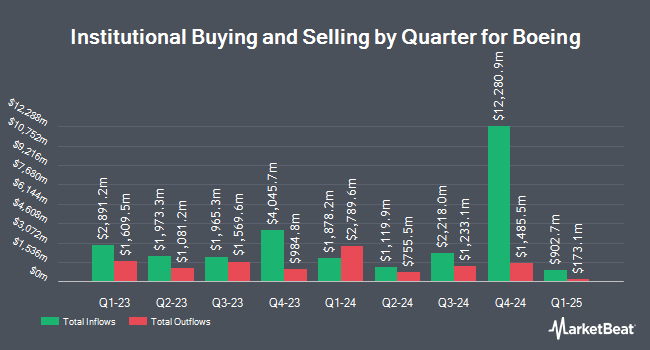

Valeo Financial Advisors LLC boosted its position in shares of The Boeing Company (NYSE:BA - Free Report) by 938.4% during the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 556,814 shares of the aircraft producer's stock after purchasing an additional 503,193 shares during the period. Valeo Financial Advisors LLC owned approximately 0.07% of Boeing worth $116,669,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also made changes to their positions in the company. Kingstone Capital Partners Texas LLC acquired a new position in shares of Boeing in the 2nd quarter worth approximately $378,459,000. Vanguard Group Inc. boosted its position in shares of Boeing by 1.9% during the first quarter. Vanguard Group Inc. now owns 65,655,044 shares of the aircraft producer's stock worth $11,197,468,000 after buying an additional 1,212,327 shares during the period. Strs Ohio purchased a new stake in shares of Boeing in the 1st quarter valued at $98,984,000. Canada Pension Plan Investment Board boosted its holdings in Boeing by 243.8% during the 1st quarter. Canada Pension Plan Investment Board now owns 754,550 shares of the aircraft producer's stock valued at $128,689,000 after acquiring an additional 535,060 shares during the period. Finally, Deutsche Bank AG grew its position in Boeing by 38.4% in the 1st quarter. Deutsche Bank AG now owns 1,805,186 shares of the aircraft producer's stock valued at $307,874,000 after acquiring an additional 501,161 shares in the last quarter. Institutional investors and hedge funds own 64.82% of the company's stock.

Insider Buying and Selling at Boeing

In related news, EVP David Christopher Raymond sold 3,771 shares of the stock in a transaction dated Friday, August 8th. The stock was sold at an average price of $229.94, for a total transaction of $867,103.74. Following the transaction, the executive vice president directly owned 35,873 shares in the company, valued at approximately $8,248,637.62. This represents a 9.51% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, Director Mortimer J. Buckley purchased 2,200 shares of the stock in a transaction on Tuesday, August 19th. The stock was acquired at an average price of $226.10 per share, with a total value of $497,420.00. Following the acquisition, the director directly owned 2,200 shares in the company, valued at $497,420. This trade represents a ∞ increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders own 0.09% of the company's stock.

Analyst Ratings Changes

BA has been the topic of a number of research reports. The Goldman Sachs Group set a $212.00 target price on shares of Boeing and gave the stock a "buy" rating in a report on Thursday, June 12th. UBS Group set a $280.00 price target on Boeing and gave the company a "buy" rating in a report on Wednesday, July 30th. KGI Securities raised shares of Boeing from a "hold" rating to a "strong-buy" rating in a report on Thursday, July 24th. Morgan Stanley restated an "equal weight" rating on shares of Boeing in a research report on Monday, July 28th. Finally, JPMorgan Chase & Co. boosted their price target on shares of Boeing from $230.00 to $251.00 and gave the company an "overweight" rating in a research report on Wednesday, July 30th. Three equities research analysts have rated the stock with a Strong Buy rating, eighteen have given a Buy rating, three have given a Hold rating and three have issued a Sell rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $233.91.

Check Out Our Latest Research Report on Boeing

Boeing Trading Down 0.5%

Shares of BA opened at $216.32 on Monday. The company has a 50-day moving average of $225.06 and a two-hundred day moving average of $205.21. The stock has a market cap of $163.57 billion, a P/E ratio of -13.10 and a beta of 1.47. The Boeing Company has a 12-month low of $128.88 and a 12-month high of $242.69.

Boeing (NYSE:BA - Get Free Report) last posted its earnings results on Tuesday, July 29th. The aircraft producer reported ($1.24) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.92) by ($0.32). The company had revenue of $22.75 billion during the quarter, compared to analysts' expectations of $20.13 billion. During the same quarter in the prior year, the firm posted ($2.90) earnings per share. The business's quarterly revenue was up 34.9% compared to the same quarter last year. As a group, analysts forecast that The Boeing Company will post -2.58 EPS for the current fiscal year.

About Boeing

(

Free Report)

The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through Commercial Airplanes; Defense, Space & Security; and Global Services segments.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Boeing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boeing wasn't on the list.

While Boeing currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.