USS Investment Management Ltd trimmed its position in Merck & Co., Inc. (NYSE:MRK - Free Report) by 31.5% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 417,722 shares of the company's stock after selling 192,358 shares during the quarter. USS Investment Management Ltd's holdings in Merck & Co., Inc. were worth $37,472,000 as of its most recent SEC filing.

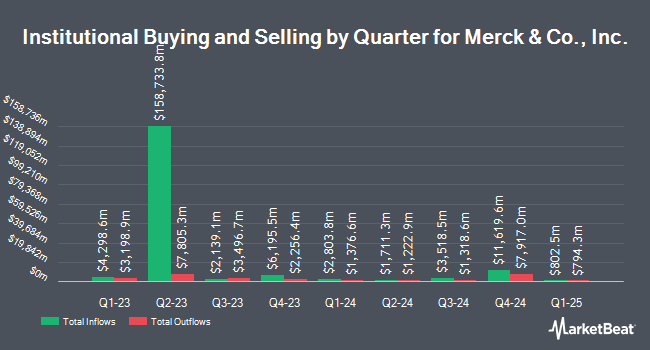

Other institutional investors and hedge funds also recently bought and sold shares of the company. Charles Schwab Investment Management Inc. raised its stake in shares of Merck & Co., Inc. by 144.6% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 49,229,283 shares of the company's stock valued at $4,418,820,000 after acquiring an additional 29,104,112 shares during the period. Nuveen LLC purchased a new stake in shares of Merck & Co., Inc. in the 1st quarter valued at approximately $991,553,000. Pacer Advisors Inc. raised its stake in shares of Merck & Co., Inc. by 2,240.9% in the 1st quarter. Pacer Advisors Inc. now owns 5,286,801 shares of the company's stock valued at $474,543,000 after acquiring an additional 5,060,959 shares during the period. GAMMA Investing LLC raised its stake in shares of Merck & Co., Inc. by 9,991.9% in the 1st quarter. GAMMA Investing LLC now owns 4,332,446 shares of the company's stock valued at $388,880,000 after acquiring an additional 4,289,516 shares during the period. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in shares of Merck & Co., Inc. by 21.4% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 21,547,758 shares of the company's stock valued at $2,143,571,000 after acquiring an additional 3,791,737 shares during the period. 76.07% of the stock is currently owned by institutional investors and hedge funds.

Merck & Co., Inc. Stock Down 0.7%

NYSE MRK traded down $0.55 on Wednesday, hitting $84.06. 11,567,946 shares of the stock were exchanged, compared to its average volume of 15,155,813. The company has a quick ratio of 1.17, a current ratio of 1.42 and a debt-to-equity ratio of 0.69. Merck & Co., Inc. has a fifty-two week low of $73.31 and a fifty-two week high of $119.38. The company has a market cap of $209.96 billion, a PE ratio of 12.95, a PEG ratio of 0.86 and a beta of 0.37. The company has a 50-day moving average price of $82.78 and a 200-day moving average price of $82.95.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last posted its quarterly earnings results on Tuesday, July 29th. The company reported $2.13 EPS for the quarter, topping the consensus estimate of $2.03 by $0.10. Merck & Co., Inc. had a net margin of 25.79% and a return on equity of 41.05%. The company had revenue of $15.81 billion during the quarter, compared to analysts' expectations of $15.92 billion. Merck & Co., Inc. has set its FY 2025 guidance at 8.870-8.970 EPS. Sell-side analysts anticipate that Merck & Co., Inc. will post 9.01 EPS for the current fiscal year.

Merck & Co., Inc. Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, October 7th. Shareholders of record on Monday, September 15th will be issued a dividend of $0.81 per share. This represents a $3.24 annualized dividend and a yield of 3.9%. The ex-dividend date is Monday, September 15th. Merck & Co., Inc.'s payout ratio is 49.92%.

Analyst Upgrades and Downgrades

MRK has been the topic of a number of research analyst reports. Citigroup reissued a "neutral" rating and issued a $84.00 price target (down from $115.00) on shares of Merck & Co., Inc. in a research note on Wednesday, May 14th. Cantor Fitzgerald downgraded shares of Merck & Co., Inc. from an "overweight" rating to a "cautious" rating in a research note on Tuesday, May 20th. Morgan Stanley reduced their price target on shares of Merck & Co., Inc. from $99.00 to $98.00 and set an "equal weight" rating on the stock in a research note on Thursday, July 10th. Finally, Wells Fargo & Company cut their target price on shares of Merck & Co., Inc. from $97.00 to $90.00 and set an "equal weight" rating on the stock in a research note on Wednesday, July 30th. One research analyst has rated the stock with a Strong Buy rating, six have issued a Buy rating, twelve have given a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $107.44.

Get Our Latest Report on Merck & Co., Inc.

About Merck & Co., Inc.

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

Featured Articles

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report