US Bancorp DE lowered its stake in Ulta Beauty Inc. (NASDAQ:ULTA - Free Report) by 5.5% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 11,929 shares of the specialty retailer's stock after selling 688 shares during the quarter. US Bancorp DE's holdings in Ulta Beauty were worth $4,372,000 at the end of the most recent quarter.

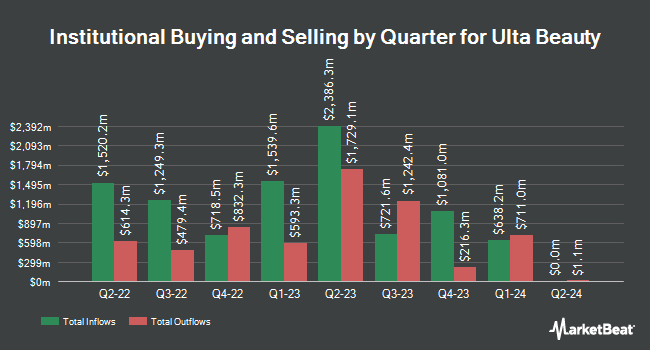

Other hedge funds have also recently made changes to their positions in the company. EFG Asset Management Americas Corp. boosted its position in Ulta Beauty by 20.2% in the 1st quarter. EFG Asset Management Americas Corp. now owns 14,596 shares of the specialty retailer's stock valued at $5,350,000 after buying an additional 2,451 shares during the period. Natixis Advisors LLC raised its holdings in Ulta Beauty by 13.8% during the first quarter. Natixis Advisors LLC now owns 27,119 shares of the specialty retailer's stock worth $9,940,000 after purchasing an additional 3,297 shares in the last quarter. Bayforest Capital Ltd acquired a new stake in shares of Ulta Beauty during the first quarter worth about $655,000. De Lisle Partners LLP lifted its stake in Ulta Beauty by 20.0% in the first quarter. De Lisle Partners LLP now owns 12,000 shares of the specialty retailer's stock valued at $4,400,000 after buying an additional 2,000 shares during the last quarter. Finally, Banque Cantonale Vaudoise acquired a new stake in Ulta Beauty during the 1st quarter worth $994,000. Hedge funds and other institutional investors own 90.39% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have recently issued reports on ULTA. UBS Group boosted their price target on shares of Ulta Beauty from $490.00 to $525.00 and gave the stock a "buy" rating in a research note on Friday, May 30th. Wells Fargo & Company upped their price target on shares of Ulta Beauty from $315.00 to $350.00 and gave the company an "underweight" rating in a report on Friday, May 30th. Wall Street Zen cut Ulta Beauty from a "buy" rating to a "hold" rating in a research report on Saturday, August 2nd. Robert W. Baird boosted their price target on Ulta Beauty from $440.00 to $525.00 and gave the company an "outperform" rating in a report on Friday, May 30th. Finally, Citigroup increased their price objective on shares of Ulta Beauty from $425.00 to $450.00 and gave the stock a "neutral" rating in a report on Friday, May 30th. One analyst has rated the stock with a sell rating, thirteen have assigned a hold rating and twelve have issued a buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $469.09.

Check Out Our Latest Report on ULTA

Ulta Beauty Stock Down 1.9%

Shares of Ulta Beauty stock traded down $10.02 on Thursday, hitting $506.17. 799,576 shares of the company's stock traded hands, compared to its average volume of 890,388. Ulta Beauty Inc. has a 52-week low of $309.01 and a 52-week high of $523.68. The stock has a market cap of $22.75 billion, a P/E ratio of 19.77, a PEG ratio of 3.08 and a beta of 1.12. The firm's 50-day moving average is $481.11 and its 200 day moving average is $413.66.

Ulta Beauty (NASDAQ:ULTA - Get Free Report) last issued its quarterly earnings results on Thursday, May 29th. The specialty retailer reported $6.70 earnings per share for the quarter, beating analysts' consensus estimates of $5.73 by $0.97. Ulta Beauty had a return on equity of 49.73% and a net margin of 10.45%. The business had revenue of $2.85 billion during the quarter, compared to the consensus estimate of $2.79 billion. During the same period in the previous year, the business earned $6.47 EPS. The business's quarterly revenue was up 4.5% on a year-over-year basis. Equities research analysts forecast that Ulta Beauty Inc. will post 23.96 EPS for the current year.

Ulta Beauty Company Profile

(

Free Report)

Ulta Beauty, Inc operates as a specialty beauty retailer in the United States. The company offers branded and private label beauty products, including cosmetics, fragrance, haircare, skincare, bath and body products, professional hair products, and salon styling tools through its Ulta Beauty stores, shop-in-shops, Ulta.com website, and its mobile applications.

See Also

Before you consider Ulta Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ulta Beauty wasn't on the list.

While Ulta Beauty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.