Cwm LLC decreased its stake in shares of Ventas, Inc. (NYSE:VTR - Free Report) by 36.8% during the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 15,747 shares of the real estate investment trust's stock after selling 9,171 shares during the period. Cwm LLC's holdings in Ventas were worth $994,000 as of its most recent SEC filing.

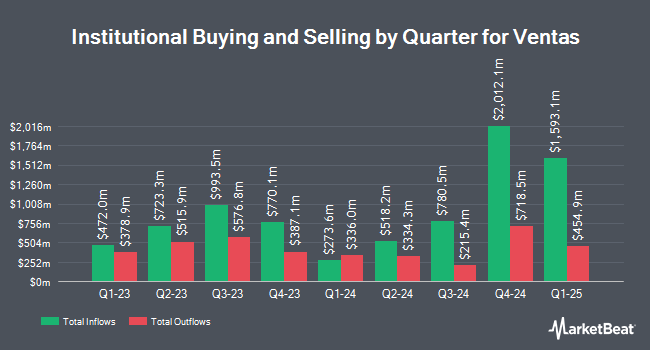

Several other large investors have also recently bought and sold shares of the stock. Lindbrook Capital LLC increased its stake in Ventas by 3.9% during the 1st quarter. Lindbrook Capital LLC now owns 4,440 shares of the real estate investment trust's stock valued at $305,000 after buying an additional 165 shares during the period. Kentucky Retirement Systems increased its stake in Ventas by 0.6% during the 1st quarter. Kentucky Retirement Systems now owns 28,574 shares of the real estate investment trust's stock valued at $1,965,000 after buying an additional 183 shares during the period. Commerzbank Aktiengesellschaft FI increased its stake in Ventas by 4.3% during the 2nd quarter. Commerzbank Aktiengesellschaft FI now owns 4,546 shares of the real estate investment trust's stock valued at $288,000 after buying an additional 187 shares during the period. Smartleaf Asset Management LLC increased its stake in Ventas by 7.1% during the 1st quarter. Smartleaf Asset Management LLC now owns 2,896 shares of the real estate investment trust's stock valued at $199,000 after buying an additional 193 shares during the period. Finally, Quarry LP increased its stake in Ventas by 17.9% during the 1st quarter. Quarry LP now owns 1,313 shares of the real estate investment trust's stock valued at $90,000 after buying an additional 199 shares during the period. Institutional investors and hedge funds own 94.18% of the company's stock.

Ventas Stock Performance

Shares of VTR opened at $70.26 on Wednesday. Ventas, Inc. has a one year low of $56.68 and a one year high of $72.02. The company has a 50-day moving average of $68.51 and a two-hundred day moving average of $66.44. The stock has a market cap of $31.93 billion, a price-to-earnings ratio of 163.39, a PEG ratio of 2.42 and a beta of 0.89. The company has a debt-to-equity ratio of 1.13, a current ratio of 0.68 and a quick ratio of 0.68.

Ventas (NYSE:VTR - Get Free Report) last announced its earnings results on Wednesday, July 30th. The real estate investment trust reported $0.87 EPS for the quarter, topping the consensus estimate of $0.85 by $0.02. Ventas had a net margin of 3.61% and a return on equity of 1.75%. The company had revenue of $1.42 billion during the quarter, compared to analysts' expectations of $1.37 billion. During the same period last year, the company posted $0.80 earnings per share. The business's revenue for the quarter was up 18.3% on a year-over-year basis. Ventas has set its FY 2025 guidance at 3.410-3.46 EPS. On average, equities research analysts expect that Ventas, Inc. will post 3.4 earnings per share for the current year.

Ventas Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, October 16th. Shareholders of record on Tuesday, September 30th were issued a $0.48 dividend. This represents a $1.92 annualized dividend and a dividend yield of 2.7%. The ex-dividend date was Tuesday, September 30th. Ventas's dividend payout ratio (DPR) is presently 446.51%.

Wall Street Analysts Forecast Growth

Several equities analysts have recently weighed in on the stock. Morgan Stanley raised their price objective on shares of Ventas from $70.00 to $75.00 and gave the company an "equal weight" rating in a research report on Friday, August 15th. Wells Fargo & Company raised their price objective on shares of Ventas from $77.00 to $80.00 and gave the company an "overweight" rating in a research report on Tuesday. Cantor Fitzgerald assumed coverage on shares of Ventas in a research report on Wednesday, October 1st. They set an "overweight" rating and a $77.00 price objective for the company. Scotiabank raised their price objective on shares of Ventas from $72.00 to $74.00 and gave the company a "sector perform" rating in a research report on Thursday, August 28th. Finally, JPMorgan Chase & Co. raised their price objective on shares of Ventas from $72.00 to $76.00 and gave the company an "overweight" rating in a research report on Tuesday, August 26th. One equities research analyst has rated the stock with a Strong Buy rating, ten have issued a Buy rating and four have assigned a Hold rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $75.46.

Get Our Latest Research Report on VTR

Insiders Place Their Bets

In related news, CEO Peter J. Bulgarelli sold 2,554 shares of the firm's stock in a transaction that occurred on Wednesday, October 1st. The shares were sold at an average price of $70.26, for a total transaction of $179,444.04. Following the completion of the sale, the chief executive officer directly owned 116,488 shares in the company, valued at approximately $8,184,446.88. This trade represents a 2.15% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CFO Robert F. Probst sold 29,691 shares of the firm's stock in a transaction that occurred on Monday, August 4th. The stock was sold at an average price of $68.49, for a total transaction of $2,033,536.59. Following the sale, the chief financial officer owned 168,364 shares of the company's stock, valued at approximately $11,531,250.36. This represents a 14.99% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 69,557 shares of company stock worth $4,771,687 over the last ninety days. 1.00% of the stock is currently owned by company insiders.

Ventas Company Profile

(

Free Report)

Ventas Inc NYSE: VTR is a leading S&P 500 real estate investment trust focused on delivering strong, sustainable shareholder returns by enabling exceptional environments that benefit a large and growing aging population. The Company's growth is fueled by its senior housing communities, which provide valuable services to residents and enable them to thrive in supported environments.

See Also

Want to see what other hedge funds are holding VTR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Ventas, Inc. (NYSE:VTR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ventas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ventas wasn't on the list.

While Ventas currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.