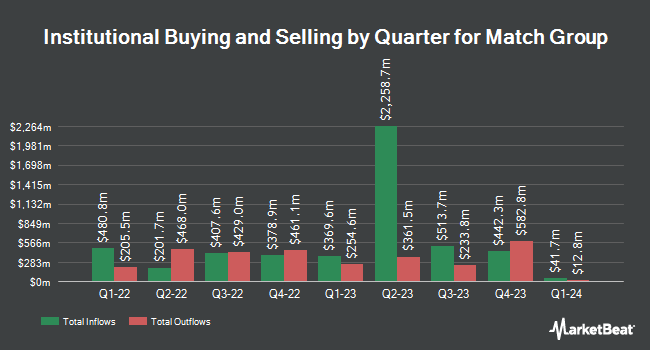

Versor Investments LP bought a new stake in shares of Match Group Inc. (NASDAQ:MTCH - Free Report) during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund bought 34,700 shares of the technology company's stock, valued at approximately $1,083,000.

Several other hedge funds have also recently made changes to their positions in the business. Summit Securities Group LLC purchased a new position in shares of Match Group during the first quarter valued at approximately $54,000. Algert Global LLC purchased a new position in shares of Match Group during the first quarter valued at approximately $971,000. Raymond James Financial Inc. increased its stake in shares of Match Group by 140.9% during the first quarter. Raymond James Financial Inc. now owns 364,698 shares of the technology company's stock valued at $11,379,000 after buying an additional 213,333 shares during the period. Ethic Inc. increased its stake in shares of Match Group by 77.7% during the first quarter. Ethic Inc. now owns 20,913 shares of the technology company's stock valued at $657,000 after buying an additional 9,141 shares during the period. Finally, Brandywine Global Investment Management LLC increased its stake in shares of Match Group by 123.2% during the first quarter. Brandywine Global Investment Management LLC now owns 151,245 shares of the technology company's stock valued at $4,719,000 after buying an additional 83,477 shares during the period. 94.05% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities research analysts recently weighed in on MTCH shares. Citigroup dropped their price target on Match Group from $31.00 to $30.00 and set a "neutral" rating on the stock in a research report on Friday, May 9th. Wells Fargo & Company lifted their price target on Match Group from $31.00 to $32.00 and gave the company an "equal weight" rating in a research report on Friday, June 27th. Evercore ISI lifted their price target on Match Group from $32.00 to $38.00 and gave the company an "in-line" rating in a research report on Wednesday, August 6th. JPMorgan Chase & Co. lifted their price target on Match Group from $28.00 to $33.00 and gave the company a "neutral" rating in a research report on Wednesday, August 6th. Finally, Barclays dropped their price target on Match Group from $52.00 to $46.00 and set an "overweight" rating on the stock in a research report on Friday, May 9th. Five equities research analysts have rated the stock with a Buy rating and fifteen have issued a Hold rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $35.44.

Get Our Latest Research Report on MTCH

Match Group Stock Performance

Shares of NASDAQ:MTCH traded up $0.51 during midday trading on Friday, reaching $37.30. 3,896,474 shares of the company's stock traded hands, compared to its average volume of 5,153,445. The company has a market cap of $8.98 billion, a price-to-earnings ratio of 18.37, a P/E/G ratio of 0.73 and a beta of 1.36. Match Group Inc. has a one year low of $26.39 and a one year high of $39.20. The stock has a 50 day moving average of $33.67 and a 200 day moving average of $31.76.

Match Group Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, October 17th. Stockholders of record on Friday, October 3rd will be issued a dividend of $0.19 per share. This represents a $0.76 dividend on an annualized basis and a dividend yield of 2.0%. The ex-dividend date of this dividend is Friday, October 3rd. Match Group's dividend payout ratio is presently 37.44%.

Insider Activity

In other news, Director Stephen Bailey sold 12,500 shares of the company's stock in a transaction on Thursday, August 7th. The stock was sold at an average price of $36.72, for a total transaction of $459,000.00. Following the transaction, the director directly owned 8,058 shares of the company's stock, valued at $295,889.76. This represents a 60.80% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. 0.64% of the stock is currently owned by insiders.

Match Group Company Profile

(

Free Report)

Match Group, Inc engages in the provision of dating products. Its portfolio of brands includes Tinder, Hinge, Match, Meetic, OkCupid, Pairs, Plenty Of Fish, Azar, BLK, and Hakuna, as well as a various other brands, each built to increase users' likelihood of connecting with others. Its services are available in over 40 languages to users worldwide.

Featured Articles

Before you consider Match Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Match Group wasn't on the list.

While Match Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.