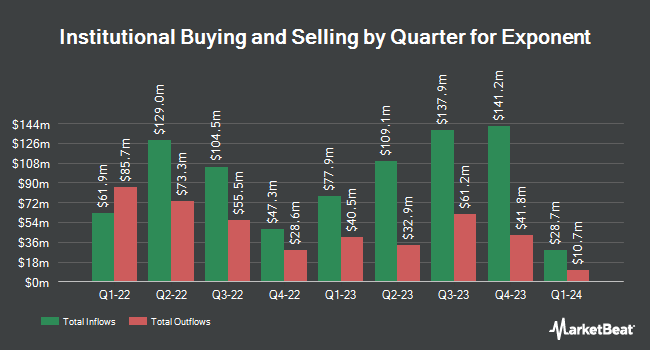

Vanguard Group Inc. reduced its position in Exponent, Inc. (NASDAQ:EXPO - Free Report) by 1.4% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 5,271,274 shares of the business services provider's stock after selling 74,229 shares during the period. Vanguard Group Inc. owned about 10.39% of Exponent worth $427,289,000 at the end of the most recent quarter.

Several other hedge funds also recently bought and sold shares of the company. Geneva Capital Management LLC increased its position in Exponent by 11.2% in the 1st quarter. Geneva Capital Management LLC now owns 1,745,828 shares of the business services provider's stock worth $141,517,000 after purchasing an additional 176,152 shares during the last quarter. Argent Trust Co acquired a new position in Exponent in the 1st quarter worth about $201,000. Malaga Cove Capital LLC increased its position in Exponent by 40.9% in the 1st quarter. Malaga Cove Capital LLC now owns 7,505 shares of the business services provider's stock worth $608,000 after purchasing an additional 2,178 shares during the last quarter. Jefferies Financial Group Inc. acquired a new position in Exponent in the 1st quarter worth about $1,071,000. Finally, Alberta Investment Management Corp acquired a new position in Exponent in the 1st quarter worth about $1,248,000. 92.37% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In other news, VP Joseph Rakow sold 1,573 shares of the company's stock in a transaction dated Tuesday, May 27th. The stock was sold at an average price of $77.72, for a total transaction of $122,253.56. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, VP John Pye sold 2,000 shares of the company's stock in a transaction dated Friday, May 23rd. The stock was sold at an average price of $76.32, for a total value of $152,640.00. Following the sale, the vice president owned 29,204 shares of the company's stock, valued at approximately $2,228,849.28. This trade represents a 6.41% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 10,064 shares of company stock worth $735,621. Insiders own 1.60% of the company's stock.

Exponent Trading Up 0.6%

EXPO stock traded up $0.43 during mid-day trading on Wednesday, hitting $70.03. The stock had a trading volume of 697,309 shares, compared to its average volume of 385,640. Exponent, Inc. has a 1-year low of $63.81 and a 1-year high of $115.75. The company has a fifty day moving average of $73.01 and a 200 day moving average of $78.36. The stock has a market capitalization of $3.54 billion, a price-to-earnings ratio of 35.02 and a beta of 0.89.

Exponent (NASDAQ:EXPO - Get Free Report) last issued its earnings results on Thursday, July 31st. The business services provider reported $0.52 earnings per share for the quarter, topping the consensus estimate of $0.48 by $0.04. Exponent had a return on equity of 24.19% and a net margin of 18.35%.The company had revenue of $132.87 million for the quarter, compared to analyst estimates of $130.82 million. During the same period in the prior year, the firm posted $0.57 EPS. The business's revenue was up 7.3% compared to the same quarter last year. As a group, sell-side analysts expect that Exponent, Inc. will post 1.98 earnings per share for the current fiscal year.

Exponent Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, September 19th. Stockholders of record on Friday, September 5th will be paid a dividend of $0.30 per share. This represents a $1.20 annualized dividend and a dividend yield of 1.7%. The ex-dividend date is Friday, September 5th. Exponent's dividend payout ratio is 60.00%.

Exponent Profile

(

Free Report)

Exponent, Inc, together with its subsidiaries, operates as a science and engineering consulting company in the United States and internationally. The company operates in two segments, Engineering and Other Scientific, and Environmental and Health. The Engineering and Other Scientific segment provides services in the areas of biomechanics, biomedical engineering and sciences, buildings and structures, civil engineering, construction consulting, data sciences, electrical engineering and computer science, human factors, materials and corrosion engineering, mechanical engineering, polymer science and materials chemistry, thermal sciences, and vehicle engineering.

See Also

Before you consider Exponent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exponent wasn't on the list.

While Exponent currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.