Valley Wealth Managers Inc. purchased a new position in shares of Seagate Technology Holdings PLC (NASDAQ:STX - Free Report) in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 206,540 shares of the data storage provider's stock, valued at approximately $17,546,000. Valley Wealth Managers Inc. owned about 0.10% of Seagate Technology at the end of the most recent quarter.

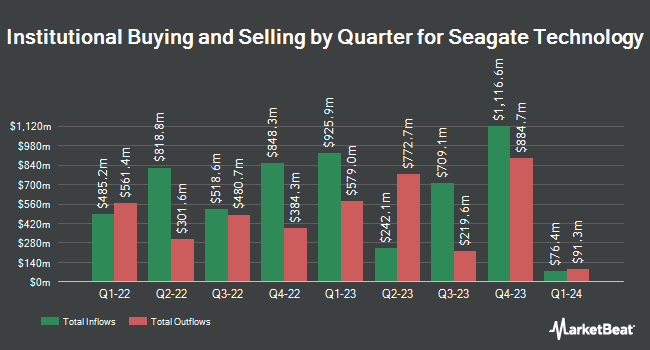

Other institutional investors also recently bought and sold shares of the company. Johnson Financial Group Inc. raised its position in Seagate Technology by 22.7% during the fourth quarter. Johnson Financial Group Inc. now owns 606 shares of the data storage provider's stock worth $52,000 after acquiring an additional 112 shares during the period. Level Four Advisory Services LLC raised its position in shares of Seagate Technology by 4.1% during the 4th quarter. Level Four Advisory Services LLC now owns 3,343 shares of the data storage provider's stock worth $289,000 after purchasing an additional 131 shares during the last quarter. B. Riley Wealth Advisors Inc. lifted its stake in Seagate Technology by 0.9% in the 4th quarter. B. Riley Wealth Advisors Inc. now owns 15,247 shares of the data storage provider's stock valued at $1,327,000 after buying an additional 134 shares in the last quarter. QRG Capital Management Inc. boosted its holdings in Seagate Technology by 1.2% in the 1st quarter. QRG Capital Management Inc. now owns 10,876 shares of the data storage provider's stock worth $924,000 after buying an additional 134 shares during the last quarter. Finally, Prosperity Consulting Group LLC increased its stake in Seagate Technology by 4.5% during the 4th quarter. Prosperity Consulting Group LLC now owns 3,459 shares of the data storage provider's stock worth $299,000 after buying an additional 150 shares in the last quarter. 92.87% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of brokerages have weighed in on STX. Cantor Fitzgerald raised their price objective on Seagate Technology from $110.00 to $125.00 and gave the company a "neutral" rating in a report on Monday, May 19th. Citigroup raised their price target on shares of Seagate Technology from $140.00 to $170.00 and gave the stock a "buy" rating in a research note on Friday, July 11th. Mizuho dropped their price objective on shares of Seagate Technology from $115.00 to $95.00 and set an "outperform" rating for the company in a research note on Thursday, April 10th. Barclays increased their price objective on shares of Seagate Technology from $80.00 to $90.00 and gave the company an "equal weight" rating in a report on Wednesday, April 30th. Finally, BNP Paribas Exane upgraded Seagate Technology from an "underperform" rating to a "neutral" rating and set a $100.00 target price on the stock in a report on Friday, May 16th. One research analyst has rated the stock with a sell rating, seven have issued a hold rating and eleven have issued a buy rating to the company's stock. According to MarketBeat, Seagate Technology presently has an average rating of "Moderate Buy" and an average price target of $134.38.

Read Our Latest Research Report on Seagate Technology

Seagate Technology Price Performance

Seagate Technology stock opened at $150.89 on Friday. The stock has a market cap of $32.02 billion, a PE ratio of 21.80 and a beta of 1.45. The stock's fifty day moving average is $133.87 and its two-hundred day moving average is $105.51. Seagate Technology Holdings PLC has a 1-year low of $63.19 and a 1-year high of $153.88.

Seagate Technology (NASDAQ:STX - Get Free Report) last released its quarterly earnings data on Tuesday, April 29th. The data storage provider reported $1.90 EPS for the quarter, beating analysts' consensus estimates of $1.75 by $0.15. The business had revenue of $2.16 billion for the quarter, compared to the consensus estimate of $2.14 billion. Seagate Technology had a negative return on equity of 105.02% and a net margin of 17.49%. The business's revenue for the quarter was up 30.5% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.33 EPS. On average, research analysts expect that Seagate Technology Holdings PLC will post 6.83 earnings per share for the current fiscal year.

Seagate Technology Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, July 8th. Shareholders of record on Wednesday, June 25th were issued a dividend of $0.72 per share. The ex-dividend date of this dividend was Wednesday, June 25th. This represents a $2.88 dividend on an annualized basis and a yield of 1.91%. Seagate Technology's payout ratio is currently 41.62%.

Seagate Technology announced that its board has approved a stock repurchase plan on Thursday, May 22nd that allows the company to repurchase $5.00 billion in shares. This repurchase authorization allows the data storage provider to reacquire up to 21.6% of its stock through open market purchases. Stock repurchase plans are generally an indication that the company's board of directors believes its shares are undervalued.

Insider Transactions at Seagate Technology

In other news, CEO William D. Mosley sold 20,000 shares of the company's stock in a transaction on Tuesday, July 1st. The shares were sold at an average price of $144.66, for a total value of $2,893,200.00. Following the completion of the transaction, the chief executive officer owned 498,710 shares in the company, valued at approximately $72,143,388.60. This represents a 3.86% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, EVP Ban Seng Teh sold 1,725 shares of the business's stock in a transaction on Friday, July 11th. The shares were sold at an average price of $144.00, for a total transaction of $248,400.00. Following the completion of the sale, the executive vice president directly owned 12,052 shares of the company's stock, valued at approximately $1,735,488. This trade represents a 12.52% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 395,516 shares of company stock worth $47,831,398. 0.81% of the stock is currently owned by insiders.

Seagate Technology Profile

(

Free Report)

Seagate Technology Holdings plc provides data storage technology and solutions in Singapore, the United States, the Netherlands, and internationally. It provides mass capacity storage products, including enterprise nearline hard disk drives (HDDs), enterprise nearline solid state drives (SSDs), enterprise nearline systems, video and image HDDs, and network-attached storage drives.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Seagate Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seagate Technology wasn't on the list.

While Seagate Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report