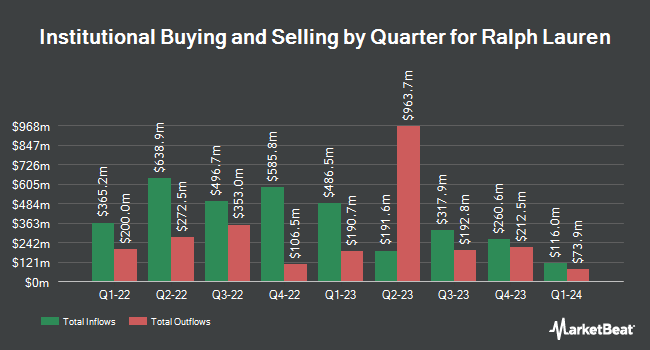

Vanguard Personalized Indexing Management LLC increased its position in Ralph Lauren Corporation (NYSE:RL - Free Report) by 30.6% during the second quarter, according to its most recent Form 13F filing with the SEC. The fund owned 4,653 shares of the textile maker's stock after buying an additional 1,090 shares during the period. Vanguard Personalized Indexing Management LLC's holdings in Ralph Lauren were worth $1,276,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the stock. Invesco Ltd. grew its holdings in Ralph Lauren by 22.3% during the first quarter. Invesco Ltd. now owns 1,512,903 shares of the textile maker's stock valued at $333,958,000 after purchasing an additional 275,391 shares during the last quarter. AQR Capital Management LLC grew its holdings in Ralph Lauren by 55.7% during the first quarter. AQR Capital Management LLC now owns 1,157,867 shares of the textile maker's stock valued at $245,468,000 after purchasing an additional 414,275 shares during the last quarter. Jennison Associates LLC grew its holdings in Ralph Lauren by 16.5% during the first quarter. Jennison Associates LLC now owns 565,687 shares of the textile maker's stock valued at $124,870,000 after purchasing an additional 79,934 shares during the last quarter. Truist Financial Corp grew its holdings in Ralph Lauren by 7.0% during the second quarter. Truist Financial Corp now owns 322,020 shares of the textile maker's stock valued at $88,324,000 after purchasing an additional 21,183 shares during the last quarter. Finally, Envestnet Asset Management Inc. grew its holdings in Ralph Lauren by 8.1% during the first quarter. Envestnet Asset Management Inc. now owns 237,479 shares of the textile maker's stock valued at $52,421,000 after purchasing an additional 17,732 shares during the last quarter. Institutional investors and hedge funds own 67.91% of the company's stock.

Analysts Set New Price Targets

Several brokerages have commented on RL. JPMorgan Chase & Co. increased their price target on Ralph Lauren from $423.00 to $430.00 and gave the company an "overweight" rating in a report on Friday, September 26th. Cfra Research upgraded Ralph Lauren from a "moderate sell" rating to a "hold" rating in a report on Monday, August 11th. Needham & Company LLC increased their price objective on Ralph Lauren from $335.00 to $350.00 and gave the company a "buy" rating in a research report on Friday, September 12th. Cowen reissued a "buy" rating on shares of Ralph Lauren in a research report on Tuesday, September 30th. Finally, TD Cowen increased their price objective on Ralph Lauren from $354.00 to $399.00 and gave the company a "buy" rating in a research report on Tuesday, September 30th. Two research analysts have rated the stock with a Strong Buy rating, sixteen have given a Buy rating, three have given a Hold rating and one has given a Sell rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $333.94.

Get Our Latest Research Report on Ralph Lauren

Ralph Lauren Stock Up 1.5%

Shares of RL stock opened at $327.94 on Friday. The stock has a market cap of $19.86 billion, a P/E ratio of 26.19, a price-to-earnings-growth ratio of 1.63 and a beta of 1.61. Ralph Lauren Corporation has a one year low of $176.61 and a one year high of $330.11. The stock has a fifty day moving average price of $307.91 and a 200 day moving average price of $276.63. The company has a debt-to-equity ratio of 0.58, a current ratio of 1.84 and a quick ratio of 1.30.

Ralph Lauren (NYSE:RL - Get Free Report) last issued its earnings results on Thursday, August 7th. The textile maker reported $3.77 EPS for the quarter, topping the consensus estimate of $3.50 by $0.27. The firm had revenue of $1.72 billion during the quarter, compared to analysts' expectations of $1.65 billion. Ralph Lauren had a return on equity of 33.72% and a net margin of 10.91%.Ralph Lauren's quarterly revenue was up 13.7% compared to the same quarter last year. During the same period last year, the business earned $2.70 earnings per share. Analysts predict that Ralph Lauren Corporation will post 12.01 earnings per share for the current year.

Ralph Lauren Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, October 10th. Investors of record on Friday, September 26th were given a $0.9125 dividend. This represents a $3.65 annualized dividend and a yield of 1.1%. The ex-dividend date of this dividend was Friday, September 26th. Ralph Lauren's dividend payout ratio (DPR) is 29.15%.

Ralph Lauren Profile

(

Free Report)

Ralph Lauren Corporation designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally. The company offers apparel, including a range of men's, women's, and children's clothing; footwear and accessories, which comprise casual shoes, dress shoes, boots, sneakers, sandals, eyewear, watches, fashion and fine jewelry, scarves, hats, gloves, and umbrellas, as well as leather goods, such as handbags, luggage, small leather goods, and belts; home products consisting of bed and bath lines, furniture, fabric and wallcoverings, floor coverings, lighting, tabletop, kitchen linens, floor coverings, dining, decorative accessories, and giftware; and fragrances.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ralph Lauren, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ralph Lauren wasn't on the list.

While Ralph Lauren currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report