Vestcor Inc acquired a new stake in Lazard, Inc. (NYSE:LAZ - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm acquired 7,135 shares of the asset manager's stock, valued at approximately $309,000.

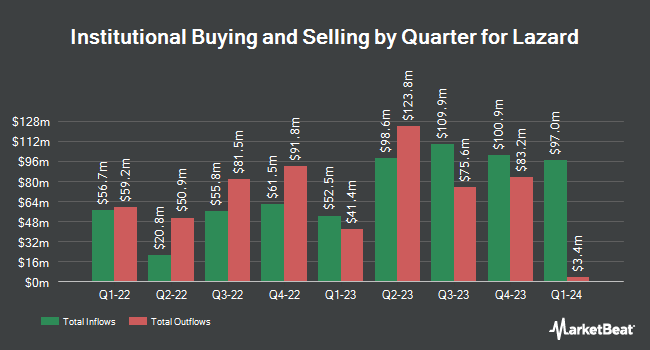

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in LAZ. LPL Financial LLC increased its position in Lazard by 44.6% in the 4th quarter. LPL Financial LLC now owns 41,507 shares of the asset manager's stock valued at $2,137,000 after acquiring an additional 12,803 shares in the last quarter. Pictet Asset Management Holding SA grew its position in shares of Lazard by 11.2% during the 4th quarter. Pictet Asset Management Holding SA now owns 12,743 shares of the asset manager's stock worth $656,000 after buying an additional 1,283 shares during the period. Alliancebernstein L.P. grew its position in shares of Lazard by 11.5% during the 4th quarter. Alliancebernstein L.P. now owns 41,713 shares of the asset manager's stock worth $2,147,000 after buying an additional 4,309 shares during the period. Franklin Resources Inc. acquired a new stake in shares of Lazard during the 4th quarter worth approximately $5,128,000. Finally, Geode Capital Management LLC grew its position in shares of Lazard by 26.7% during the 4th quarter. Geode Capital Management LLC now owns 2,297,249 shares of the asset manager's stock worth $118,294,000 after buying an additional 483,696 shares during the period. Institutional investors and hedge funds own 54.80% of the company's stock.

Analyst Ratings Changes

A number of research analysts recently issued reports on the stock. Keefe, Bruyette & Woods boosted their price objective on shares of Lazard from $57.00 to $60.00 and gave the company a "market perform" rating in a report on Friday, July 25th. Wall Street Zen cut shares of Lazard from a "buy" rating to a "hold" rating in a report on Thursday, April 10th. The Goldman Sachs Group boosted their price objective on shares of Lazard from $35.00 to $40.00 and gave the company a "sell" rating in a report on Thursday, May 15th. JMP Securities set a $60.00 price objective on shares of Lazard and gave the company a "market outperform" rating in a report on Monday, July 14th. Finally, Wells Fargo & Company boosted their price objective on shares of Lazard from $38.00 to $50.00 and gave the company an "equal weight" rating in a report on Friday, July 11th. Two research analysts have rated the stock with a sell rating, five have given a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat.com, Lazard has a consensus rating of "Hold" and a consensus price target of $51.50.

View Our Latest Report on Lazard

Lazard Price Performance

LAZ traded up $0.81 on Friday, hitting $52.09. 353,899 shares of the stock were exchanged, compared to its average volume of 1,118,507. The firm has a market capitalization of $5.87 billion, a price-to-earnings ratio of 17.99 and a beta of 1.35. The company has a debt-to-equity ratio of 2.15, a current ratio of 2.53 and a quick ratio of 2.53. Lazard, Inc. has a 12 month low of $31.97 and a 12 month high of $61.14. The business has a 50-day moving average of $48.81 and a two-hundred day moving average of $46.51.

Lazard (NYSE:LAZ - Get Free Report) last posted its earnings results on Thursday, July 24th. The asset manager reported $0.52 EPS for the quarter, topping analysts' consensus estimates of $0.38 by $0.14. The firm had revenue of $796.00 million during the quarter, compared to analysts' expectations of $674.13 million. Lazard had a net margin of 9.96% and a return on equity of 34.33%. The business's revenue for the quarter was up 16.2% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.52 earnings per share. Sell-side analysts forecast that Lazard, Inc. will post 4.24 EPS for the current fiscal year.

Lazard Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, August 15th. Stockholders of record on Monday, August 4th will be issued a $0.50 dividend. The ex-dividend date of this dividend is Monday, August 4th. This represents a $2.00 dividend on an annualized basis and a dividend yield of 3.8%. Lazard's dividend payout ratio is 68.97%.

Lazard Company Profile

(

Free Report)

Lazard, Inc, together with its subsidiaries, operates as a financial advisory and asset management firm in North and South America, Europe, the Middle East, Asia, and Australia. It operates in two segments, Financial Advisory and Asset Management. The Financial Advisory segment offers financial advisory services, such as mergers and acquisitions, capital markets, shareholder, sovereign, geopolitical advisory, and other strategic advisory services, as well as restructuring and liability management, and capital raising and placement services.

Further Reading

Before you consider Lazard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lazard wasn't on the list.

While Lazard currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.