Vanguard Group Inc. lifted its stake in DoorDash, Inc. (NASDAQ:DASH - Free Report) by 25.8% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 39,397,286 shares of the company's stock after buying an additional 8,073,882 shares during the period. Vanguard Group Inc. owned approximately 9.38% of DoorDash worth $7,200,642,000 as of its most recent SEC filing.

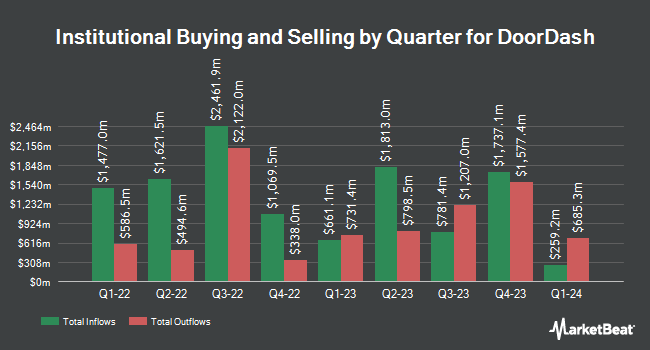

Other large investors have also recently modified their holdings of the company. Brighton Jones LLC increased its position in shares of DoorDash by 24.0% during the fourth quarter. Brighton Jones LLC now owns 9,336 shares of the company's stock valued at $1,566,000 after buying an additional 1,807 shares during the period. Envestnet Asset Management Inc. lifted its position in DoorDash by 6.5% during the fourth quarter. Envestnet Asset Management Inc. now owns 92,012 shares of the company's stock valued at $15,435,000 after buying an additional 5,617 shares during the period. FMR LLC lifted its position in DoorDash by 17.1% during the fourth quarter. FMR LLC now owns 1,342,890 shares of the company's stock valued at $225,270,000 after buying an additional 195,973 shares during the period. Invesco Ltd. lifted its position in DoorDash by 20.2% during the fourth quarter. Invesco Ltd. now owns 3,383,657 shares of the company's stock valued at $567,609,000 after buying an additional 567,948 shares during the period. Finally, Bank of Nova Scotia lifted its position in DoorDash by 840.0% during the 4th quarter. Bank of Nova Scotia now owns 114,419 shares of the company's stock valued at $19,194,000 after acquiring an additional 102,247 shares during the period. Hedge funds and other institutional investors own 90.64% of the company's stock.

Insider Activity at DoorDash

In related news, CEO Tony Xu sold 4,042 shares of the stock in a transaction that occurred on Monday, July 28th. The stock was sold at an average price of $250.28, for a total transaction of $1,011,631.76. Following the completion of the transaction, the chief executive officer directly owned 520,450 shares of the company's stock, valued at approximately $130,258,226. This represents a 0.77% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Ravi Inukonda sold 1,425 shares of the stock in a transaction that occurred on Friday, July 25th. The shares were sold at an average price of $244.78, for a total value of $348,811.50. Following the transaction, the chief financial officer directly owned 244,905 shares of the company's stock, valued at approximately $59,947,845.90. The trade was a 0.58% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 583,537 shares of company stock worth $133,720,004 in the last three months. Corporate insiders own 5.83% of the company's stock.

Analyst Upgrades and Downgrades

DASH has been the subject of a number of recent research reports. Sanford C. Bernstein lifted their price target on shares of DoorDash from $210.00 to $265.00 and gave the company an "outperform" rating in a research report on Monday, July 21st. Evercore ISI lifted their price target on shares of DoorDash from $240.00 to $360.00 and gave the company an "outperform" rating in a research report on Friday. DA Davidson lifted their price target on shares of DoorDash from $150.00 to $190.00 and gave the company a "neutral" rating in a research report on Tuesday, May 6th. Wells Fargo & Company increased their price objective on shares of DoorDash from $239.00 to $280.00 and gave the company an "equal weight" rating in a research report on Thursday. Finally, Morgan Stanley increased their price objective on shares of DoorDash from $275.00 to $300.00 and gave the company an "overweight" rating in a research report on Thursday. Twelve analysts have rated the stock with a hold rating, twenty-three have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $259.18.

View Our Latest Research Report on DASH

DoorDash Stock Performance

Shares of NASDAQ DASH traded down $11.80 during midday trading on Friday, hitting $259.19. 5,340,842 shares of the company's stock traded hands, compared to its average volume of 3,280,438. DoorDash, Inc. has a 1 year low of $121.44 and a 1 year high of $278.15. The company has a debt-to-equity ratio of 0.30, a quick ratio of 1.72 and a current ratio of 2.07. The stock has a market capitalization of $109.83 billion, a price-to-earnings ratio of 144.00 and a beta of 1.70. The firm has a fifty day moving average of $236.11 and a 200 day moving average of $206.45.

DoorDash (NASDAQ:DASH - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The company reported $0.65 earnings per share for the quarter, beating analysts' consensus estimates of $0.42 by $0.23. The firm had revenue of $3.28 billion for the quarter, compared to analysts' expectations of $3.16 billion. DoorDash had a return on equity of 9.56% and a net margin of 6.57%. The business's quarterly revenue was up 24.9% on a year-over-year basis. During the same period in the previous year, the firm earned ($0.38) EPS. On average, analysts forecast that DoorDash, Inc. will post 2.22 earnings per share for the current year.

DoorDash Company Profile

(

Free Report)

DoorDash, Inc, together with its subsidiaries, operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally. The company operates DoorDash Marketplace and Wolt Marketplace, which provide various services, such as customer acquisition, demand generation, order fulfillment, merchandising, payment processing, and customer support.

Read More

Before you consider DoorDash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoorDash wasn't on the list.

While DoorDash currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report