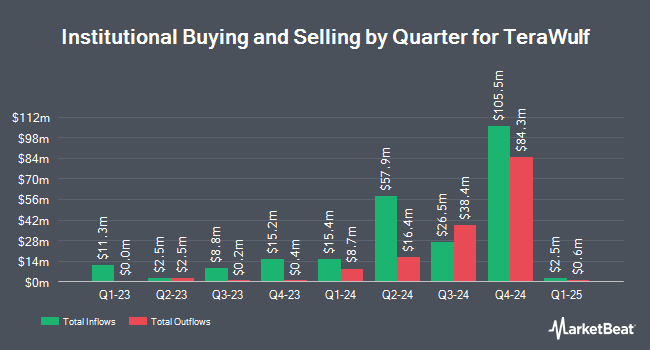

Vanguard Group Inc. raised its stake in shares of TeraWulf Inc. (NASDAQ:WULF - Free Report) by 2.3% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 23,880,134 shares of the company's stock after buying an additional 534,315 shares during the quarter. Vanguard Group Inc. owned about 6.23% of TeraWulf worth $65,193,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other institutional investors have also added to or reduced their stakes in the company. Calamos Advisors LLC purchased a new stake in TeraWulf during the 1st quarter valued at approximately $33,000. Platform Technology Partners purchased a new stake in TeraWulf during the 1st quarter valued at approximately $39,000. Kraematon Investment Advisors Inc. purchased a new stake in TeraWulf during the 1st quarter valued at approximately $42,000. Regatta Capital Group LLC purchased a new stake in TeraWulf during the 1st quarter valued at approximately $42,000. Finally, CoreCap Advisors LLC grew its holdings in TeraWulf by 67.9% during the 4th quarter. CoreCap Advisors LLC now owns 7,554 shares of the company's stock valued at $43,000 after buying an additional 3,054 shares in the last quarter. 62.49% of the stock is owned by hedge funds and other institutional investors.

TeraWulf Trading Up 0.1%

Shares of TeraWulf stock traded up $0.01 on Friday, reaching $9.45. The company had a trading volume of 35,622,346 shares, compared to its average volume of 65,769,864. The firm has a market cap of $3.70 billion, a price-to-earnings ratio of -27.00 and a beta of 3.17. The company has a debt-to-equity ratio of 2.96, a current ratio of 0.66 and a quick ratio of 0.66. The firm's 50-day moving average price is $5.93 and its two-hundred day moving average price is $4.30. TeraWulf Inc. has a 1 year low of $2.06 and a 1 year high of $10.71.

TeraWulf (NASDAQ:WULF - Get Free Report) last announced its earnings results on Friday, August 8th. The company reported ($0.05) EPS for the quarter, missing analysts' consensus estimates of ($0.04) by ($0.01). The company had revenue of $47.64 million during the quarter, compared to analysts' expectations of $46.30 million. TeraWulf had a negative return on equity of 54.98% and a negative net margin of 91.42%.TeraWulf's revenue for the quarter was up 33.9% compared to the same quarter last year. During the same quarter last year, the firm posted ($0.03) EPS. As a group, research analysts predict that TeraWulf Inc. will post -0.17 earnings per share for the current fiscal year.

Insider Buying and Selling at TeraWulf

In other news, Director Amanda Fabiano sold 4,600 shares of the stock in a transaction that occurred on Friday, August 15th. The stock was sold at an average price of $8.64, for a total value of $39,744.00. Following the sale, the director directly owned 40,769 shares in the company, valued at approximately $352,244.16. This represents a 10.14% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Insiders own 24.88% of the company's stock.

Analysts Set New Price Targets

Several brokerages have recently issued reports on WULF. Roth Capital upped their price objective on TeraWulf from $7.00 to $12.50 and gave the stock a "buy" rating in a report on Friday, August 15th. Northland Securities upped their price objective on TeraWulf from $12.00 to $15.00 and gave the stock an "outperform" rating in a report on Tuesday. Rosenblatt Securities upped their price objective on TeraWulf from $10.50 to $12.00 and gave the stock a "buy" rating in a report on Friday, August 22nd. Wall Street Zen cut TeraWulf from a "hold" rating to a "sell" rating in a report on Sunday, August 24th. Finally, JMP Securities upped their price objective on TeraWulf from $7.00 to $13.00 and gave the stock a "market outperform" rating in a report on Friday, August 15th. Two research analysts have rated the stock with a Strong Buy rating, eight have assigned a Buy rating and one has assigned a Hold rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Buy" and a consensus target price of $11.22.

Check Out Our Latest Report on WULF

About TeraWulf

(

Free Report)

TeraWulf Inc, together with its subsidiaries, operates as a digital asset technology company in the United States. The company develops, owns, and operates bitcoin mining facilities in New York and Pennsylvania. It is also involved in the provision of miner hosting services to third-party entities. The company was founded in 2021 and is headquartered in Easton, Maryland.

See Also

Before you consider TeraWulf, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TeraWulf wasn't on the list.

While TeraWulf currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.