Value Partners Investments Inc. acquired a new position in Diageo plc (NYSE:DEO - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm acquired 29,921 shares of the company's stock, valued at approximately $3,139,000.

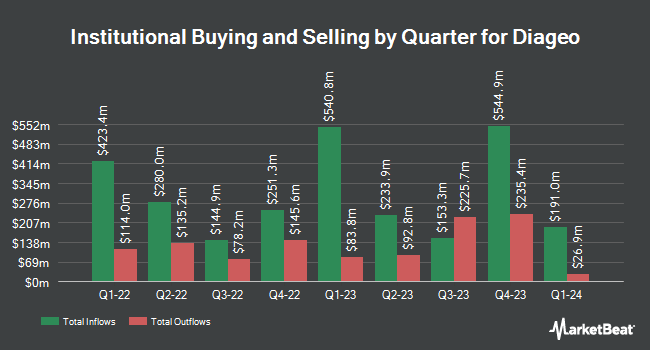

Several other institutional investors have also recently made changes to their positions in DEO. Kovitz Investment Group Partners LLC raised its stake in shares of Diageo by 234.4% in the fourth quarter. Kovitz Investment Group Partners LLC now owns 2,600,702 shares of the company's stock worth $330,627,000 after buying an additional 1,822,994 shares during the period. Bank of Montreal Can raised its stake in shares of Diageo by 1,181.5% in the fourth quarter. Bank of Montreal Can now owns 1,406,004 shares of the company's stock worth $178,745,000 after buying an additional 1,296,285 shares during the period. Raymond James Financial Inc. bought a new position in shares of Diageo in the fourth quarter worth about $123,892,000. FMR LLC raised its stake in shares of Diageo by 10.9% in the fourth quarter. FMR LLC now owns 5,813,938 shares of the company's stock worth $739,126,000 after buying an additional 571,873 shares during the period. Finally, Proficio Capital Partners LLC raised its stake in shares of Diageo by 3,073.4% in the fourth quarter. Proficio Capital Partners LLC now owns 209,510 shares of the company's stock worth $26,635,000 after buying an additional 202,908 shares during the period. Institutional investors own 8.97% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have recently commented on the company. Deutsche Bank Aktiengesellschaft raised Diageo from a "sell" rating to a "hold" rating in a research note on Monday, March 3rd. Berenberg Bank started coverage on Diageo in a research note on Wednesday, April 2nd. They set a "buy" rating on the stock. Finally, Morgan Stanley reissued an "underweight" rating on shares of Diageo in a research note on Monday, May 12th. Two research analysts have rated the stock with a sell rating, three have assigned a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $129.00.

Read Our Latest Report on Diageo

Diageo Stock Down 1.3%

Shares of DEO opened at $99.89 on Thursday. The business's 50 day moving average is $109.36 and its 200 day moving average is $112.92. The company has a market capitalization of $55.57 billion, a PE ratio of 14.58 and a beta of 0.58. Diageo plc has a 12-month low of $99.26 and a 12-month high of $142.73. The company has a current ratio of 1.60, a quick ratio of 0.67 and a debt-to-equity ratio of 1.62.

About Diageo

(

Free Report)

Diageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. The company offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavored malt beverages. It also provides Chinese, Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as flavored malt beverages, ready to drink, and non-alcoholic products.

Featured Articles

Want to see what other hedge funds are holding DEO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Diageo plc (NYSE:DEO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.