned 14,112 shares in the company, valued at $311,451.84. This represents a 15.93% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Corporate insiders own 9.40% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have recently weighed in on the stock. Canaccord Genuity Group dropped their price target on shares of Progyny from $23.00 to $21.00 and set a "hold" rating for the company in a research report on Monday, May 12th. Leerink Partnrs upgraded shares of Progyny from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, July 8th. Leerink Partners upgraded shares of Progyny from a "market perform" rating to an "outperform" rating and set a $28.00 price target for the company in a research report on Tuesday, July 8th. Wall Street Zen upgraded shares of Progyny from a "hold" rating to a "buy" rating in a research report on Saturday, July 26th. Finally, Truist Financial lifted their price objective on shares of Progyny from $24.00 to $27.00 and gave the company a "hold" rating in a research note on Thursday, July 17th. Five investment analysts have rated the stock with a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, Progyny presently has a consensus rating of "Moderate Buy" and an average price target of $24.82.

Read Our Latest Stock Report on PGNY

About Progyny

(

Free Report)

Progyny, Inc, a benefits management company, specializes in fertility and family building benefits solutions in the United States. Its fertility benefits solution includes differentiated benefits plan design, personalized concierge-style member support services, and selective network of fertility specialists.

See Also

Before you consider Progyny, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progyny wasn't on the list.

While Progyny currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.