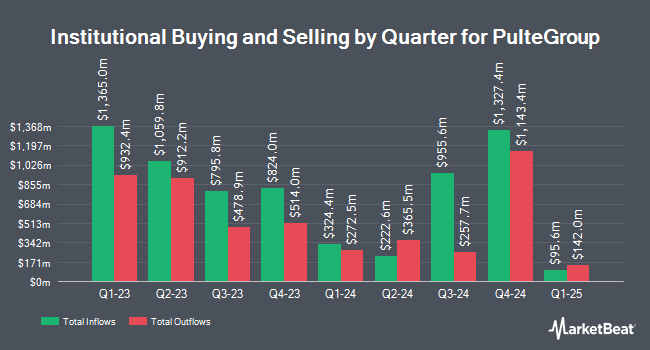

Vest Financial LLC boosted its holdings in shares of PulteGroup, Inc. (NYSE:PHM - Free Report) by 16.8% in the second quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 365,317 shares of the construction company's stock after acquiring an additional 52,594 shares during the quarter. Vest Financial LLC owned 0.19% of PulteGroup worth $38,526,000 at the end of the most recent quarter.

A number of other institutional investors have also recently bought and sold shares of the business. JPMorgan Chase & Co. boosted its position in PulteGroup by 40.3% during the 1st quarter. JPMorgan Chase & Co. now owns 3,486,330 shares of the construction company's stock worth $358,395,000 after acquiring an additional 1,001,290 shares during the period. Ameriprise Financial Inc. boosted its position in PulteGroup by 11.8% during the 1st quarter. Ameriprise Financial Inc. now owns 2,570,022 shares of the construction company's stock worth $264,216,000 after acquiring an additional 271,917 shares during the period. Nuveen LLC acquired a new stake in PulteGroup during the 1st quarter worth about $213,092,000. Price T Rowe Associates Inc. MD boosted its position in PulteGroup by 21.2% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,579,792 shares of the construction company's stock worth $162,403,000 after acquiring an additional 276,077 shares during the period. Finally, Victory Capital Management Inc. boosted its position in PulteGroup by 25.6% during the 1st quarter. Victory Capital Management Inc. now owns 1,397,409 shares of the construction company's stock worth $143,654,000 after acquiring an additional 284,627 shares during the period. 89.90% of the stock is currently owned by institutional investors and hedge funds.

PulteGroup Stock Down 1.2%

Shares of PHM stock opened at $119.92 on Monday. The stock's 50 day simple moving average is $130.52 and its 200 day simple moving average is $113.04. The company has a debt-to-equity ratio of 0.13, a quick ratio of 0.77 and a current ratio of 0.77. PulteGroup, Inc. has a twelve month low of $88.07 and a twelve month high of $149.47. The company has a market capitalization of $23.66 billion, a price-to-earnings ratio of 8.96, a PEG ratio of 0.35 and a beta of 1.29.

PulteGroup (NYSE:PHM - Get Free Report) last issued its quarterly earnings data on Tuesday, July 22nd. The construction company reported $3.03 earnings per share for the quarter, beating analysts' consensus estimates of $2.92 by $0.11. PulteGroup had a return on equity of 21.01% and a net margin of 15.50%.The business had revenue of $4.40 billion for the quarter, compared to the consensus estimate of $4.42 billion. During the same period last year, the business earned $3.83 EPS. The firm's revenue was down 4.3% compared to the same quarter last year. As a group, research analysts predict that PulteGroup, Inc. will post 12.32 EPS for the current year.

PulteGroup Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, October 2nd. Investors of record on Tuesday, September 16th were paid a $0.22 dividend. This represents a $0.88 dividend on an annualized basis and a dividend yield of 0.7%. The ex-dividend date of this dividend was Tuesday, September 16th. PulteGroup's dividend payout ratio (DPR) is presently 6.58%.

Wall Street Analysts Forecast Growth

PHM has been the subject of a number of research reports. Citigroup raised their price objective on PulteGroup from $132.00 to $143.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 1st. Seaport Res Ptn raised PulteGroup from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, July 22nd. Bank of America cut their price target on PulteGroup from $145.00 to $140.00 and set a "buy" rating for the company in a research note on Friday. JPMorgan Chase & Co. raised their price target on PulteGroup from $121.00 to $123.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 23rd. Finally, UBS Group raised their price target on PulteGroup from $141.00 to $150.00 and gave the stock a "buy" rating in a research note on Wednesday, July 23rd. One analyst has rated the stock with a Strong Buy rating, eight have issued a Buy rating and seven have given a Hold rating to the stock. According to data from MarketBeat, PulteGroup has a consensus rating of "Moderate Buy" and a consensus price target of $136.92.

Get Our Latest Stock Report on PHM

About PulteGroup

(

Free Report)

PulteGroup, Inc, through its subsidiaries, primarily engages in the homebuilding business in the United States. It acquires and develops land primarily for residential purposes; and constructs housing on such land. The company also offers various home designs, including single-family detached, townhomes, condominiums, and duplexes under the Centex, Pulte Homes, Del Webb, DiVosta Homes, John Wieland Homes and Neighborhoods, and American West brand names.

Read More

Want to see what other hedge funds are holding PHM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for PulteGroup, Inc. (NYSE:PHM - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PulteGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PulteGroup wasn't on the list.

While PulteGroup currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.