UNIVEST FINANCIAL Corp decreased its holdings in BlackRock (NYSE:BLK - Free Report) by 11.6% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 26,444 shares of the asset manager's stock after selling 3,486 shares during the period. BlackRock accounts for approximately 1.6% of UNIVEST FINANCIAL Corp's holdings, making the stock its 14th biggest holding. UNIVEST FINANCIAL Corp's holdings in BlackRock were worth $25,029,000 as of its most recent SEC filing.

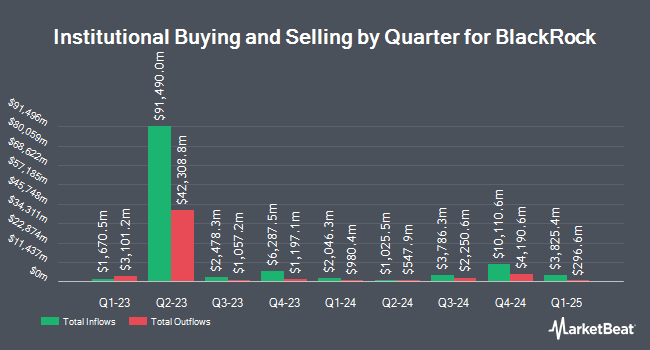

A number of other institutional investors have also recently made changes to their positions in BLK. Brighton Jones LLC lifted its holdings in shares of BlackRock by 23.1% in the 4th quarter. Brighton Jones LLC now owns 1,575 shares of the asset manager's stock valued at $1,615,000 after acquiring an additional 296 shares during the last quarter. Cynosure Group LLC bought a new position in shares of BlackRock in the 4th quarter valued at about $353,000. Disciplined Investors L.L.C. bought a new position in shares of BlackRock in the 4th quarter valued at about $201,000. World Investment Advisors lifted its holdings in shares of BlackRock by 50.4% in the 4th quarter. World Investment Advisors now owns 3,616 shares of the asset manager's stock valued at $3,706,000 after acquiring an additional 1,211 shares during the last quarter. Finally, Grant Private Wealth Management Inc bought a new position in shares of BlackRock in the 4th quarter valued at about $820,000. Institutional investors own 80.69% of the company's stock.

Analysts Set New Price Targets

Several analysts have issued reports on BLK shares. TD Cowen decreased their price objective on shares of BlackRock from $1,251.00 to $1,032.00 and set a "buy" rating for the company in a research note on Wednesday, April 9th. JPMorgan Chase & Co. raised their price objective on shares of BlackRock from $1,018.00 to $1,093.00 and gave the stock a "neutral" rating in a research note on Wednesday, July 16th. Bank of America raised their price objective on shares of BlackRock from $1,214.00 to $1,224.00 and gave the stock a "buy" rating in a research note on Wednesday, July 16th. Jefferies Financial Group raised their price objective on shares of BlackRock from $959.00 to $1,210.00 in a research note on Thursday, July 10th. Finally, UBS Group reaffirmed a "neutral" rating and set a $980.00 price target on shares of BlackRock in a research note on Tuesday, July 8th. Three analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company's stock. According to MarketBeat.com, BlackRock has an average rating of "Moderate Buy" and an average price target of $1,151.21.

Read Our Latest Stock Report on BlackRock

BlackRock Price Performance

BLK stock traded down $14.72 during trading on Friday, reaching $1,091.29. 672,794 shares of the company were exchanged, compared to its average volume of 646,030. The company has a market cap of $169.07 billion, a P/E ratio of 26.39, a PEG ratio of 2.21 and a beta of 1.42. BlackRock has a 52-week low of $773.74 and a 52-week high of $1,130.66. The stock's 50 day moving average price is $1,040.67 and its 200 day moving average price is $981.44. The company has a debt-to-equity ratio of 0.38, a quick ratio of 4.34 and a current ratio of 4.34.

BlackRock (NYSE:BLK - Get Free Report) last posted its quarterly earnings data on Tuesday, July 15th. The asset manager reported $12.05 earnings per share for the quarter, beating analysts' consensus estimates of $10.41 by $1.64. BlackRock had a net margin of 29.68% and a return on equity of 15.83%. The business had revenue of $5.42 billion during the quarter, compared to analyst estimates of $5.40 billion. During the same quarter in the previous year, the business posted $10.36 earnings per share. The company's revenue was up 12.9% on a year-over-year basis. As a group, analysts predict that BlackRock will post 47.41 earnings per share for the current fiscal year.

BlackRock Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 23rd. Stockholders of record on Friday, September 5th will be given a $5.21 dividend. The ex-dividend date of this dividend is Friday, September 5th. This represents a $20.84 annualized dividend and a dividend yield of 1.9%. BlackRock's dividend payout ratio is presently 50.39%.

Insider Buying and Selling at BlackRock

In other news, Director J. Richard Kushel sold 17,142 shares of the stock in a transaction on Wednesday, July 30th. The shares were sold at an average price of $1,120.50, for a total value of $19,207,611.00. Following the completion of the sale, the director owned 61,369 shares of the company's stock, valued at $68,763,964.50. This represents a 21.83% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Rachel Lord sold 18,036 shares of the company's stock in a transaction on Friday, July 25th. The shares were sold at an average price of $1,125.60, for a total transaction of $20,301,321.60. Following the completion of the transaction, the director owned 19,205 shares of the company's stock, valued at $21,617,148. This trade represents a 48.43% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 66,494 shares of company stock worth $74,694,573 over the last three months. 1.98% of the stock is currently owned by insiders.

About BlackRock

(

Free Report)

BlackRock, Inc is a publicly owned investment manager. The firm primarily provides its services to institutional, intermediary, and individual investors including corporate, public, union, and industry pension plans, insurance companies, third-party mutual funds, endowments, public institutions, governments, foundations, charities, sovereign wealth funds, corporations, official institutions, and banks.

Recommended Stories

Before you consider BlackRock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackRock wasn't on the list.

While BlackRock currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report