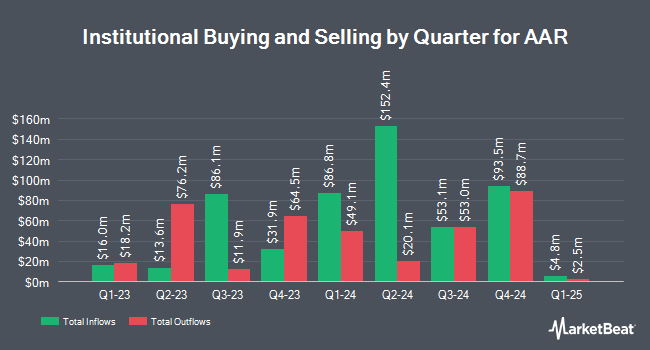

Vanguard Group Inc. cut its stake in shares of AAR Corp. (NYSE:AIR - Free Report) by 1.1% during the first quarter, according to its most recent disclosure with the SEC. The institutional investor owned 3,800,510 shares of the aerospace company's stock after selling 40,375 shares during the period. Vanguard Group Inc. owned about 10.53% of AAR worth $212,791,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Harbor Capital Advisors Inc. purchased a new position in AAR during the first quarter valued at approximately $526,000. GAMMA Investing LLC grew its position in AAR by 10,454.2% during the first quarter. GAMMA Investing LLC now owns 63,325 shares of the aerospace company's stock valued at $3,546,000 after purchasing an additional 62,725 shares in the last quarter. Natixis Advisors LLC grew its position in AAR by 57.4% during the first quarter. Natixis Advisors LLC now owns 23,591 shares of the aerospace company's stock valued at $1,321,000 after purchasing an additional 8,601 shares in the last quarter. Teacher Retirement System of Texas purchased a new position in AAR during the first quarter valued at approximately $294,000. Finally, First Trust Advisors LP grew its position in AAR by 60.3% during the fourth quarter. First Trust Advisors LP now owns 26,173 shares of the aerospace company's stock valued at $1,604,000 after purchasing an additional 9,846 shares in the last quarter. 90.74% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of research firms have issued reports on AIR. Royal Bank Of Canada lifted their target price on shares of AAR from $75.00 to $85.00 and gave the company an "outperform" rating in a research note on Thursday, July 17th. KeyCorp lifted their target price on shares of AAR from $80.00 to $86.00 and gave the company an "overweight" rating in a research note on Thursday, July 17th. Truist Financial lifted their target price on shares of AAR from $78.00 to $81.00 and gave the company a "buy" rating in a research note on Friday, July 11th. Finally, Wall Street Zen upgraded shares of AAR from a "hold" rating to a "buy" rating in a research note on Tuesday, August 19th. Four research analysts have rated the stock with a Buy rating, According to MarketBeat, the company has a consensus rating of "Buy" and an average price target of $83.75.

Read Our Latest Report on AIR

Insider Activity

In other news, Director Jennifer L. Vogel sold 7,000 shares of the business's stock in a transaction on Wednesday, July 23rd. The shares were sold at an average price of $78.07, for a total value of $546,490.00. Following the completion of the sale, the director directly owned 22,970 shares in the company, valued at approximately $1,793,267.90. The trade was a 23.36% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CFO Sean M. Gillen sold 18,000 shares of the company's stock in a transaction on Wednesday, July 23rd. The shares were sold at an average price of $77.37, for a total transaction of $1,392,660.00. Following the transaction, the chief financial officer owned 99,868 shares of the company's stock, valued at approximately $7,726,787.16. The trade was a 15.27% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 95,182 shares of company stock valued at $7,331,452 over the last three months. Corporate insiders own 3.60% of the company's stock.

AAR Stock Performance

Shares of AAR stock traded down $0.80 on Monday, reaching $75.02. The stock had a trading volume of 235,845 shares, compared to its average volume of 378,373. The business's 50-day moving average price is $73.64 and its two-hundred day moving average price is $65.47. The company has a debt-to-equity ratio of 0.80, a quick ratio of 1.26 and a current ratio of 2.72. AAR Corp. has a fifty-two week low of $46.51 and a fifty-two week high of $86.43. The stock has a market cap of $2.70 billion, a P/E ratio of 227.34 and a beta of 1.53.

AAR (NYSE:AIR - Get Free Report) last issued its quarterly earnings data on Wednesday, July 16th. The aerospace company reported $1.16 earnings per share for the quarter, topping analysts' consensus estimates of $1.00 by $0.16. AAR had a net margin of 0.45% and a return on equity of 11.66%. The business had revenue of $754.50 million during the quarter, compared to analysts' expectations of $695.81 million. During the same period in the previous year, the company earned $0.88 earnings per share. AAR's revenue for the quarter was up 15.0% on a year-over-year basis. On average, sell-side analysts forecast that AAR Corp. will post 3.77 EPS for the current year.

About AAR

(

Free Report)

AAR Corp. provides products and services to commercial aviation, government, and defense markets worldwide. The Parts Supply segment leases and sells aircraft components and replacement parts. The Repair & Engineering segment provides airframe maintenance services, such as airframe inspection, painting, line maintenance, airframe modification, structural repair, avionics service and installation, exterior and interior refurbishment, and engineering and support services; component repair services comprising maintenance, repair, and overhaul (MRO) services, engine and airframe accessories, and interior refurbishment; and landing gear overhaul services, including repair services on wheels and brakes.

Recommended Stories

Before you consider AAR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAR wasn't on the list.

While AAR currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.