Vanguard Group Inc. increased its holdings in Kiniksa Pharmaceuticals International, plc (NASDAQ:KNSA - Free Report) by 4.7% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 3,359,101 shares of the company's stock after acquiring an additional 151,604 shares during the period. Vanguard Group Inc. owned about 4.62% of Kiniksa Pharmaceuticals International worth $74,606,000 at the end of the most recent quarter.

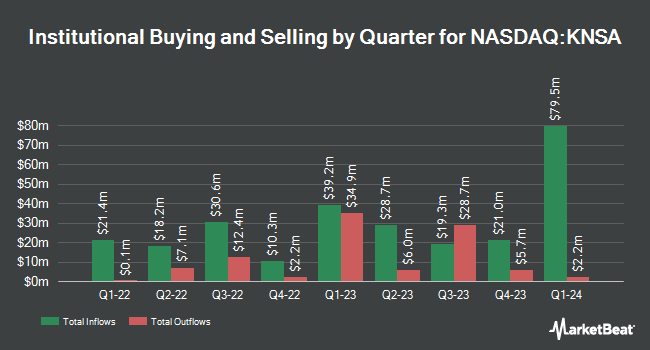

A number of other institutional investors and hedge funds also recently made changes to their positions in the business. Braidwell LP raised its holdings in shares of Kiniksa Pharmaceuticals International by 19.3% in the 4th quarter. Braidwell LP now owns 3,452,447 shares of the company's stock worth $68,289,000 after acquiring an additional 557,934 shares during the last quarter. Nuveen Asset Management LLC grew its position in Kiniksa Pharmaceuticals International by 7.3% in the 4th quarter. Nuveen Asset Management LLC now owns 795,612 shares of the company's stock worth $15,737,000 after purchasing an additional 54,361 shares in the last quarter. Millennium Management LLC increased its stake in Kiniksa Pharmaceuticals International by 50.9% in the 4th quarter. Millennium Management LLC now owns 779,672 shares of the company's stock valued at $15,422,000 after buying an additional 263,146 shares during the last quarter. Dimensional Fund Advisors LP increased its stake in Kiniksa Pharmaceuticals International by 3.9% in the 4th quarter. Dimensional Fund Advisors LP now owns 771,607 shares of the company's stock valued at $15,262,000 after buying an additional 29,300 shares during the last quarter. Finally, Parkman Healthcare Partners LLC increased its stake in Kiniksa Pharmaceuticals International by 1.4% in the 4th quarter. Parkman Healthcare Partners LLC now owns 765,453 shares of the company's stock valued at $15,141,000 after buying an additional 10,209 shares during the last quarter. Institutional investors and hedge funds own 53.95% of the company's stock.

Insider Transactions at Kiniksa Pharmaceuticals International

In other Kiniksa Pharmaceuticals International news, insider John F. Paolini sold 29,325 shares of the firm's stock in a transaction on Wednesday, August 6th. The shares were sold at an average price of $32.55, for a total value of $954,528.75. Following the completion of the transaction, the insider directly owned 57,403 shares of the company's stock, valued at $1,868,467.65. This trade represents a 33.81% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Thomas Malley sold 78,233 shares of Kiniksa Pharmaceuticals International stock in a transaction on Thursday, August 14th. The stock was sold at an average price of $33.09, for a total transaction of $2,588,729.97. Following the sale, the director directly owned 12,546 shares of the company's stock, valued at $415,147.14. This represents a 86.18% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 593,416 shares of company stock worth $18,924,806. 53.48% of the stock is owned by corporate insiders.

Kiniksa Pharmaceuticals International Price Performance

NASDAQ:KNSA traded down $0.03 during trading hours on Thursday, hitting $33.68. The stock had a trading volume of 113,593 shares, compared to its average volume of 677,676. The company has a 50 day simple moving average of $30.10 and a two-hundred day simple moving average of $25.77. Kiniksa Pharmaceuticals International, plc has a one year low of $17.82 and a one year high of $34.55. The firm has a market capitalization of $2.50 billion, a price-to-earnings ratio of 841.74 and a beta of 0.14.

Kiniksa Pharmaceuticals International (NASDAQ:KNSA - Get Free Report) last announced its quarterly earnings results on Tuesday, July 29th. The company reported $0.23 EPS for the quarter, beating the consensus estimate of $0.18 by $0.05. Kiniksa Pharmaceuticals International had a net margin of 0.90% and a return on equity of 1.05%. The firm had revenue of $156.80 million during the quarter, compared to the consensus estimate of $145.21 million. Kiniksa Pharmaceuticals International has set its FY 2025 guidance at EPS. Equities research analysts anticipate that Kiniksa Pharmaceuticals International, plc will post -0.55 earnings per share for the current year.

Analyst Upgrades and Downgrades

KNSA has been the subject of several analyst reports. Wells Fargo & Company increased their price objective on shares of Kiniksa Pharmaceuticals International from $30.00 to $42.00 and gave the company an "overweight" rating in a research note on Wednesday, July 9th. Wedbush reiterated an "outperform" rating and issued a $36.00 price objective on shares of Kiniksa Pharmaceuticals International in a research note on Monday, July 21st. Wall Street Zen upgraded shares of Kiniksa Pharmaceuticals International from a "buy" rating to a "strong-buy" rating in a research note on Saturday, August 2nd. Finally, Jefferies Financial Group increased their price objective on shares of Kiniksa Pharmaceuticals International from $45.00 to $54.00 and gave the company a "buy" rating in a research note on Tuesday, July 29th. Six investment analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $41.17.

Get Our Latest Analysis on Kiniksa Pharmaceuticals International

Kiniksa Pharmaceuticals International Profile

(

Free Report)

Kiniksa Pharmaceuticals, Ltd., a biopharmaceutical company, focuses on discovering, acquiring, developing, and commercializing therapeutic medicines for patients suffering from debilitating diseases with significant unmet medical needs worldwide. Its product candidates include ARCALYST, an interleukin-1alpha and interleukin-1beta, for the treatment of recurrent pericarditis, which is an inflammatory cardiovascular disease; Mavrilimumab, a monoclonal antibody inhibitor that completed Phase II clinical trials for the treatment of giant cell arteritis; Vixarelimab, a monoclonal antibody, that is in Phase 2b clinical trial for the treatment of prurigo nodularis, a chronic inflammatory skin condition; and KPL-404, a monoclonal antibody inhibitor of the CD40- CD154 interaction, a T-cell co-stimulatory signal critical for B-cell maturation, immunoglobulin class switching, and type 1 immune response.

See Also

Before you consider Kiniksa Pharmaceuticals International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kiniksa Pharmaceuticals International wasn't on the list.

While Kiniksa Pharmaceuticals International currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report