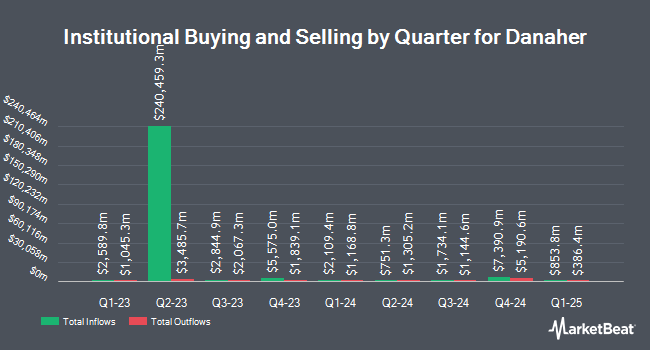

Venturi Wealth Management LLC boosted its holdings in shares of Danaher Corporation (NYSE:DHR - Free Report) by 1,901.9% during the 2nd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 66,764 shares of the conglomerate's stock after purchasing an additional 63,429 shares during the quarter. Venturi Wealth Management LLC's holdings in Danaher were worth $13,189,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. GHP Investment Advisors Inc. increased its holdings in shares of Danaher by 396.0% in the 1st quarter. GHP Investment Advisors Inc. now owns 124 shares of the conglomerate's stock valued at $25,000 after acquiring an additional 99 shares during the last quarter. Sierra Ocean LLC increased its holdings in shares of Danaher by 116.9% in the 1st quarter. Sierra Ocean LLC now owns 141 shares of the conglomerate's stock valued at $29,000 after acquiring an additional 76 shares during the last quarter. Red Tortoise LLC increased its holdings in shares of Danaher by 175.0% in the 2nd quarter. Red Tortoise LLC now owns 154 shares of the conglomerate's stock valued at $30,000 after acquiring an additional 98 shares during the last quarter. Smallwood Wealth Investment Management LLC bought a new stake in shares of Danaher in the 1st quarter valued at approximately $31,000. Finally, Dunhill Financial LLC increased its holdings in shares of Danaher by 68.4% in the 1st quarter. Dunhill Financial LLC now owns 165 shares of the conglomerate's stock valued at $34,000 after acquiring an additional 67 shares during the last quarter. 79.05% of the stock is currently owned by hedge funds and other institutional investors.

Danaher Trading Down 1.5%

Shares of DHR stock opened at $208.63 on Wednesday. The company has a debt-to-equity ratio of 0.32, a quick ratio of 1.22 and a current ratio of 1.62. Danaher Corporation has a 1 year low of $171.00 and a 1 year high of $279.41. The stock has a fifty day moving average of $200.40 and a two-hundred day moving average of $197.32. The firm has a market capitalization of $149.39 billion, a PE ratio of 44.39, a price-to-earnings-growth ratio of 3.02 and a beta of 0.77.

Danaher (NYSE:DHR - Get Free Report) last announced its quarterly earnings results on Tuesday, July 22nd. The conglomerate reported $1.80 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.64 by $0.16. Danaher had a return on equity of 10.70% and a net margin of 14.21%.The company had revenue of $5.94 billion during the quarter, compared to analyst estimates of $5.83 billion. During the same quarter in the previous year, the firm posted $1.72 EPS. The firm's quarterly revenue was up 3.4% on a year-over-year basis. Danaher has set its FY 2025 guidance at 7.700-7.800 EPS. As a group, research analysts expect that Danaher Corporation will post 7.63 EPS for the current year.

Danaher Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, October 31st. Shareholders of record on Friday, September 26th will be given a dividend of $0.32 per share. This represents a $1.28 dividend on an annualized basis and a yield of 0.6%. The ex-dividend date is Friday, September 26th. Danaher's payout ratio is 27.23%.

Analyst Upgrades and Downgrades

A number of brokerages have recently weighed in on DHR. UBS Group lowered their price target on Danaher from $240.00 to $225.00 and set a "buy" rating for the company in a report on Wednesday, July 23rd. Guggenheim restated a "buy" rating and set a $250.00 price objective on shares of Danaher in a research report on Wednesday, July 23rd. Royal Bank Of Canada set a $241.00 price objective on Danaher in a research report on Tuesday, September 2nd. Evercore ISI boosted their price objective on Danaher from $226.00 to $245.00 and gave the company an "outperform" rating in a research report on Tuesday. Finally, Bank of America reduced their price objective on Danaher from $230.00 to $220.00 and set a "buy" rating for the company in a research report on Monday, September 22nd. Seventeen analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the company's stock. According to MarketBeat.com, Danaher currently has an average rating of "Moderate Buy" and a consensus price target of $246.74.

Get Our Latest Stock Report on Danaher

Insider Buying and Selling at Danaher

In other news, Director Teri List sold 2,778 shares of the company's stock in a transaction on Friday, August 22nd. The stock was sold at an average price of $211.06, for a total value of $586,324.68. Following the completion of the sale, the director owned 20,751 shares in the company, valued at $4,379,706.06. This represents a 11.81% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. 11.20% of the stock is currently owned by company insiders.

About Danaher

(

Free Report)

Danaher Corporation designs, manufactures, and markets professional, medical, industrial, and commercial products and services worldwide. The Biotechnology segments offers bioprocess technologies, consumables, and services that advance, accelerate, and integrate the development and manufacture of therapeutics; cell line and cell culture media development services; cell culture media, process liquids and buffers for manufacturing, chromatography resins, filtration technologies, aseptic fill finish; single-use hardware and consumables and services, such as the design and installation of full manufacturing suites; lab filtration, separation, and purification; lab-scale protein purification and analytical tools; reagents, membranes, and services; and healthcare filtration solutions.

See Also

Want to see what other hedge funds are holding DHR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Danaher Corporation (NYSE:DHR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Danaher, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Danaher wasn't on the list.

While Danaher currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.