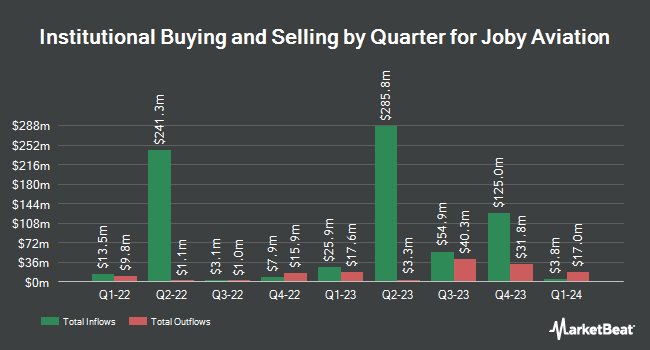

Valeo Financial Advisors LLC bought a new stake in Joby Aviation, Inc. (NYSE:JOBY - Free Report) in the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 43,717 shares of the company's stock, valued at approximately $461,000.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. GAMMA Investing LLC lifted its holdings in Joby Aviation by 773.9% in the first quarter. GAMMA Investing LLC now owns 5,663 shares of the company's stock valued at $34,000 after acquiring an additional 5,015 shares during the period. Strs Ohio acquired a new stake in Joby Aviation in the first quarter valued at $37,000. Ameritas Advisory Services LLC acquired a new position in shares of Joby Aviation during the 2nd quarter worth $39,000. Decker Retirement Planning Inc. raised its stake in shares of Joby Aviation by 250.0% during the 1st quarter. Decker Retirement Planning Inc. now owns 7,000 shares of the company's stock worth $42,000 after buying an additional 5,000 shares during the last quarter. Finally, Hollencrest Capital Management acquired a new position in shares of Joby Aviation during the 1st quarter worth $43,000. Institutional investors and hedge funds own 52.85% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms have recently issued reports on JOBY. Cantor Fitzgerald reaffirmed a "neutral" rating and set a $9.00 price target on shares of Joby Aviation in a research note on Monday, June 23rd. Canaccord Genuity Group downgraded Joby Aviation from a "buy" rating to a "hold" rating and lifted their price target for the stock from $12.00 to $17.00 in a research note on Thursday, August 7th. HC Wainwright downgraded Joby Aviation from a "buy" rating to a "neutral" rating in a research note on Thursday, August 7th. JPMorgan Chase & Co. lifted their price target on Joby Aviation from $5.00 to $7.00 and gave the stock an "underweight" rating in a research note on Friday, August 1st. Finally, Wall Street Zen downgraded Joby Aviation from a "hold" rating to a "sell" rating in a research note on Saturday, August 2nd. One equities research analyst has rated the stock with a Buy rating, four have given a Hold rating and two have assigned a Sell rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Reduce" and an average price target of $10.50.

Read Our Latest Research Report on Joby Aviation

Insider Buying and Selling

In other Joby Aviation news, insider Bonny W. Simi sold 8,272 shares of Joby Aviation stock in a transaction dated Thursday, October 2nd. The stock was sold at an average price of $16.78, for a total value of $138,804.16. Following the completion of the sale, the insider owned 219,206 shares in the company, valued at $3,678,276.68. The trade was a 3.64% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, insider Didier Papadopoulos sold 5,102 shares of Joby Aviation stock in a transaction dated Friday, October 3rd. The shares were sold at an average price of $18.08, for a total value of $92,244.16. Following the completion of the transaction, the insider directly owned 98,104 shares in the company, valued at $1,773,720.32. This represents a 4.94% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 2,330,881 shares of company stock worth $33,997,315 over the last ninety days. Insiders own 28.50% of the company's stock.

Joby Aviation Price Performance

JOBY opened at $17.38 on Thursday. The stock has a market capitalization of $14.88 billion, a price-to-earnings ratio of -16.24 and a beta of 2.52. The business has a 50-day moving average of $15.80 and a two-hundred day moving average of $11.21. Joby Aviation, Inc. has a 12 month low of $4.80 and a 12 month high of $20.95.

Joby Aviation (NYSE:JOBY - Get Free Report) last posted its quarterly earnings results on Wednesday, August 6th. The company reported ($0.24) EPS for the quarter, missing the consensus estimate of ($0.18) by ($0.06). The business had revenue of $0.02 million during the quarter, compared to the consensus estimate of $0.05 million. Joby Aviation's revenue for the quarter was down 94.6% compared to the same quarter last year. During the same period last year, the business earned ($0.18) EPS. Equities research analysts anticipate that Joby Aviation, Inc. will post -0.69 earnings per share for the current year.

About Joby Aviation

(

Free Report)

Joby Aviation, Inc, a vertically integrated air mobility company, engages in building an electric vertical takeoff and landing aircraft optimized to deliver air transportation as a service. The company intends to build an aerial ridesharing service, as well as developing an application-based platform that will enable consumers to book rides.

Read More

Want to see what other hedge funds are holding JOBY? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Joby Aviation, Inc. (NYSE:JOBY - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Joby Aviation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Joby Aviation wasn't on the list.

While Joby Aviation currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.