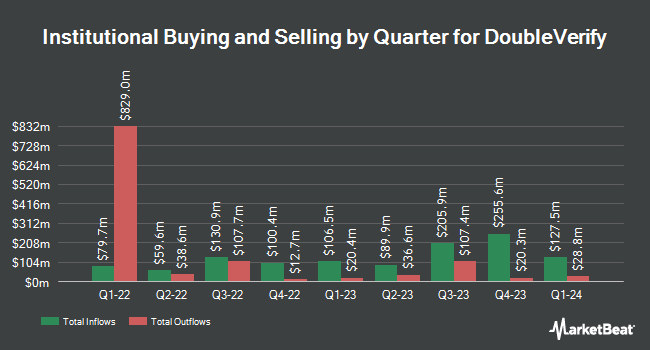

US Bancorp DE decreased its position in DoubleVerify Holdings, Inc. (NYSE:DV - Free Report) by 67.7% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 11,612 shares of the company's stock after selling 24,335 shares during the quarter. US Bancorp DE's holdings in DoubleVerify were worth $155,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Federated Hermes Inc. increased its holdings in shares of DoubleVerify by 6.3% during the fourth quarter. Federated Hermes Inc. now owns 9,571 shares of the company's stock valued at $184,000 after acquiring an additional 571 shares in the last quarter. Sterling Capital Management LLC increased its holdings in DoubleVerify by 31.2% in the 4th quarter. Sterling Capital Management LLC now owns 5,108 shares of the company's stock worth $98,000 after buying an additional 1,214 shares in the last quarter. Nuveen Asset Management LLC increased its holdings in DoubleVerify by 0.5% in the 4th quarter. Nuveen Asset Management LLC now owns 380,005 shares of the company's stock worth $7,300,000 after buying an additional 1,779 shares in the last quarter. Signaturefd LLC increased its holdings in DoubleVerify by 582.9% in the 1st quarter. Signaturefd LLC now owns 2,322 shares of the company's stock worth $31,000 after buying an additional 1,982 shares in the last quarter. Finally, Avantax Advisory Services Inc. increased its holdings in DoubleVerify by 11.4% in the 1st quarter. Avantax Advisory Services Inc. now owns 25,926 shares of the company's stock worth $347,000 after buying an additional 2,659 shares in the last quarter. 97.29% of the stock is currently owned by institutional investors.

DoubleVerify Stock Performance

NYSE:DV traded down $0.0040 on Thursday, hitting $15.5160. The stock had a trading volume of 1,160,475 shares, compared to its average volume of 2,431,627. DoubleVerify Holdings, Inc. has a 52-week low of $11.52 and a 52-week high of $23.11. The company has a quick ratio of 4.41, a current ratio of 4.41 and a debt-to-equity ratio of 0.01. The stock has a market cap of $2.54 billion, a price-to-earnings ratio of 53.51, a price-to-earnings-growth ratio of 2.32 and a beta of 1.05. The business's 50-day simple moving average is $15.20 and its two-hundred day simple moving average is $15.28.

DoubleVerify (NYSE:DV - Get Free Report) last posted its quarterly earnings data on Tuesday, August 5th. The company reported $0.05 earnings per share for the quarter, missing analysts' consensus estimates of $0.06 by ($0.01). DoubleVerify had a net margin of 7.38% and a return on equity of 4.86%. The company had revenue of $189.02 million for the quarter, compared to analysts' expectations of $171.14 million. During the same period in the previous year, the firm earned $0.04 earnings per share. The firm's quarterly revenue was up 21.3% on a year-over-year basis. DoubleVerify has set its Q3 2025 guidance at EPS. As a group, research analysts predict that DoubleVerify Holdings, Inc. will post 0.36 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several equities research analysts recently commented on DV shares. BMO Capital Markets reiterated an "outperform" rating and issued a $27.00 price objective (up from $26.00) on shares of DoubleVerify in a report on Wednesday, August 6th. JMP Securities reiterated a "market outperform" rating and issued a $20.00 price objective on shares of DoubleVerify in a report on Thursday, June 12th. Truist Financial reiterated a "buy" rating and issued a $22.00 price objective (up from $21.00) on shares of DoubleVerify in a report on Thursday, June 12th. Craig Hallum reiterated a "buy" rating and issued a $20.00 price objective on shares of DoubleVerify in a report on Monday, July 7th. Finally, Morgan Stanley lifted their price objective on DoubleVerify from $17.00 to $18.00 and gave the stock an "equal weight" rating in a report on Wednesday, August 6th. Fourteen analysts have rated the stock with a Buy rating, seven have assigned a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat.com, DoubleVerify has an average rating of "Moderate Buy" and a consensus target price of $19.13.

Get Our Latest Report on DoubleVerify

DoubleVerify Company Profile

(

Free Report)

DoubleVerify Holdings, Inc provides a software platform for digital media measurement, and data analytics in the United States and internationally. The company provides solutions to advertisers that enable advertisers to increase the effectiveness and quality and return on their digital advertising investments.

Further Reading

Before you consider DoubleVerify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleVerify wasn't on the list.

While DoubleVerify currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.