Vanguard Group Inc. lowered its stake in Summit Therapeutics PLC (NASDAQ:SMMT - Free Report) by 0.3% during the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 11,640,507 shares of the company's stock after selling 30,069 shares during the period. Vanguard Group Inc. owned 1.57% of Summit Therapeutics worth $224,545,000 as of its most recent filing with the Securities & Exchange Commission.

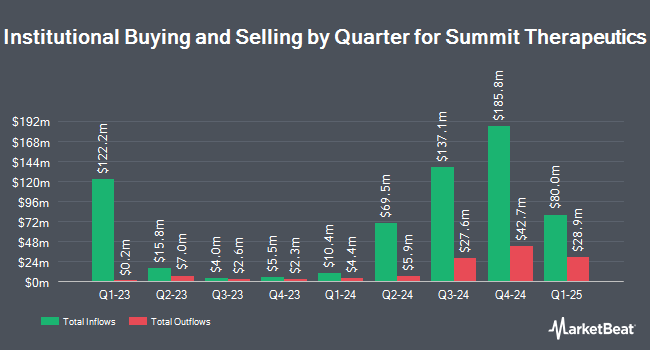

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Trivest Advisors Ltd purchased a new stake in Summit Therapeutics during the 1st quarter valued at $907,000. Skandinaviska Enskilda Banken AB publ boosted its stake in Summit Therapeutics by 103.4% during the 1st quarter. Skandinaviska Enskilda Banken AB publ now owns 66,451 shares of the company's stock valued at $1,283,000 after purchasing an additional 33,788 shares during the last quarter. Legato Capital Management LLC purchased a new stake in Summit Therapeutics during the 1st quarter valued at $233,000. Universal Beteiligungs und Servicegesellschaft mbH purchased a new stake in Summit Therapeutics during the 1st quarter valued at $308,000. Finally, Atle Fund Management AB boosted its stake in Summit Therapeutics by 3.9% during the 1st quarter. Atle Fund Management AB now owns 105,077 shares of the company's stock valued at $2,027,000 after purchasing an additional 3,900 shares during the last quarter. Hedge funds and other institutional investors own 4.61% of the company's stock.

Wall Street Analyst Weigh In

SMMT has been the topic of a number of research reports. Jefferies Financial Group set a $44.00 price target on Summit Therapeutics and gave the stock a "buy" rating in a research note on Friday, April 25th. HC Wainwright restated a "buy" rating and issued a $44.00 price target on shares of Summit Therapeutics in a research note on Friday. Evercore ISI raised their target price on Summit Therapeutics from $30.00 to $34.00 and gave the stock an "outperform" rating in a report on Tuesday, August 12th. Leerink Partners initiated coverage on Summit Therapeutics in a report on Wednesday, June 11th. They issued an "underperform" rating and a $12.00 target price on the stock. Finally, Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Summit Therapeutics in a report on Wednesday, April 23rd. Three equities research analysts have rated the stock with a sell rating, one has assigned a hold rating, eleven have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, Summit Therapeutics currently has an average rating of "Moderate Buy" and a consensus price target of $35.00.

View Our Latest Report on Summit Therapeutics

Summit Therapeutics Stock Down 1.5%

NASDAQ:SMMT opened at $26.29 on Tuesday. The business's 50-day simple moving average is $24.58 and its two-hundred day simple moving average is $22.80. The stock has a market cap of $19.53 billion, a PE ratio of -26.03 and a beta of -1.06. Summit Therapeutics PLC has a 52 week low of $11.29 and a 52 week high of $36.91.

Summit Therapeutics (NASDAQ:SMMT - Get Free Report) last issued its earnings results on Monday, August 11th. The company reported ($0.76) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.10) by ($0.66). Sell-side analysts anticipate that Summit Therapeutics PLC will post -0.3 earnings per share for the current fiscal year.

Summit Therapeutics Company Profile

(

Free Report)

Summit Therapeutics Inc, a biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies in the United States, and the United Kingdom. The company's lead development candidate is Ivonescimab, a bispecific antibody for immunotherapy through blockade of PD-1 with the anti-angiogenesis; and anti-infectives portfolio includes SMT-738, a novel class of precision antibiotics for the treatment of multidrug resistant infections, which primarily includes carbapenem-resistant Enterobacteriaceae infections.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Summit Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Summit Therapeutics wasn't on the list.

While Summit Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.