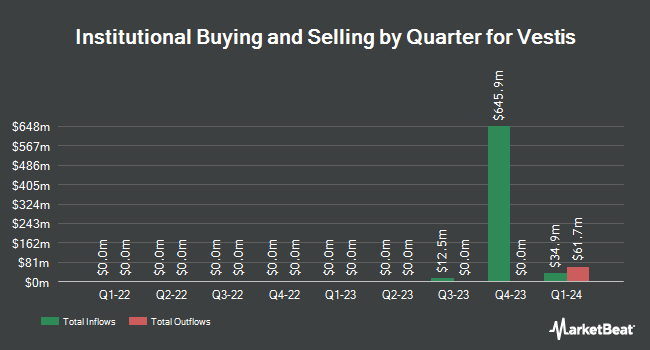

Mutual of America Capital Management LLC trimmed its position in shares of Vestis Corporation (NYSE:VSTS - Free Report) by 91.9% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 16,691 shares of the company's stock after selling 189,882 shares during the quarter. Mutual of America Capital Management LLC's holdings in Vestis were worth $165,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other large investors also recently modified their holdings of the company. Alberta Investment Management Corp grew its holdings in Vestis by 65.2% during the first quarter. Alberta Investment Management Corp now owns 6,145,000 shares of the company's stock valued at $60,836,000 after purchasing an additional 2,426,167 shares during the period. Millennium Management LLC grew its holdings in Vestis by 179.4% during the fourth quarter. Millennium Management LLC now owns 3,003,762 shares of the company's stock valued at $45,777,000 after purchasing an additional 1,928,687 shares during the period. Royce & Associates LP grew its holdings in Vestis by 196.2% during the first quarter. Royce & Associates LP now owns 2,842,936 shares of the company's stock valued at $28,145,000 after purchasing an additional 1,883,106 shares during the period. Alyeska Investment Group L.P. bought a new stake in Vestis during the fourth quarter valued at about $25,805,000. Finally, First Trust Advisors LP bought a new stake in Vestis during the fourth quarter valued at about $22,936,000. Institutional investors own 97.40% of the company's stock.

Vestis Trading Up 3.3%

Shares of VSTS traded up $0.16 during mid-day trading on Monday, reaching $4.84. 523,144 shares of the company's stock traded hands, compared to its average volume of 2,375,064. The stock has a market cap of $637.45 million, a P/E ratio of -20.98 and a beta of 0.96. The stock's 50-day moving average is $5.87 and its two-hundred day moving average is $8.21. Vestis Corporation has a 12 month low of $4.32 and a 12 month high of $17.83. The company has a debt-to-equity ratio of 1.45, a current ratio of 1.84 and a quick ratio of 1.42.

Vestis (NYSE:VSTS - Get Free Report) last released its quarterly earnings data on Tuesday, August 5th. The company reported $0.05 EPS for the quarter, hitting the consensus estimate of $0.05. The company had revenue of $673.80 million for the quarter, compared to the consensus estimate of $673.65 million. Vestis had a positive return on equity of 3.76% and a negative net margin of 1.11%. Vestis's quarterly revenue was down 3.5% on a year-over-year basis. During the same period last year, the business posted $0.16 EPS. Research analysts forecast that Vestis Corporation will post 0.7 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several brokerages have recently commented on VSTS. JPMorgan Chase & Co. lowered their price objective on Vestis from $6.00 to $5.50 and set an "underweight" rating on the stock in a research report on Thursday, August 7th. Barclays reduced their target price on Vestis from $10.00 to $5.00 and set an "underweight" rating on the stock in a report on Friday, May 9th. Finally, Wall Street Zen raised Vestis from a "sell" rating to a "hold" rating in a research note on Saturday, August 9th. Two research analysts have rated the stock with a sell rating and three have assigned a hold rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $9.13.

Get Our Latest Stock Analysis on VSTS

Insider Transactions at Vestis

In related news, Director Keith A. Meister bought 314,390 shares of the company's stock in a transaction on Wednesday, May 28th. The shares were acquired at an average price of $6.03 per share, with a total value of $1,895,771.70. Following the transaction, the director owned 18,803,899 shares of the company's stock, valued at $113,387,510.97. The trade was a 1.70% increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Over the last quarter, insiders acquired 800,675 shares of company stock worth $4,777,432. 13.60% of the stock is currently owned by company insiders.

Vestis Profile

(

Free Report)

Vestis Corporation provides uniform rentals and workplace supplies in the United States and Canada. Its products include uniform options, such as shirts, pants, outerwear, gowns, scrubs, high visibility garments, particulate-free garments, and flame-resistant garments, as well as shoes and accessories; and workplace supplies, including managed restroom supply services, first-aid supplies and safety products, floor mats, towels, and linens.

Read More

Before you consider Vestis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vestis wasn't on the list.

While Vestis currently has a Strong Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.