Versor Investments LP purchased a new position in Rockwell Automation, Inc. (NYSE:ROK - Free Report) during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund purchased 1,302 shares of the industrial products company's stock, valued at approximately $336,000.

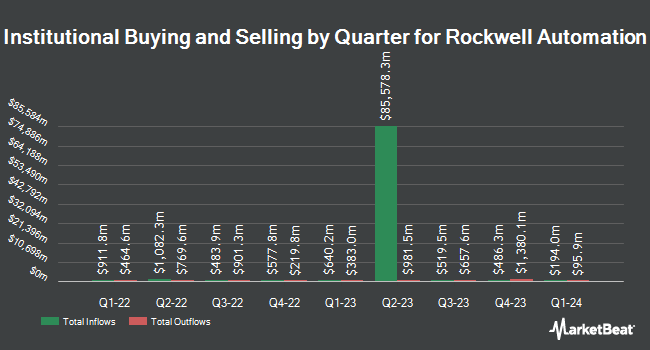

Other large investors also recently bought and sold shares of the company. Brighton Jones LLC bought a new position in Rockwell Automation during the 4th quarter valued at about $281,000. Bank Pictet & Cie Europe AG lifted its stake in Rockwell Automation by 0.9% during the 4th quarter. Bank Pictet & Cie Europe AG now owns 4,195 shares of the industrial products company's stock valued at $1,199,000 after acquiring an additional 38 shares during the period. Guggenheim Capital LLC lifted its stake in Rockwell Automation by 3.5% during the 4th quarter. Guggenheim Capital LLC now owns 3,081 shares of the industrial products company's stock valued at $881,000 after acquiring an additional 105 shares during the period. Natixis bought a new position in Rockwell Automation during the 4th quarter valued at about $530,000. Finally, MML Investors Services LLC lifted its stake in Rockwell Automation by 17.2% during the 4th quarter. MML Investors Services LLC now owns 6,394 shares of the industrial products company's stock valued at $1,827,000 after acquiring an additional 939 shares during the period. 75.75% of the stock is currently owned by institutional investors.

Insider Activity at Rockwell Automation

In related news, SVP Christopher Nardecchia sold 551 shares of the stock in a transaction that occurred on Monday, June 9th. The stock was sold at an average price of $326.31, for a total transaction of $179,796.81. Following the completion of the transaction, the senior vice president directly owned 12,711 shares of the company's stock, valued at approximately $4,147,726.41. This represents a 4.15% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, SVP Matthew W. Fordenwalt sold 500 shares of the firm's stock in a transaction on Wednesday, June 4th. The shares were sold at an average price of $320.02, for a total transaction of $160,010.00. Following the completion of the transaction, the senior vice president directly owned 2,709 shares of the company's stock, valued at approximately $866,934.18. This trade represents a 15.58% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 8,818 shares of company stock valued at $3,012,888 in the last 90 days. 0.68% of the stock is currently owned by insiders.

Rockwell Automation Price Performance

NYSE:ROK traded down $5.78 on Wednesday, reaching $349.89. 343,809 shares of the company's stock traded hands, compared to its average volume of 939,385. The company has a quick ratio of 0.72, a current ratio of 1.06 and a debt-to-equity ratio of 0.72. The stock has a 50-day simple moving average of $342.37 and a 200-day simple moving average of $299.82. The firm has a market cap of $39.34 billion, a PE ratio of 41.05, a P/E/G ratio of 3.60 and a beta of 1.39. Rockwell Automation, Inc. has a 12 month low of $215.00 and a 12 month high of $360.92.

Rockwell Automation (NYSE:ROK - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The industrial products company reported $2.82 EPS for the quarter, beating the consensus estimate of $2.67 by $0.15. Rockwell Automation had a net margin of 12.03% and a return on equity of 30.14%. The business had revenue of $2.14 billion during the quarter, compared to the consensus estimate of $2.07 billion. During the same quarter in the prior year, the firm earned $2.71 EPS. The business's revenue was up 4.5% on a year-over-year basis. Equities research analysts forecast that Rockwell Automation, Inc. will post 9.35 earnings per share for the current year.

Rockwell Automation Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, September 10th. Investors of record on Monday, August 18th will be paid a dividend of $1.31 per share. The ex-dividend date of this dividend is Monday, August 18th. This represents a $5.24 dividend on an annualized basis and a yield of 1.5%. Rockwell Automation's dividend payout ratio is presently 61.50%.

Analysts Set New Price Targets

ROK has been the topic of several research analyst reports. TD Cowen upgraded shares of Rockwell Automation from a "sell" rating to a "hold" rating and set a $275.00 target price on the stock in a research note on Friday, May 9th. CICC Research assumed coverage on Rockwell Automation in a report on Monday, July 7th. They issued an "outperform" rating and a $381.00 target price on the stock. Wall Street Zen raised Rockwell Automation from a "hold" rating to a "buy" rating in a report on Saturday, August 9th. Citigroup reissued a "buy" rating and issued a $392.00 target price (up previously from $371.00) on shares of Rockwell Automation in a report on Monday, July 14th. Finally, JPMorgan Chase & Co. increased their target price on Rockwell Automation from $271.00 to $299.00 and gave the company a "neutral" rating in a report on Friday, May 16th. One analyst has rated the stock with a Strong Buy rating, eleven have issued a Buy rating, six have issued a Hold rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $340.16.

View Our Latest Report on Rockwell Automation

About Rockwell Automation

(

Free Report)

Rockwell Automation, Inc provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates through three segments, Intelligent Devices, Software & Control, and Lifecycle Services. Its solutions include hardware and software products and services.

Read More

Before you consider Rockwell Automation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rockwell Automation wasn't on the list.

While Rockwell Automation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.